Consumers grab credit cards for holiday shopping

Payments Dive

DECEMBER 2, 2024

Credit card debt will not slow shoppers down as they spend for the holidays, according to a new survey of U.S. consumers.

Payments Dive

DECEMBER 2, 2024

Credit card debt will not slow shoppers down as they spend for the holidays, according to a new survey of U.S. consumers.

Abrigo

DECEMBER 2, 2024

This article covers these key topics: Holiday risks: Thieves target checks in the mail Financial institutions can educate customers about holiday check fraud A staff refresher on check fraud red flags will help Check fraud detection software, collaboration, and reporting are crucial Check fraud risks during the holiday season Holiday check fraud puts financial institutions and their customers or members at risk.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

South State Correspondent

DECEMBER 4, 2024

The Federal Reserve Bank of New York published three articles on why banks fail (the first one here ). While the aim of the research was to identify the cause of approximately 5,000 US bank failures over the course of 160 years, the research also infers what factors bank executes can influence to not only avoid failure but to improve performance. In summary, the research finds that bank failure is caused primarily by rapid asset growth, that then causes rising asset losses, deteriorating solven

American Banker

DECEMBER 2, 2024

Banks have been returning some funds to fintech customers affected by the Synapse collapse, but a multimillion-dollar discrepancy between how much Synapse says customers are owed and how much the banks say they have remains.

Advertiser: Trellis

Finance teams find Trellis to be particularly effective in conducting comprehensive due diligence on both individuals and businesses. With our court data solution, financial experts can access critical litigation insights, making it an invaluable resource for informed decision-making in the financial sector.

BankUnderground

DECEMBER 4, 2024

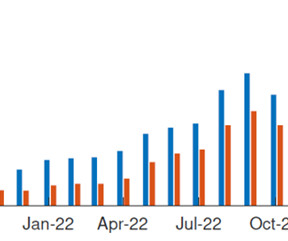

Bowen Xiao Zero-day options have exploded in popularity in recent years, accounting for approximately half of S&P 500’s total options volume, a ten-fold increase from just 5% in 2016. Their flexibility, low premia and underlying leverage appeal to all market participants ranging from conservative investors hedging against intraday market volatility to aggressive traders speculating for quick profit generation.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

Gonzobanker

DECEMBER 5, 2024

Will new infusions in the digital banking space translate to real innovation? This year has delivered many that wasnt on our digital 2024 bingo card moments for our industry. Two deals that were very much needed in the market were Candescents (the artist formally known as NCR Voyix) acquisition by Veritas Capital in September for $2.45 billion in cash (plus up to $100 million in contingent considerations) and Lumin Digitals growth equity raise of $160 million led by Light Street Capital, NewView

BankBazaar

DECEMBER 2, 2024

Large cash transactions, particularly those exceeding specified thresholds, can attract attention from the Income Tax Department. While these regulations are designed to uphold the integrity of the financial system and prevent illicit activities, they are not intended to discourage legitimate transactions. Understanding which transactions might draw scrutiny can help taxpayers avoid unnecessary notices or penalties.

Jack Henry

DECEMBER 2, 2024

When it comes to AI, compliance and accountability are more than regulatory obligations – they are commitments to your accountholders’ trust and the integrity of your financial institution. So, what happens if you don’t have robust AI governance and accountability structures in place? Consequences like regulatory penalties, potential biases in decision-making, and privacy breaches could harm your reputation and lead to financial losses.

Payments Dive

DECEMBER 2, 2024

Meet the payment needs of every generation to boost loyalty, satisfaction and on-time payments.

Advertiser: ZoomInfo

AI adoption is reshaping sales and marketing. But is it delivering real results? We surveyed 1,000+ GTM professionals to find out. The data is clear: AI users report 47% higher productivity and an average of 12 hours saved per week. But leaders say mainstream AI tools still fall short on accuracy and business impact. Download the full report today to see how AI is being used — and where go-to-market professionals think there are gaps and opportunities.

Gonzobanker

DECEMBER 5, 2024

Will new infusions in the digital banking space translate to real innovation? This year has delivered many “that wasn’t on our digital 2024 bingo card” moments for the team at Cornerstone Advisors. Two deals that especially took us by surprise were Candescent’s (the artist formally known as NCR Voyix) acquisition by Veritas Capital in September for $2.45 billion in cash (plus up to $100 million in contingent considerations) and Lumin Digital’s growth equity raise of $160 million led by Light Str

TheGuardian

DECEMBER 3, 2024

Wealth management employee charged with robbery, attempted murder and arson after home visit to elderly clients The boss of Japanese bank Nomura has apologised and taken a voluntary pay cut after a former employee was charged with robbery and attempted murder of a customer. Kentaro Okuda, who has led Nomura since 2020, will take a 30% pay cut over the next three months, with several other senior managers at the bank taking similar reductions, the bank said.

