Feds crack down on improper payments

Payments Dive

JULY 20, 2022

A federal government report released this week takes aim at the problem of fraudulent public benefit payments, which mushroomed to $281 billion for fiscal year 2021.

Payments Dive

JULY 20, 2022

A federal government report released this week takes aim at the problem of fraudulent public benefit payments, which mushroomed to $281 billion for fiscal year 2021.

Gonzobanker

JULY 20, 2022

The lack of ownership in driving digital transformation is a huge roadblock for financial institutions. In my digital transformation work with Cornerstone Advisors clients, I often ask executives a simple question: “Who owns digital?” The most common responses are: 1) blank stare, 2) scrunched face of contemplation, and 3) “a lot of different people.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Perficient

JULY 18, 2022

A TRACE-eligible security does not include a debt security that is issued by a foreign, sovereign government or a money market instrument. A money market instrument is, other than a U.S. Treasury Security, a debt security that at issuance has a maturity of one calendar year or less, or if an agency or government-sponsored enterprise (GSE), a maturity of one calendar year and one day or less.

Accenture

JULY 19, 2022

Telecom firms play a critical role in connecting people: 85% of the US population use smartphones today, and the penetration rate in the UK has reached 92%. This access to a massive market creates a unique opportunity for the key telecoms players to offer streamlined, end-to-end customer journeys, which can be powered by frictionless digital…. The post 3 key areas where payments can empower telecoms appeared first on Accenture Banking Blog.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Payments Dive

JULY 20, 2022

“Challengers frequently believe BNPL 1.0 is what it is, and will not evolve,” writes Brian Shniderman, CEO of Opy, a U.S. subsidiary of Australian payments fintech Openpay. “But it can, and very recently, it has proven that it will.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

Abrigo

JULY 21, 2022

Teaching branch staff these KYC tips can aid CDD compliance BSA Officers can help tellers and other branch staff learn how to ask questions that both foster relationships and support CDD compliance. . You might also like this resource, "Customer due diligence checklist." DOWNLOAD. Takeaway 1 Front-line teams are the eyes and ears of the bank or credit union and can support Customer Due Diligence (CDD) requirements.

Accenture

JULY 20, 2022

The recent nCino nSight 2022 conference in Raleigh, North Carolina, was the first large-scale, in-person event I’ve attended in over two years. Although the presentations at the event were very informative and insightful, (look below for our nSight 2022 key session summary), I’m not going to discuss those here. Instead, I’d like to focus on…. The post Back to in-person events (for now) and loving it!

Payments Dive

JULY 18, 2022

The company has more than doubled its headcount over the past year to meet demand for its payments software from clients like Marqeta and Gusto. Now, it plans more expansion for real-time services.

South State Correspondent

JULY 20, 2022

For Now, Focus is on Europe. Treasuries are finding a bid this morning as concerns re-emerge over possible energy disruptions in Europe which could slow the global economy. The EU proposed the union cut gas consumption by 15% to be better prepared for a possible full cut-off of gas by Russia heading into the winter months. With the Ukraine war showing no signs of improvement the gas supply situation is likely to be a continuing thorn in the side of the European economy, and it will only worsen a

Advertiser: ZoomInfo

Incorporating generative AI (gen AI) into your sales process can speed up your wins through improved efficiency, personalized customer interactions, and better informed decision- making. Gen AI is a game changer for busy salespeople and can reduce time-consuming tasks, such as customer research, note-taking, and writing emails, and provide insightful data analysis and recommendations.

CFPB Monitor

JULY 20, 2022

As discussed in an earlier blog post , the California Department of Financial Protection and Innovation (“DFPI”) issued an Invitation for Comments on the Proposed Second Rulemaking under the Debt Collection Licensing Act (“DCLA”) on August 19, 2021. The Commissioner is now considering draft regulations related to the DCLA’s scope, annual report, and document retention requirements, and has issued an “ Invitation for Comments on Draft Text for Proposed Second Rulemaking Under the Debt Collection

Accenture

JULY 17, 2022

Anyone in the world of payments knows SWIFT—the Society for Worldwide Interbank Financial Telecommunication—because it’s a crucial part of the international payments infrastructure. SWIFT will turn 50 next year, and it’s possible that in all that time it has never been subject to more disruption and innovation than it is right now. Consider the many….

Payments Dive

JULY 18, 2022

An experienced commerce partner can help provide the technology needed to help merchants keep up.

South State Correspondent

JULY 18, 2022

75bps Returns as the Expected Rate Hike for Next Week. The initial chatter about a possible 100bps rate hike that came after the ugly June CPI report has died down and a 75bps rate hike has returned as the consensus outlook for next week’s FOMC meeting. The chatter died down immediately after Friday’s University of Michigan Sentiment Survey found long-run inflation expectations had edged lower to 2.8% from 3.1% previously and 3.0% expected.

