Visa exec talks the future of banking, ATM evolution

ATM Marketplace

OCTOBER 1, 2022

Clinton Cheng, VP, global head of Visa/PLUS ATM Network, took a deep dive into banking during the closing keynote at the Bank Customer Experience Summit.

ATM Marketplace

OCTOBER 1, 2022

Clinton Cheng, VP, global head of Visa/PLUS ATM Network, took a deep dive into banking during the closing keynote at the Bank Customer Experience Summit.

Accenture

OCTOBER 4, 2022

There have been impressive technological advances in banking systems in recent years. But banks can’t just purchase new software and expect it to magically improve their business—the product is only the beginning. Careful implementation and a culture of innovation and true transformation are needed to make the most of any investment in replaced or upgraded….

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Abrigo

OCTOBER 4, 2022

Financial institutions must plan to take advantage of rising rates. Several factors make this rising-rate environment different, so strong asset/liability management is critical for increased earnings. You might also like this checklist, "6 Reasons to update your core deposit analysis." DOWNLOAD . Takeaway 1 Banks and credit unions can increase earnings in a rising-rate environment with careful asset/liability management.

Payments Dive

OCTOBER 3, 2022

Open banking has revolutionized financial transactions. Here’s a real-time look into the industry.

Advertisement

Most people dread the nearing of the month-end close and reconciliation process, and who can blame them? It's typically a tedious, long, stressful process; but it doesn't have to be. Implementing automation into your month-end process can significantly reduce this headache by automating up to 40% of your reconciliation and saving nearly 30% of your time spent.

Perficient

OCTOBER 7, 2022

Hurricane Ian slammed into Florida’s gulf coast and Georgetown, South Carolina, on September 28, leaving countless businesses and homes — if not wholly destroyed — drowned with flood water and without power. The Insurance Information Institute, an industry-funded research group, estimates that Ian has caused at least $30 billion in damage. Now that the storm has passed, residents are scrambling to assess damages to their homes and businesses and, if insured, begin the claims processes with their

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

South State Correspondent

OCTOBER 5, 2022

Treasuries Rethink a Fed Pivot. Treasury yields are higher this morning as investors rethink the probabilities of a Fed pivot anytime soon. While the UK backed off from its inflation-inducing fiscal plan, the central bank of Australia hiked rates by 25bps when 50bps was expected, and the flight-to-safety trade around Credit Suisse Bank all aided the argument for a possible Fed pivot, there was enough push back in Fed speeches to dim the odds of a near-term pivot.

Payments Dive

OCTOBER 5, 2022

The Block-owned buy now-pay later provider is growing beyond its “pay in 4” plans by adding a financing option for pricier purchases.

Bobsguide

OCTOBER 5, 2022

Intix is proud to launch xCOMPLY to help financial institutions deal with compliance operations more efficiently. Regulatory requirements are becoming more and more complex, and financial institutions know that access to transaction data has become a must. However, the evolution of the regulatory landscape means that transparency on the business context of transactions has become vital. xCOMPLY achieves this by helping financial institutions to know their transaction (KYT) in a holistic and deep

Independent Banker

OCTOBER 1, 2022

As digital crime evolves, cyber insurance could be part of the solution. We explore how it can protect banks against financial losses and provide resources in the event of a cyber attack. By Beth Mattson-Teig. Big organizations like Microsoft, Colonial Pipeline and the Red Cross have notably been hit by cybercrime, but in this case, smaller doesn’t necessarily mean safer.

Advertisement

Dive into the complexities of New York lien laws with our comprehensive eBook, 'New York Lien Law Essentials: 5 Key Facts for Commercial Lenders.' In this detailed guide, we explore the critical formalities necessary for lenders navigating ground-up construction and fix-and-flip projects in the New York market. From documentation requirements to the implications of non-compliance, learn how to safeguard your lending position and prioritize legal adherence.

South State Correspondent

OCTOBER 4, 2022

While we believe in “Wowing” your customers as a concept, we don’t believe in it as a strategic focus as a bank. The idea is too challenging to execute. However, we do believe that every banker should understand what “customer delight” (we will use interchangeably with “wowing”) quantitatively looks like so delight can be operationalized.

Payments Dive

OCTOBER 4, 2022

In a 6-1 vote, the Federal Reserve finalized a debit card processing rule that underscores a requirement that multiple card networks be available for routing transactions, including online.

CFPB Monitor

OCTOBER 7, 2022

For forward Federal Housing Administration (FHA) insured purchase mortgage loans made to first-time homebuyers, the U.S. Department of Housing and Urban Development (HUD) recently announced in Mortgagee Letter 2022-17 the consideration of positive rental history in FHA’s Technology Open to Approved Lenders (TOTAL) Mortgage Scorecard. Positive rental history may be considered in TOTAL scoring events that occur on or after October 30, 2022, for loans with case numbers assigned on or after Septemb

Independent Banker

OCTOBER 1, 2022

Community banks are at a critical juncture when it comes to cybersecurity. ICBA has extensive knowledge, expertise and education you can tap into to help you chart the path ahead. By Charles Potts, ICBA. Every year, ICBA surveys the industry and its members to identify their top concerns as part of its innovation strategy. Without fail, cybersecurity ranks among the top three, making it a clear priority for our organization.

