US businesses cling to paper checks

Payments Dive

APRIL 7, 2025

Large and small businesses alike are still using the 20th-century form of payment extensively, even as the federal government presses ahead with digital alternatives.

Payments Dive

APRIL 7, 2025

Large and small businesses alike are still using the 20th-century form of payment extensively, even as the federal government presses ahead with digital alternatives.

Abrigo

APRIL 8, 2025

This article covers these key topics: The difference between 1D and 2D risk rating models How CECL has impacted the necessity of a dual approach Why the LGD variable is so difficult to pinpoint Does your risk rating framework align with your CECL needs? More banks are rethinking the value of two-dimensional (2D) risk rating models as CECL and real-world challenges with LGD raise questions about their practicality.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

South State Correspondent

APRIL 9, 2025

At present, we track 150+ AI agent platforms that households and business can use right now to manage banking products. While the public is currently focused on booking travel, restaurants and events, soon they will be using agents to optimize their banking. These agents can now compare different banking products, to include researching fees, and then open an account in under ten minutes.

BankUnderground

APRIL 10, 2025

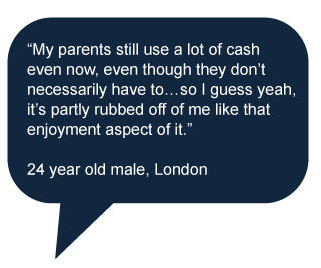

Lily Smith Like mother, like daughter? Like father, like son? Despite the increasing prevalence of digital payments in todays world, young people continue to use cash. The persistence of cash use, even among youngsters who have grown up with debit cards and smartphones, raises interesting questions about the factors that influence young peoples payment choices.

Advertisement

Why Legacy Lending Workflows Are Costing You More Than You Think Legacy systems and manual workflows might feel familiar, but they come with growing risks—compliance gaps, costly delays, and lost opportunities. This guide breaks down why clinging to traditional processes is no longer sustainable and how automation can help lenders regain control, improve efficiency, and reduce risk across the closing process.

South State Correspondent

APRIL 8, 2025

In previous articles ( here and here ), we discussed how a portfolio of commercial loans with various expected average lives results in different net present value (NPV) of income and return over a ten-year period. We also identified ten variables that are responsible for extending the average expected life of a commercial loan. As we continue with a focus on managing loan life, we would like to demonstrate how the average expected life of a loan portfolio affects the efficiency ratio and compet

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

Payments Dive

APRIL 9, 2025

The measure revoking the bureau’s oversight of large technology payments players, such as Google and Block, passed on a straight party-line vote.

TheGuardian

APRIL 9, 2025

Concern grows over programs deployed to act with autonomy that may exploit weaknesses Business live latest updates Increasingly autonomous AI programs could end up manipulating markets and intentionally creating crises in order to boost profits for banks and traders, the Bank of England has warned. Artificial intelligences ability to exploit profit-making opportunities was among a wide range of risks cited in a report by the Bank of Englands financial policy committee (FPC), which has been moni

ABA Community Banking

APRIL 9, 2025

The Treasury Department intends to play a greater role in bank regulation with more regulatory tailoring for community banks, which could include exempting them from some requirements entirely, Treasury Secretary Scott Bessent said. The post Bessent outlines administrations plan for easing bank regulation appeared first on ABA Banking Journal.

Abrigo

APRIL 11, 2025

Why the vendor matters in technology adoption Technology can deliver long-term value when a vendor and its employees bring not only technical expertise but also implementation guidance, regulatory awareness, and a collaborative approach to problem-solving. Key topics covered in this post: Buying software: The benefits of partnership Setting up the financial institution for success Helping software users in an ever-changing environment Advisory & product support builds trust Benefits of a ve

Advertiser: Trellis

Finance teams find Trellis to be particularly effective in conducting comprehensive due diligence on both individuals and businesses. With our court data solution, financial experts can access critical litigation insights, making it an invaluable resource for informed decision-making in the financial sector.

Payments Dive

APRIL 11, 2025

The Justice Department will stop prosecuting “unwitting” regulatory violations and focus its efforts on going after those who victimize crypto investors or use crypto to support illicit activities.

Gonzobanker

APRIL 10, 2025

Customer acquisition cost (CAC): The metric that keeps CMOs awake at night, CFOs grumbling about marketing spend, and CEOs demanding more growth, faster! Few metrics in the banking and fintech arena are as hard to reliably quantify as this one. Luckily, a new study from Fintel Connect, 2025 Cost Per Acquisition Benchmarking Guide for Financial Services ,provides some much-needed reality checks.

