6 payments trends to watch in 2023

Payments Dive

JANUARY 10, 2023

FedNow, embedded payments, deal-making, cybersecurity and more mature BNPL will be dominant themes, among others, in the industry this year.

Payments Dive

JANUARY 10, 2023

FedNow, embedded payments, deal-making, cybersecurity and more mature BNPL will be dominant themes, among others, in the industry this year.

ABA Community Banking

JANUARY 11, 2023

Meet Saleem Iqbal, ABA’s Community Bankers Council chair. The post ‘My hobby is banking’ appeared first on ABA Banking Journal.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

South State Correspondent

JANUARY 11, 2023

In a previous article ( HERE ), we analyzed industry performance and demonstrated that the average five-year net interest margin (NIM) and return on assets (ROA) are unrelated. The correlation coefficient (R 2 ) between these two variables is NEGATIVE 0.02 (essentially no explanatory relationship). This lack of connection has been a general observation in the banking industry for decades.

Payments Dive

JANUARY 11, 2023

U.S. fintech funding for the fourth quarter of 2022 was down nearly 80% compared to the same quarter in 2021, CB Insights said Wednesday.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

BankInovation

JANUARY 12, 2023

As the banking space continues to evolve, financial institutions are finding that companies they previously considered rivals may be potential partners. In a survey of 792 bank decision-makers in 50 countries conducted by France-based Sopra Banking Software, 77% of senior banking executives said they “feel pressured” to partner with fintechs to stay relevant in the […].

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

South State Correspondent

JANUARY 11, 2023

Many banks work hard to have a low-cost deposit base only to undermine their efforts. One of the biggest mistakes bank make when pricing deposits is advertising an above-market rate, thereby shortening deposit duration and increasing negative convexity for that one account and the whole product offering. This subtle distinction might be lost on many inexperienced bankers, and it is worth a review – while the rate impacts an account, the mere advertising also affects the account.

Payments Dive

JANUARY 12, 2023

With industry acquisitions ramping up this year, payments analysts have pinpointed a pack of potential payments company targets.

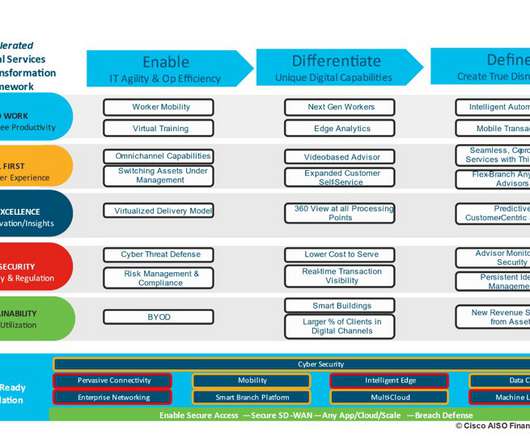

Cisco

JANUARY 10, 2023

As a change agent serving the financial services industry for over 20 years, it is a great privilege to collaborate with Bank, Insurance, and Wealth Management institutions to devise and execute digital transformation strategy, solve complex business problems, and leverage technology to strengthen business results. Ending a chaotic 2022 with the Federal Reserve in their December meeting raising interest rates to control inflation another 50 basis points following four consecutive 75 basis point

CFPB Monitor

JANUARY 12, 2023

The CFPB has filed an amicus brief in Mohamed v. Bank of America, N.A. in which it argues that a prepaid card loaded with pandemic-related unemployment benefits is a “prepaid account” subject to Regulation E, including its error resolution requirements.

Advertiser: ZoomInfo

Incorporating generative AI (gen AI) into your sales process can speed up your wins through improved efficiency, personalized customer interactions, and better informed decision- making. Gen AI is a game changer for busy salespeople and can reduce time-consuming tasks, such as customer research, note-taking, and writing emails, and provide insightful data analysis and recommendations.

South State Correspondent

JANUARY 10, 2023

Examining Bond Portfolio Trends: Fourth Quarter 2022. Beginning in May 2012, we started tracking portfolio trends of our bond accounting customers here at SouthState|DuncanWilliams. At present, we account for over 130 client portfolios with a combined book value of $13.96 billion (not including SouthState Bank), or $107 million on average per portfolio.

Payments Dive

JANUARY 12, 2023

The acquisition is the latest B2B move for the card company, which expects Nipendo’s capabilities to strengthen its position in that market.

