Stressing ‘community’ in community banking

ABA Community Banking

SEPTEMBER 11, 2023

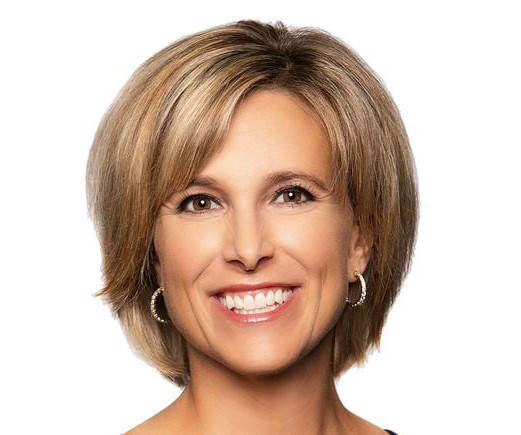

As CEO of First United Bank and Trust, ABA Treasurer Carissa Rodeheaver views personal relationships as the core business strength of the institution. The post Stressing ‘community’ in community banking appeared first on ABA Banking Journal.

Let's personalize your content