Contra Accounts 101

Jack Henry

MARCH 25, 2021

No, this has nothing to do with the Iran-Contra affair. Now that I have thoroughly dated myself, let’s get into contra accounts. What is a contra, and what do I need to know? I’m glad you asked.

Jack Henry

MARCH 25, 2021

No, this has nothing to do with the Iran-Contra affair. Now that I have thoroughly dated myself, let’s get into contra accounts. What is a contra, and what do I need to know? I’m glad you asked.

Banking Exchange

MARCH 23, 2021

Payment disputes related to friendly fraud are expected to soar this holiday season due to the pandemic-fueled surge in e-commerce Risk Management Cyberfraud/ID Theft Consumer Compliance Operational Risk Security Online Payments Feature Feature3.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

ATM Marketplace

MARCH 23, 2021

Ruston Miles, founder and advisor of Bluefin Payment Systems takes a long look at how the coronavirus pandemic affected the payments industry and how that changes the future. This will be the first article in ATM Marketplace's series, COVID-19: A look back at a year of change

Perficient

MARCH 22, 2021

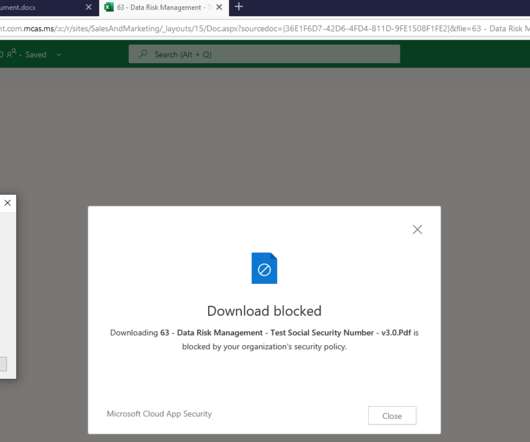

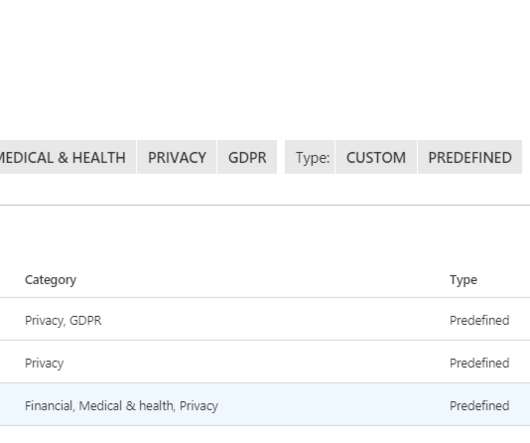

Welcome back! Last time we talked about controlling file downloads of sensitive content by using a session policy in MCAS. This time we’ll take things a step further and show you how to restrict specific activities like cut/copy, paste, and printing! If you are joining us for the first time, I encourage you to check out the first blog for a quick rundown of our scenario.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Accenture

MARCH 23, 2021

Payments is a hot topic for middle market banks. In fact, I think payments modernization is the most consequential transformation that they’ll make this decade. With the shadow of an aging payments infrastructure looming large, banks can’t stay on the sidelines. This is an existential issue. Banks that don’t act put their future at risk.…. The post Once-in-a-generation chance for banks in payments appeared first on Accenture Banking Blog.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

Payments Source

MARCH 26, 2021

The country has lots of smartphones, few plastic cards, and it's just starting to get rid of cash. ]].

Perficient

MARCH 22, 2021

After a year unlike anyone ever anticipated, I sat down with Perficient’s Vice President of People Andrea Lampert , to learn more about the inspiration behind the work Perficient recently invested in refining our People Promise, a meaningful and aspirational statement that captures the essence of who we are and who we aspire to be. Andrea, thank you for the time today.

BankBazaar

MARCH 22, 2021

Sometimes, no matter how hard you try, your relationship with money refuses to improve. The answer could lie in your money scripts. Not sure what they are? Read on. Every New Year brings with it the promise of boundless possibilities to turn our lives around. In the run-up to the New Year, we all may have made an effort to spend some quiet time by ourselves, pausing and reflecting on the year gone by and filing notes about what aspects of our lives we may want to improve in the coming year.

Abrigo

MARCH 24, 2021

Anti-Money Laundering Act of 2020 BSA professionals should prepare for changes as new regulations and guidance from FinCEN unfold. Want more BSA readiness articles sent to your inbox? Takeaway 1 The Anti-Money Laundering Act of 2020 (AMLA) is the first significant change to the Bank Secrecy Act in nearly 20 years. Takeaway 2 While the AMLA is now law, regulations, guidance, and other information still needs to be written.

Advertiser: ZoomInfo

Incorporating generative AI (gen AI) into your sales process can speed up your wins through improved efficiency, personalized customer interactions, and better informed decision- making. Gen AI is a game changer for busy salespeople and can reduce time-consuming tasks, such as customer research, note-taking, and writing emails, and provide insightful data analysis and recommendations.

