Helping bank employees remain 'coachable' is a key management skill

American Banker

JANUARY 30, 2024

Organizations that emphasize not just coaching but the importance of remaining coachable, tend to develop more talented and engaged teams.

American Banker

JANUARY 30, 2024

Organizations that emphasize not just coaching but the importance of remaining coachable, tend to develop more talented and engaged teams.

The Emmerich Group

JANUARY 31, 2024

The days of transactional banking are over. Yes, there was a day when the customers would walk into our lobbies. Yes, there was a day where they came looking for us. Yes, I remember those days, too. Those days are long gone And it was a rapid turn. Yes, the amount of traffic coming into Continue Reading The post The Transactional to Transformational Model for Community Banks appeared first on Emmerich Financial.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Jack Henry

JANUARY 31, 2024

As we kick off the new year, it’s always a great time to reflect on the past and look forward to the future. Strategizing is important for all organizations as many industries are reinvented by technology and reimagined by changing consumer needs. Amid banking trends, fintech trends, and other emerging factors, the financial services sector is no stranger to change.

Gonzobanker

FEBRUARY 1, 2024

Turn up “Whole Lotta Love” and let the pure adrenalin rush of Jimmy Page’s intro accompany this year’s Acquire or Be Acquired recap … In the ever-evolving world of banking, Bank Director’s Acquire or Be Acquired Conference remains a constant. Early this week, the conference was the epicenter of discussions, where 2,000 attendees descended upon Arizona to strategize and set the tone for our great industry’s future.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

South State Correspondent

JANUARY 30, 2024

A typical current strategy for community banks when originating commercial real estate loans is to offer floating-rate loans or shorter-term adjustable structures. Borrowers are waiting for the Fed to lower short-term interest rates, hopefully translating into a refinancing opportunity for the borrower at a lower loan rate. Unfortunately, this strategy has all the underpinnings of a credit problem case study, and we do not have to search for a hypothetical example.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

TheGuardian

FEBRUARY 1, 2024

Toxic Tories have run themselves out as Starmer brings out the big hitters for a day at the Oval It was the hottest gig in town. Within hours of the event being announced all the £1,000 a head tickets had gone. Thank God for those uncapped bonuses. Anyone who was anyone in the business world was here. Executives from Goldman Sachs, Google, Mastercard, HSBC and countless more besides.

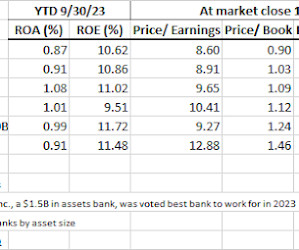

Jeff For Banks

FEBRUARY 1, 2024

Now that the debate is turning from Fed tightening to when the Fed will start dropping rates, we took a look at how financial institutions fared during the tightening cycle, using the quarter ended December 31, 2021 as the base period. The Fed began tightening at its March 17, 2022 meeting with a 25 basis points increase in the Fed Funds Rate and ended July 26, 2023.

ABA Community Banking

JANUARY 30, 2024

Credit unions are swallowing up tax-paying banks at an alarming rate, using the tax break lawmakers granted them to serve people of modest means. Following a record 16 credit union bank buys announced in 2022, credit unions’ share of total bank purchases hit an all-time high last year. The post Bank buys raise questions about the ‘credit union difference’ appeared first on ABA Banking Journal.

BankInovation

JANUARY 30, 2024

Technology and innovations advanced in leaps and bounds in 2023, including enhancements to AI, the introduction of generative AI and investment in data analytics.

Advertiser: ZoomInfo

Incorporating generative AI (gen AI) into your sales process can speed up your wins through improved efficiency, personalized customer interactions, and better informed decision- making. Gen AI is a game changer for busy salespeople and can reduce time-consuming tasks, such as customer research, note-taking, and writing emails, and provide insightful data analysis and recommendations.

Payments Dive

FEBRUARY 2, 2024

The retailer is working with artificial intelligence startup Grabango to offer the service for the first time in the U.S. at a location in the Chicago suburb of Aurora, Illinois.

Perficient

FEBRUARY 2, 2024

In discussions with financial services executives, Perficient consultants consistently explore the extension of the submission deadline for resolution plans among certain large financial institutions with assets exceeding $250 billion. Moving forward, these institutions will need to submit their resolution plans by March 31, 2025. Our Expertise Perficient launched its Risk and Regulatory CoE in October 2023 to proactively address compliance issues.

South State Correspondent

JANUARY 30, 2024

Times are tough. Banks are under pressure to find ways to increase earnings against a backdrop of slower increases in earning assets and quickly rising deposit and credit costs. As such, bank budgets have come under scrutiny. We recently conducted a small sample poll, and out of 21 banks, budgets were down an average of 14% for this year. Marketing and technology (IT) are two budgets that have taken the most significant hit.

CFPB Monitor

JANUARY 30, 2024

Maryland has joined the ranks of states considering legislation that would codify elements of “true lender” theory in an effort to impose federally preempted state licensing requirements and rate caps on loans to Maryland residents. House Bill 254 (HB 254), introduced on January 10, 2024 in the Maryland House of Delegates, would add Subtitle 15 – the “True Lender Act” – to Title 12 (Credit Regulations) of the Maryland Commercial Law.