BankUnderground

JANUARY 12, 2023

Kristina Bluwstein, Sudipto Karmakar and David Aikman. Introduction. Inflation reached almost 9% in July 2022, its highest reading since the early 1990s. A large proportion of the working age population will never have experienced such price increases, or the prospect of higher interest rates to bring inflation back under control. In recent years, many commentators have been concerned about risks to financial stability from the prolonged period of low rates, including the possibility of financia

CFPB Monitor

JANUARY 13, 2023

The CFPB has issued a proposed rule to establish a system for the registration of nonbanks subject to CFPB supervision that use “certain terms or conditions that seek to waive consumer rights or other legal protections or limit the ability.

Advertisement

Automation is changing the game for commercial lenders, offering a clear path to competitive advantage in 2025. Rising costs, outdated workflows, and manual data entry slow growth and impact borrower satisfaction. Automation addresses these challenges, reducing costs, speeding up loan cycles, improving accuracy, and elevating borrower experiences. With market uncertainty easing, now is the time to act—waiting until loan volumes rebound leaves lenders unprepared and struggling to compete.

ATM Marketplace

JANUARY 13, 2023

Cryptocurrency has taken a big hit of late with the bankruptcy of the FTX crypto exchange, but one crypto entrepreneur that has brought crypto to the vending space believes the technology has a promising future: particularly the oft maligned NFT.

Payments Dive

JANUARY 13, 2023

The buy now, pay later provider said it encountered a “technical issue” and that transactions would be corrected at banks within three to seven days.

Banking Exchange

JANUARY 9, 2023

Entities that are not federally regulated should not be allowed to make SBA-approved loans, industry groups argue Compliance Feature3 Feature Compliance Management Compliance/Regulatory Small Business PPP Covid19.

TheGuardian

JANUARY 11, 2023

Report from climate activist groups says City is unprepared for potential collapse in value of fossil fuel assets The UK could suffer 500,000 job losses and be forced to spend £674bn of taxpayer cash to rescue its banks, unless the City prepares for the value of fossil fuels to collapse as a result of climate crisis regulations , research shows. The report, published by a collective of climate activist groups known as the One to One campaign, suggests those financial repercussions could eclipse

Advertisement

Remote Deposit Capture (RDC) clients are more likely to use additional treasury services and maintain larger deposits. However, poor customer experiences—particularly if they delay deposits—can compel RDC clients to take their business elsewhere. This eBook makes the case for outsourcing RDC operations to a proven managed services partner. This approach helps Treasury Departments with limited resources provide excellent client experiences that result in higher retention and productivity rates.

ATM Marketplace

JANUARY 10, 2023

We have now entered into 2023, and it's time to look ahead to see what's on the horizon for branches, self-service and overall banking trends this year.

Payments Dive

JANUARY 9, 2023

The digital payment pioneer’s CEO Dan Schulman faces speculation about his exit. “We think he could move on from PayPal, legacy intact,” one analyst team wrote.

American Banker

JANUARY 10, 2023

TheGuardian

JANUARY 13, 2023

Bank slashes predicted 2023 European wholesale price by 30% as mild weather reduces demand HSBC has slashed its forecasts for future wholesale gas prices in response to mild weather in Europe – raising hopes of a sharp decline in household energy bills. The bank cut its 2023 forecasts for the price of gas traded in Europe by about 30% and its forecast for 2024 by 20%.

Advertisement

With automation, you’ll reduce errors and save valuable time, allowing you to focus on what really matters: strategic analysis and insightful decision-making. Picture accurate financial reports ready at your fingertips, giving you the confidence to tackle business challenges head-on. Embracing automation not only boosts productivity but also elevates your role from number cruncher to closing rockstar.

ATM Marketplace

JANUARY 9, 2023

IoT can scale as far and wide as its connectivity and data security will allow — from the tiniest devices featuring built-in wireless connectivity to HD video surveillance systems, enabled by cellular routers or gateways. The potential is there, but choosing the right solutions requires careful consideration.

Payments Dive

JANUARY 9, 2023

How AP Automation can help you survive and thrive during times of economic uncertainty.

TheGuardian

JANUARY 11, 2023

Consumers have got used to poor returns on savings accounts, but there are now better deals If you are one of the millions of people whose savings are languishing in an account paying little or no interest, it might be time to act because you could be earning 4.25%, or more on your cash. Earlier this week the Coventry building society warned that Britons have a collective £268bn sitting in easy and instant access accounts paying no interest – an increase of more than £9.6bnon a year ago.

Advertiser: ZoomInfo

In today’s ultra-competitive markets, it’s no longer enough to wait for buyers to show obvious signs of interest. Instead, sales teams must be proactive, identifying and acting on nuanced buyer behaviors — often before prospects are fully ready to make a purchase. In this eBook from ZoomInfo & Sell Better, learn 10 actionable ways to use these buyer signals to transform your sales strategy and close deals faster.

Let's personalize your content