Los Angeles burns as banks step up to fuel aid efforts

American Banker

JANUARY 13, 2025

Bankers are putting pre-established action plans for disaster recovery into motion as wildfires in Los Angeles sweep across the region.

American Banker

JANUARY 13, 2025

Bankers are putting pre-established action plans for disaster recovery into motion as wildfires in Los Angeles sweep across the region.

Payments Dive

JANUARY 14, 2025

Consumers who use BNPL take out multiple loans and have more personal debt than consumers who don’t use the payment method, according to a new report from the Consumer Financial Protection Bureau.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

South State Correspondent

JANUARY 14, 2025

Last years worries of deterioration in labor-market conditions have evaporated and the Fed is still harboring concerns about elevated inflation risks. Many banks budgeted some six rate cuts in their 2024 asset-liability plans last year that never materialized. Going forward, the major unknown is the new administrations policies that all skew to higher inflation (from labor reduction, higher deficits, less regulation, to tariffs).

TheGuardian

JANUARY 15, 2025

The scope of the Cop26 net zero banking alliance may have been limited, but the exodus of six US banks signifies a seismic political shift Last week, as flames began tearing through greater Los Angeles, claiming multiple lives and forcing more than 100,000 people to evacuate, JP Morgan became the sixth major US bank to quit the Net Zero Banking Alliance (NZBA) since the start of December.

Advertisement

Why Legacy Lending Workflows Are Costing You More Than You Think Legacy systems and manual workflows might feel familiar, but they come with growing risks—compliance gaps, costly delays, and lost opportunities. This guide breaks down why clinging to traditional processes is no longer sustainable and how automation can help lenders regain control, improve efficiency, and reduce risk across the closing process.

ABA Community Banking

JANUARY 14, 2025

On the inaugural episode of the ABA Fraudcast, former ABA Chair Dan Robb, president and CEO of Jonesburg State Bank in Missouri, describes the recent targeting of his bank by fraudsters who texted thousands of residents of his community, seeking access to customer accounts. The post ABA Fraudcast: One community bank’s fight against a mass text scam appeared first on ABA Banking Journal.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

The Paypers

JANUARY 13, 2025

Google Pay has announced its official launch in the region of Pakistan by mid-March 2025, aiming to accelerate the country’s overall expanding digital payment landscape.

BankBazaar

JANUARY 14, 2025

Looking for the emerging trends in Indias personal finance market? Here are some key insights from the Moneymood 2025 report presented by BankBazaar. BankBazaar.com, an Indian fintech co-brand Credit Card issuer and online financial product marketplace, launched the sixth edition of BankBazaar Moneymood 2025. This report summarises personal finance trends from 2024 and outlines expectations for 2025.

Cisco

JANUARY 13, 2025

High Frequency Trading (HFT) customers demand real-time and fast connectivity to the exchange. Learn how to achieve multicast fairness with Nexus 3550-T and NX-OS for timely delivery of data and access to the exchange.

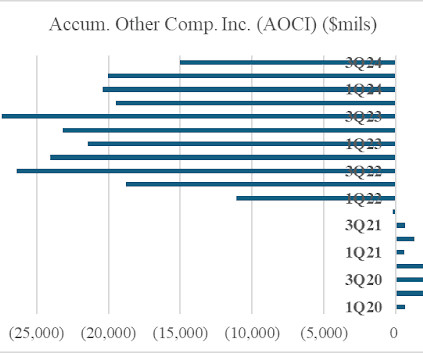

Jeff For Banks

JANUARY 14, 2025

Bank earnings remained below par for 2024 due to continued net interest margin pressures. As a result, many financial institutions amplified their misery by turning unrealized losses in their relatively low-yielding bond portfolios into actual losses by selling their underperforming bonds. In my book, Squared Away-How Bankers Can Succeed as Economic First Responders , I referred to the phenomenon of further impairing already impaired earnings by making strategic investments in your bank as "pull

Advertiser: Trellis

Finance teams find Trellis to be particularly effective in conducting comprehensive due diligence on both individuals and businesses. With our court data solution, financial experts can access critical litigation insights, making it an invaluable resource for informed decision-making in the financial sector.

South State Correspondent

JANUARY 16, 2025

Based on the 2007 to 2010 bank failure experience, we modeled the financial health of every bank using the last 16 quarters of historical performance. We have also created projections for the next 18 months. There are 150 banks that currently have a Grade of 8 out of 10, with 10 being the safest. In this article, we look at those 150 safest banks to learn five connected lessons on how to create a bank that can withstand the next great economic downturn.

Abrigo

JANUARY 17, 2025

This article covers these key topics: What is a core deposit intangible? Why are core deposit intangibles important? Using core deposit intangibles in mergers and acquisitions Using the core deposit intangible to assess value at banks & credit unio ns When evaluating a potential acquisition, banks must assess the core deposit intangible (CDI). Read on to learn about the importance of this metric, especially in today's dynamic environment.