BankBazaar

DECEMBER 4, 2024

Weddings are more than just ceremonies. They’re larger-than-life productions steeped in traditions, emotions and societal expectations. From keeping up with the Sharmas to chasing Instagram-worthy moments, the pressure to spend big can be overwhelming. But why do we spend so much? Ah, weddings! The grand, glitzy spectacles that could rival even the most extravagant Bollywood sets.

Payments Dive

DECEMBER 4, 2024

The payments processor predicts fraud-fighting tools, embedded payments and comprehensive point-of-sale systems will be center stage in 2025.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

ATM Marketplace

DECEMBER 4, 2024

Despite their dwindling numbers, most ATM owners are still finding plenty of uses for them. In the 17th edition of the ATM & Self-Service Software Trends survey, about 57% said their reliance on ATMs remained the same, while about 31% said they were more reliant on their ATMs.

TheGuardian

DECEMBER 3, 2024

Paul Thwaite says government’s exit from its stake in bank could come in first half of 2025 and will be a ‘great moment’ The chief executive of NatWest has said the bailed-out bank is on a “fast trajectory to private ownership”, with the government likely to fully exit its stake within the first half of 2025. Paul Thwaite said it would be a symbolic moment for NatWest Group staff and the wider banking sector, allowing the industry to close another chapter of the fallout from the 2008 banking cra

BankBazaar

DECEMBER 2, 2024

The all-new version of the B ankBazaar mobile a pp for Android and iOS is here ! With sleek UI/UX changes , smarter features, and a focus on your needs, it’s more than just an update— it’s a promise to make every interaction effortless and more engaging , transforming the way you manage your finances. Explore with us now as we show you the future of finance management today!

Payments Dive

DECEMBER 2, 2024

Payments players charted an increase in spending over the Thanksgiving Day holiday weekend, with e-commerce sales growth outstripping the rise in stores.

Advertisement

Automation is changing the game for commercial lenders, offering a clear path to competitive advantage in 2025. Rising costs, outdated workflows, and manual data entry slow growth and impact borrower satisfaction. Automation addresses these challenges, reducing costs, speeding up loan cycles, improving accuracy, and elevating borrower experiences. With market uncertainty easing, now is the time to act—waiting until loan volumes rebound leaves lenders unprepared and struggling to compete.

BankUnderground

DECEMBER 3, 2024

Jenny Clark and Theresa Löber The UK’s climate continues to change, getting wetter and warmer , with extremes becoming ever more pronounced. Even if we limit global warming to 1.5°C above pre-industrial levels, experts warn that we’ll see the number and severity of extreme weather events increase further. Without adaptation, we will see more property, infrastructure and agriculture damaged or destroyed, with devastating consequences to households, communities and businesses – as well as increasi

ATM Marketplace

DECEMBER 5, 2024

A webinar hosted by ATM Marketplace and sponsored by KAL examined some of the key findings of the 17th annual 2024/2025 ATM Software Trends Report.

PopularBank

DECEMBER 2, 2024

Popular Bank believes in the power of community and the importance of supporting initiatives that uplift individuals and foster success. As such, we are proud to highlight our ongoing partnership with Bottomless Closet, a New York City based non-profit organization. Established in 1999, Bottomless Closet is dedicated to empowering women to thrive professionally, providing them with the resources and support needed to succeed.

Payments Dive

DECEMBER 4, 2024

The Federal Reserve projects the real-time payment system’s costs will climb slightly next year, from the $245.5 million it expects to spend this year.

Advertisement

Remote Deposit Capture (RDC) clients are more likely to use additional treasury services and maintain larger deposits. However, poor customer experiences—particularly if they delay deposits—can compel RDC clients to take their business elsewhere. This eBook makes the case for outsourcing RDC operations to a proven managed services partner. This approach helps Treasury Departments with limited resources provide excellent client experiences that result in higher retention and productivity rates.

American Banker

DECEMBER 6, 2024

Telcoin is seeking to become the first chartered bank under Nebraska's Digital Asset Depository Institutions regime. Its CEO believes it can become a regulated bridge between crypto and banking.

ATM Marketplace

DECEMBER 3, 2024

As we move into 2025, understanding the nuances of TR-31 is essential for financial institutions and ATM operators to ensure compliance and maintain robust security

Jack Henry

DECEMBER 2, 2024

Digital account opening solutions have undoubtedly emerged as one of the most essential initiatives a financial institution should invest in. In fact, account opening has been a very hot topic in Cornerstone’s What’s Going on in Banking report for the past four years.

Payments Dive

DECEMBER 2, 2024

The Canadian payments software company said it expects the operational overhaul to impact 200 workers and result in savings that can be redirected to its priorities.

Advertiser: ZoomInfo

ZoomInfo customers aren’t just selling — they’re winning. Revenue teams using our Go-To-Market Intelligence platform grew pipeline by 32%, increased deal sizes by 40%, and booked 55% more meetings. Download this report to see what 11,000+ customers say about our Go-To-Market Intelligence platform and how it impacts their bottom line. The data speaks for itself!

Let's personalize your content