Advertisement

Automation is changing the game for commercial lenders, offering a clear path to competitive advantage in 2025. Rising costs, outdated workflows, and manual data entry slow growth and impact borrower satisfaction. Automation addresses these challenges, reducing costs, speeding up loan cycles, improving accuracy, and elevating borrower experiences. With market uncertainty easing, now is the time to act—waiting until loan volumes rebound leaves lenders unprepared and struggling to compete.

ATM Marketplace

JULY 19, 2022

Typically, retail ATMs have had fewer features than bank ATMs, but that may be changing. ATM Marketplace interviewed Brad Nolan, EVP and CMO at Hyosung America, to learn more about how the market is changing.

BankUnderground

JULY 20, 2022

Miguel García-Posada and Sergio Mayordomo. In February, the Bank hosted its inaugural Bank of England Agenda for Research (BEAR) conference, with the theme of ‘The Monetary Toolkit’ As part of our occasional series of Guest Posts by external presenters at Bank research events, the authors of one paper from the BEAR conference outline their findings on the effect of negative rates on Spanish banks….

Payments Dive

JULY 18, 2022

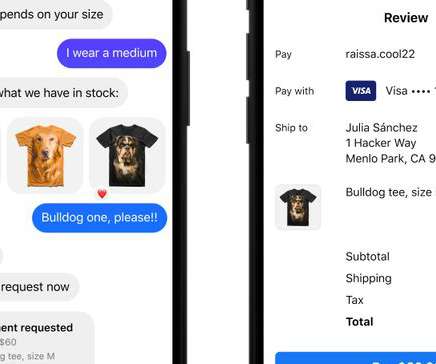

Meta-owned Instagram will allow users to make purchases from small businesses directly within messages sent in the app.

South State Correspondent

JULY 17, 2022

The Federal Reserve is rapidly changing the interest rate environment to fight inflation. The Fed’s actions are forcing lenders and borrowers to consider ways to protect cash flow, credit, liquidity, and interest rate risks. Many borrowers ask lenders how they can use swaps, caps, floors, and collars to protect their businesses and lower borrowing costs.

Advertisement

Remote Deposit Capture (RDC) clients are more likely to use additional treasury services and maintain larger deposits. However, poor customer experiences—particularly if they delay deposits—can compel RDC clients to take their business elsewhere. This eBook makes the case for outsourcing RDC operations to a proven managed services partner. This approach helps Treasury Departments with limited resources provide excellent client experiences that result in higher retention and productivity rates.

ATM Marketplace

JULY 22, 2022

Clinton Cheng, VP, global head of the Visa/PLUS ATM Network at Visa, will deliver key insights regarding the future of self-service banking and payments at the Bank Customer Experience Summit, being held in Chicago from Aug. 31 to Sept. 1.

Payments Dive

JULY 19, 2022

Following its second acquisition as a public company, Boston-based Flywire will continue to look for purchase opportunities that expand the payments company’s reach globally, said CEO Mike Massaro.

CB Insights

JULY 19, 2022

Global fintech funding fell 33% quarter-over-quarter (QoQ) to hit $20.4B — its lowest level since Q4’20. Deals also hit a 6-quarter low, dropping 17% QoQ to reach 1,225. In line with this trend, $100M+ mega-rounds also accounted for a smaller percentage of total deals (4%) and funding (47%) than they did at any quarterly point last year. Below, check out a handful of highlights from our 197-page, data-driven State of Fintech Q2’22 Report.

Advertisement

With automation, you’ll reduce errors and save valuable time, allowing you to focus on what really matters: strategic analysis and insightful decision-making. Picture accurate financial reports ready at your fingertips, giving you the confidence to tackle business challenges head-on. Embracing automation not only boosts productivity but also elevates your role from number cruncher to closing rockstar.

FICO

JULY 21, 2022

Home. Blog. FICO. Continuous Financial Education for Women Small Business Owners. FICO-hosted panel at NAWBO’s 2022 Advocacy Days discusses how financial education impacts access to capital and business growth for small businesses. FICO. Tue, 02/18/2020 - 14:57. by Joanne Gaskin. expand_less Back To Top. Thu, 07/21/2022 - 15:30. In June, I had the pleasure of participating in a panel discussing credit access and financial education for women small business owners at the National Association of W

Payments Dive

JULY 22, 2022

The spending behaviors of American Express customers don’t suggest an economic downturn is imminent, CEO Steve Squeri asserted during Friday’s second quarter earnings call.

BankInovation

JULY 21, 2022

Cloud services are transforming business operations for financial institutions, providing a modern IT infrastructure while mitigating cyber risk. Referred to by IBM as “one of the most important shifts in the history of enterprise computing,” adoption of the public cloud is growing as organizations become more familiar with the advantages provided by the technology.

Advertiser: ZoomInfo

In today’s ultra-competitive markets, it’s no longer enough to wait for buyers to show obvious signs of interest. Instead, sales teams must be proactive, identifying and acting on nuanced buyer behaviors — often before prospects are fully ready to make a purchase. In this eBook from ZoomInfo & Sell Better, learn 10 actionable ways to use these buyer signals to transform your sales strategy and close deals faster.

Let's personalize your content