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

South State Correspondent

OCTOBER 4, 2022

The Federal Reserve Open Market Committee (FOMC) has raised short-term interest rates by 3.00% in the six months between March and September. The market is now forecasting an additional 1.25% in hikes by year’s end, with the next move coming on November 3rd. Many borrowers and market participants have been surprised by the speed of these increases.

Payments Dive

OCTOBER 7, 2022

“Unfortunately, the business-to-business market lags behind its B2C counterpart and is only just beginning to embrace embedded finance,” writes Melio COO Tomer Barel.

CFPB Monitor

OCTOBER 7, 2022

On September 29, 2022, the Attorneys General of Arkansas, Iowa, Kansas, Missouri, Nebraska, and South Carolina filed a complaint in the U.S. District Court for the Eastern District of Missouri against President Biden, Secretary of Education Miguel Cardona, and the U.S. Department of Education ( 4:22-cv-01040 ) seeking to halt implementation of the Biden Administration’s student loan relief plan announced on August 24, 2022.

Independent Banker

OCTOBER 1, 2022

Photo by Chris Williams. “The knowledge we have cultivated over years of circumventing attacks means that we have a depth of understanding about cyber and data security that the general population doesn’t—and those are lessons we can share.”. When it comes to fraud, you don’t know what you don’t know, and what you don’t know can greatly influence your bottom line.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

South State Correspondent

OCTOBER 3, 2022

The Week Opens with Treasuries in Rally Mode. The week opens with Treasuries rallying on a combination of flight-to-safety and talk that yield highs for this cycle may be in place. Since touching 4% last Wednesday the 10yr yield has fallen to 3.68% this morning, up more than a point in price. The flight-to-safety component revolves around rumors that Credit Suisse Bank is facing capital concerns.

Payments Dive

OCTOBER 6, 2022

The card behemoth said it’s observing an increase in in-person fraud now that U.S. consumers are returning to their pre-pandemic shopping habits.

CFPB Monitor

OCTOBER 4, 2022

The Justice Department announced that it has entered into an agreement with Lakeland Bank to settle the DOJ’s claims that Lakeland engaged in unlawful redlining in the Newark, New Jersey metropolitan area. The DOJ’s lawsuit against Lakeland, filed in a New Jersey federal district court, is part of the DOJ’s nationwide “ Combating Redlining Initiative ” launched in October 2021.

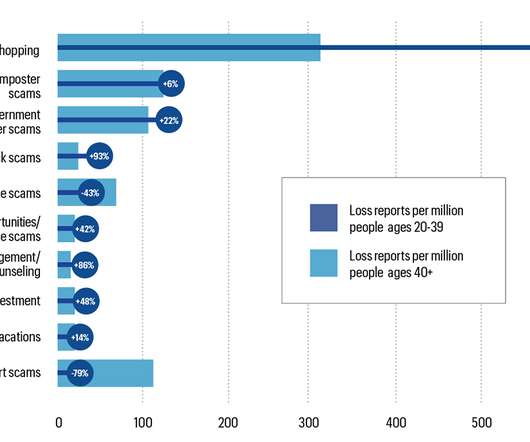

Independent Banker

OCTOBER 1, 2022

Financial fraud and cyber attacks aren’t a one-age-fits-all scenario. By identifying the preferred banking and spending habits of different generations, scammers can tailor how they reach their targets. We look at community banks’ options for fighting this type of crime. By Katie Kuehner-Hebert. Fraudsters will find ways to attack as many people as possible in as many different ways, but often their methods are different depending on a person’s age.

Speaker: Nancy Wu, Head of Sales and Customer Success at SkyStem

Join us for an enlightening webinar as we delve into the transformative realm of modern accounting practices. In today's digital age, the convergence of outsourcing and automation has revolutionized how businesses manage their financial operations. In this webinar we will explore the synergistic potential of these two strategies to streamline processes, enhance accuracy, save cost and drive strategic decision-making.

Bobsguide

OCTOBER 7, 2022

Helen Cook joins Finastra as Chief People Officer. London, UK – October 6, 2022 – Finastra today announced the appointment of Helen Cook as Chief People Officer. In her role she takes global responsibility for the people organization and advancing the company’s aspiration to be the most inclusive and diverse employer in the Fintech industry. She is particularly passionate about building a curious and well-tooled workforce, supporting employees to develop skills that keep them relevant, eng

Payments Dive

OCTOBER 4, 2022

The senator pushed to bolster a key CFPB rule after releasing a report tallying claims of fraud and scams on the P2P platform submitted by Truist, PNC, U.S. Bank and Bank of America.

CFPB Monitor

OCTOBER 4, 2022

Last week, the CFPB issued a “ Student Loan Servicing Special Edition ” of Supervisory Highlights. In this blog post, we highlight a stealth expansion of supervisory jurisdiction and focus on the CFPB’s findings in two key areas: Transcript withholding policies at institutional lenders (e.g. for-profit colleges that make private loans directly to student); and Administration by servicers of Public Service Loan Forgiveness (PSLF), Income-Driven Repayment (IDR), and Teacher Loan Forgiveness (TLF)

Independent Banker

OCTOBER 1, 2022

Photo by Chris Williams. “While there’s no cyber or data security silver bullet, by bringing the theoretical into a true banking environment, we can begin to establish action plans that speak to real-world attacks.”. Cyber and data security have long been areas of emphasis for community banks, but in today’s escalating digital environment, that focus has grown.

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

Let's personalize your content