Payments Dive

JANUARY 16, 2025

The digital payments provider agreed to pay penalties to the Consumer Financial Protection Bureau and a group of states under settlements that alleged the company violated banking laws.

TheGuardian

JANUARY 16, 2025

Calls for central bank to reduce unfair costs for consumers and stop businesses being gouged Follow our Australia news live blog for latest updates Get our breaking news email , free app or daily news podcast Six Labor MPs are urging the Reserve Bank to ban all surcharges for every debit transaction and dramatically reduce merchant fees for businesses, asking the central bank to go further than the governments pledge to stop surcharges only on card payments.

Advertiser: ZoomInfo

AI adoption is reshaping sales and marketing. But is it delivering real results? We surveyed 1,000+ GTM professionals to find out. The data is clear: AI users report 47% higher productivity and an average of 12 hours saved per week. But leaders say mainstream AI tools still fall short on accuracy and business impact. Download the full report today to see how AI is being used — and where go-to-market professionals think there are gaps and opportunities.

BankUnderground

JANUARY 17, 2025

Michael Salib and Mesha Ghazaleh The Banks monetary policy objectives are some of the most significant objectives bestowed by Parliament on any UK public authority. They are to maintain price stability and, subject to that, support the Governments economic policy, including its objectives for growth and employment. In our paper we offer a historical and legal account of the Banks monetary policy objectives by looking at their origins, the parliamentary debates around their wording and their inte

ATM Marketplace

JANUARY 17, 2025

What's the advantage of cash in 2025? Read more to find out.

Payments Dive

JANUARY 16, 2025

The payments were made over a three-year period beginning in 2020, and were not listed in some filings with the Securities and Exchange Commission. As a result, the company agreed to pay a fine under a settlement last week.

TheGuardian

JANUARY 15, 2025

Investment bank beats Wall Street expectations as it reports earning $11.95 per share in fourth quarter Goldman Sachs posted its biggest profit since the third quarter of 2021 to beat Wall Street expectations, driven by bankers who brought in more fees from dealmaking, debt sales and strength in trading. The investment banks shares rose 2.6% before the bell on Wednesday as it earned $11.95 per share in the fourth quarter, compared with $8.22 expected by analysts, according to estimates compiled

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

ABA Community Banking

JANUARY 17, 2025

This year could be a banner year for bank mergers and acquisitions, with improving economic conditions, enhanced net interest margins and the possibility of tax cuts, according to a recent analysis by the law firm Hunton Andrews Kurth. The post Report: Bank merger activity likely to speed up in 2025 appeared first on ABA Banking Journal.

The Paypers

JANUARY 13, 2025

Social media company X has outlined its ambition to evolve into an all-encompassing platform with the launch of the X Money payment feature scheduled for 2025.

Payments Dive

JANUARY 14, 2025

The card network entered the agreement to settle a proposed class action that alleged it discriminated against Black, Hispanic and female employees by underpaying them.

TheGuardian

JANUARY 17, 2025

Latest setback, after talks with Treasury, blamed on lack of clarity about implementation in US Business live latest updates The Bank of England has delayed the introduction of tougher global banking capital rules by a further year to prevent another 2008-style crash, blaming the second delay on a lack of clarity about its implementation in the US.

Speaker: Joe Wroblewski, Senior Sales Engineer

Is your tech stack working for you—or are you working for it ? 🤖 In today’s world of automation and AI, technology should simplify workflows—not add complexity. Seamless integration and interconnectivity are key to maximizing productivity, optimizing workflows, and improving collaboration. Join expert Joe Wroblewski for a practical and insightful session on how you can build a smarter, more connected tech stack that drives efficiency and long-term success!

American Banker

JANUARY 16, 2025

The future of the Consumer Financial Protection Bureau, Michael Barr's resignation and credit union acquisitions of banks are top matters facing bankers.

The Paypers

JANUARY 15, 2025

NYDFS has partnered with the Bank of England on a Transatlantic Regulatory Exchange (TRE) programme to strengthen oversight of digital assets and emerging payments.

Payments Dive

JANUARY 17, 2025

Banks seeking to halt a new Illinois law that bars credit card interchange fees on taxes and tips succeeded on one front, but not another, at least for now.

TheGuardian

JANUARY 17, 2025

FCA also aims to change law to try to prevent a repeat of mass compensation schemes for consumers such as PPI Mortgage rules could be loosened by the City regulator as it comes under government pressure to increase economic growth and home ownership across the UK. The move to simplify responsible lending for property purchases is part of a range of proposals put forward by the Financial Conduct Authority in an attempt to prove that the watchdog is not standing in the way of the Labour cabinets g

Advertisement

Automation is changing the game for commercial lenders, offering a clear path to competitive advantage in 2025. Rising costs, outdated workflows, and manual data entry slow growth and impact borrower satisfaction. Automation addresses these challenges, reducing costs, speeding up loan cycles, improving accuracy, and elevating borrower experiences. With market uncertainty easing, now is the time to act—waiting until loan volumes rebound leaves lenders unprepared and struggling to compete.

Let's personalize your content