Advertisement

Automation is changing the game for commercial lenders, offering a clear path to competitive advantage in 2025. Rising costs, outdated workflows, and manual data entry slow growth and impact borrower satisfaction. Automation addresses these challenges, reducing costs, speeding up loan cycles, improving accuracy, and elevating borrower experiences. With market uncertainty easing, now is the time to act—waiting until loan volumes rebound leaves lenders unprepared and struggling to compete.

Payments Dive

FEBRUARY 2, 2024

PayPal, Block and Brex all started cutting employees in January in pursuit of efficiency and profits.

Perficient

JANUARY 30, 2024

Our success at Perficient emanates from the dedication of our team. We take immense pride in recognizing that our committed individuals propel innovation and drive change within our industry. Every voice within our organization holds significance, none more so than Carolyn Lee , a Project Manager (PM) in our Financial Services business unit and a leader in Perficient’s Risk and Regulatory Center of Excellence (CoE).

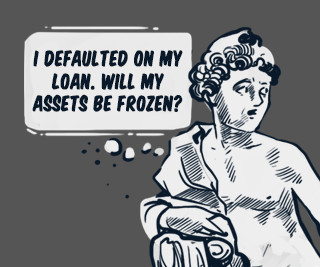

BankBazaar

JANUARY 31, 2024

While navigating a loan default can be challenging, understanding your rights and available options empowers you to make informed decisions. Here’s everything you need to know if you find yourself in this predicament. Repaying a loan and managing EMIs can sometimes become a challenging endeavour, potentially leading to concerns about defaulting. While defaulting is not an ideal situation, it’s important to recognise that it doesn’t mark the end of the road, nor does it brand you as a

BankInovation

JANUARY 30, 2024

Graphics processing units on today’s computers can only hold so much capacity — and financial institutions are looking to quantum computing to process ever-growing data sets and turbocharge AI.

Advertisement

Remote Deposit Capture (RDC) clients are more likely to use additional treasury services and maintain larger deposits. However, poor customer experiences—particularly if they delay deposits—can compel RDC clients to take their business elsewhere. This eBook makes the case for outsourcing RDC operations to a proven managed services partner. This approach helps Treasury Departments with limited resources provide excellent client experiences that result in higher retention and productivity rates.

Payments Dive

FEBRUARY 1, 2024

The card network is readying to offer Chinese consumers its card services domestically after winning approval last year for a joint venture in that country.

CFPB Monitor

JANUARY 30, 2024

The Department of Justice (DOJ) announced that Patriot Bank (Patriot or Bank) has agreed to pay $1.9 million to resolve allegations that the Bank engaged in a pattern or practice of redlining majority-Black and Hispanic neighborhoods in Memphis, Tennessee from 2015 to at least 2020, in violation of the Fair Housing Act (FHA) and the Equal Credit Opportunity Act (ECOA).

ATM Marketplace

JANUARY 30, 2024

With AI, ATM operators can identify ahead of time potential device faults and either make the fixes remotely or schedule maintenance. It can also detect potential attacks, either physical or software.

TheGuardian

JANUARY 31, 2024

Shadow chancellor says party aims to be champion of a thriving financial sector if it wins election Business live – latest updates Labour will not reinstate a cap on bankers’ bonuses if it wins the next election, the shadow chancellor has said. Rachel Reeves said she had “no intention” of bringing back the cap, saying she wanted to be the “champion of a thriving financial services industry”.

Advertisement

With automation, you’ll reduce errors and save valuable time, allowing you to focus on what really matters: strategic analysis and insightful decision-making. Picture accurate financial reports ready at your fingertips, giving you the confidence to tackle business challenges head-on. Embracing automation not only boosts productivity but also elevates your role from number cruncher to closing rockstar.

Payments Dive

JANUARY 30, 2024

The digital payments company plans to cut about 2,500 jobs, according to multiple news reports, shrinking the company as it seeks to jump-start profitable growth.

American Banker

JANUARY 28, 2024

Fintechs that jump ship to more stable sponsor banks need to prove they have a solid business and take compliance seriously.

ATM Marketplace

FEBRUARY 2, 2024

Customer experience is a critical part of every business, as it builds customer loyalty and improves the overall brand image and equity. When looking at the retail bank customer experience, there are multiple considerations to keep in mind in 2024.

TheGuardian

FEBRUARY 1, 2024

Out-of-court settlement reached with law firm acting for customers who have been left owing big sums One of Britain’s biggest high street banks has agreed a payout to settle a case involving “unfair” mortgages – giving hope to thousands of people who have been left owing huge sums. On the eve of a trial set to last six weeks, Bank of Scotland – part of Lloyds Banking Group – and a law firm representing 160 current and former customers reached an out-of-court settlement that means the bank will n

Advertiser: ZoomInfo

In today’s ultra-competitive markets, it’s no longer enough to wait for buyers to show obvious signs of interest. Instead, sales teams must be proactive, identifying and acting on nuanced buyer behaviors — often before prospects are fully ready to make a purchase. In this eBook from ZoomInfo & Sell Better, learn 10 actionable ways to use these buyer signals to transform your sales strategy and close deals faster.

Let's personalize your content