Jeff For Banks

APRIL 7, 2025

Be a goldfish. Or a zebra. In this latest Jeff4Banks.com video blog, I explore strategic bets, a term not embraced by bankers, likely because of the "bets" and the implication that it is gambling. So often we hear bankers object to making what could be franchise transforming "bets" because they are not goldfish. They take a failed bet some time ago in the past and use it as the reason to kill all future bets.

TheGuardian

APRIL 10, 2025

Bank is largest UK lender to cut rates in apparent response to turbulence, and experts predict others will follow Business live latest updates Barclays has become the largest UK lender so far to cut its mortgage rates in apparent response to the financial turmoil sparked by the US trade tariffs, with some deals now priced at below 4%. It is the first big six lender to enter the sub-4% fixed-rate market after similar announcements by some smaller lenders earlier this week, leaving brokers wonder

Advertiser: ZoomInfo

AI adoption is reshaping sales and marketing. But is it delivering real results? We surveyed 1,000+ GTM professionals to find out. The data is clear: AI users report 47% higher productivity and an average of 12 hours saved per week. But leaders say mainstream AI tools still fall short on accuracy and business impact. Download the full report today to see how AI is being used — and where go-to-market professionals think there are gaps and opportunities.

Payments Dive

APRIL 7, 2025

If approved, the charter would give Stripe the ability to process credit card transactions without a bank partner.

ATM Marketplace

APRIL 11, 2025

Security experts share how to prevent new ATM threats, including Man in the Middle attacks.

ABA Community Banking

APRIL 8, 2025

The FDIC will waive some requirements for large bank resolution planning and take steps to boost de novo bank formation, particularly in areas of the country without a local community bank, Acting FDIC Chairman Travis Hill said. The post FDICs Hill: Agency to revisit resolution planning, de novo bank formation appeared first on ABA Banking Journal.

TheGuardian

APRIL 6, 2025

Craig Donaldson challenging ruling by UK regulator, which accused him of misleading investors over 900m accounting blunder The former chief executive of Metro Bank says he has been made untouchable, advised to move to Australia and even had trouble opening bank accounts after the UK regulator accused him of misleading investors over a 900m accounting blunder.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Payments Dive

APRIL 11, 2025

The payments technology company agreed to pay the fine under a consent order to settle allegations related to lax oversight of its Cash App payments tool.

ATM Marketplace

APRIL 11, 2025

Financial inclusion is not just a trend; it is an urgent necessity.

ABA Community Banking

APRIL 8, 2025

Nearly nine in 10 Americans with a bank account (89%) say they are very satisfied or satisfied with their primary bank and 93% rate their banks customer service as excellent, very good or good, according to an ABA survey. The post ABA survey: U.S. consumers happy with their bank, applaud fraud protection efforts appeared first on ABA Banking Journal.

Jack Henry

APRIL 11, 2025

Celebrate financial innovation and impact. Submit your entry for the 2025 Cobalt Awards by May 12 to earn industry recognition and a $10K charitable donation.

Speaker: Joe Wroblewski, Senior Sales Engineer

Is your tech stack working for you—or are you working for it ? 🤖 In today’s world of automation and AI, technology should simplify workflows—not add complexity. Seamless integration and interconnectivity are key to maximizing productivity, optimizing workflows, and improving collaboration. Join expert Joe Wroblewski for a practical and insightful session on how you can build a smarter, more connected tech stack that drives efficiency and long-term success!

Payments Dive

APRIL 8, 2025

The company’s point-of-sale devices are manufactured overseas, and therefore subject to across-the-board import taxes.

American Banker

APRIL 8, 2025

The largest asset manager globally announced Tuesday it will enter a new master custody service agreement with Anchorage Digital, the only U.S. federally chartered digital asset bank.

ABA Community Banking

APRIL 9, 2025

The reality is that the banking industry is not the only one knocking on lawmakers doors with a list of things to accomplish. The post Chairs View: The time is now to right-size banking regulation appeared first on ABA Banking Journal.

Jack Henry

APRIL 10, 2025

For years, banks and credit unions have encouraged accountholders to switch to e-statements by highlighting environmental benefits. While reducing environmental impact is important, it hasnt been the game-changer many expected. What truly motivates people to make the switch? Security.

Advertisement

Automation is changing the game for commercial lenders, offering a clear path to competitive advantage in 2025. Rising costs, outdated workflows, and manual data entry slow growth and impact borrower satisfaction. Automation addresses these challenges, reducing costs, speeding up loan cycles, improving accuracy, and elevating borrower experiences. With market uncertainty easing, now is the time to act—waiting until loan volumes rebound leaves lenders unprepared and struggling to compete.

Let's personalize your content