Payments Source

MARCH 25, 2021

Wallex hopes its EURST stablecoin will be transparent and familiar enough to appeal to mainstream payment companies. ]].

Perficient

MARCH 21, 2021

In this day and age, protecting your organization’s sensitive data has started to become exceedingly difficult. Where remote work has become the new norm, you will likely see many end-users using their own unmanaged devices to access corporate information. With this comes the risk of unmanaged devices sending/sharing sensitive information without the ability to control or monitor these types of activity.

Bobsguide

MARCH 23, 2021

A flexible, collaborative and adaptable approach to partnership was behind the success of 2020 bobsguide Best Retail Banking System Implementation award winners Compass Plus and Unibank. Unibank, one of the largest, most innovative and successful retail banks in Azerbaijan, originally teamed up.

CFPB Monitor

MARCH 25, 2021

On March 23 , Illinois Governor Pritzker signed into law SB 1792 , which contains the Predatory Loan Prevention Act (the “Act”). The new law became effective immediately upon signing notwithstanding the authority it gives the Illinois Secretary of Financial and Professional Regulation to adopt rules “consistent with [the] Act.”. The Act extends the 36% “all-in” Military Annual Percentage Rate (MAPR) finance charge cap of the federal Military Lending Act (MLA) to “any person or entity that offer

Advertisement

Automation is changing the game for commercial lenders, offering a clear path to competitive advantage in 2025. Rising costs, outdated workflows, and manual data entry slow growth and impact borrower satisfaction. Automation addresses these challenges, reducing costs, speeding up loan cycles, improving accuracy, and elevating borrower experiences. With market uncertainty easing, now is the time to act—waiting until loan volumes rebound leaves lenders unprepared and struggling to compete.

Payments Source

MARCH 22, 2021

In-person branch use will continue, but retail banks should nonetheless double down on building intuitive, easy-to-use mobile experiences that drive customer satisfaction and brand loyalty ]].

Perficient

MARCH 25, 2021

Scott Albahary, Perficient’s financial services chief strategist, and I recently spoke with the Western Bankers Association about using empathy and personalization strategies to improve debt collection and recoveries. If you get a chance, listen to the short episode. But, if you can’t, here are the key points Scott and I make: Banks responded generously to support their customers’ debt hardship needs through the pandemic, but programs are ending.

SWBC's LenderHub

MARCH 23, 2021

But I hold up my hand, I'm just trying make you understand, Lord, you know, everybody tells Lil' Junior "Somebody hoodooed the hoodoo man." – Junior Wells “The Hoodoo Man Blues”.

TheGuardian

MARCH 21, 2021

Former prime minister said to have sent multiple messages to chancellor to access funds for doomed lender New questions are being raised over David Cameron’s attempts to lobby government on behalf of doomed lender Greensill Capital, after he reportedly contacted the chancellor’s private phone in hopes of securing special access to hundreds of thousands of pounds of emergency Covid loans.

Advertisement

Remote Deposit Capture (RDC) clients are more likely to use additional treasury services and maintain larger deposits. However, poor customer experiences—particularly if they delay deposits—can compel RDC clients to take their business elsewhere. This eBook makes the case for outsourcing RDC operations to a proven managed services partner. This approach helps Treasury Departments with limited resources provide excellent client experiences that result in higher retention and productivity rates.

Payments Source

MARCH 23, 2021

Decentralized finance, in tandem with financial institutions, could create a more efficient, convenient, wider-reaching, and more secure experience than traditional finance alone, says FISPAN's Clayton Weir. ]].

Perficient

MARCH 23, 2021

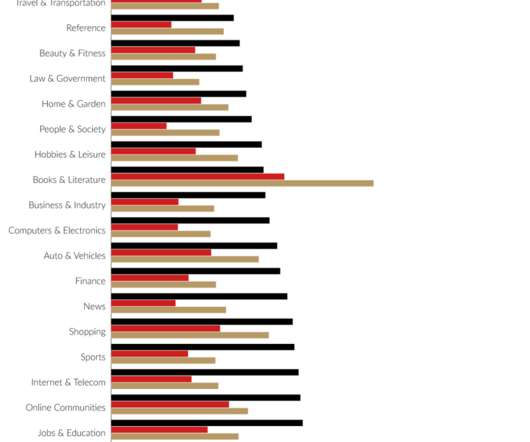

This study is a comprehensive review of mobile versus desktop usage on the web. In this year’s study, we compare 2019 and 2020 traffic patterns in the U.S. and globally. We also include tablet usage stats. The data in this study was pulled from Google Analytics’ Benchmarking feature , which provides aggregated industry data from companies who share their data.

SWBC's LenderHub

MARCH 22, 2021

Last Week: Rate traders’ disappointment with the Fed dominated the week. On Wednesday, the FOMC statement and Chairman Powell’s press conference drove home two points. The first is that the Fed considers inflationary pressures on the horizon as the economy opens up and recovers from the pandemic to be transitory.

Banking Exchange

MARCH 24, 2021

S&P Global Market Intelligence analyzed more than 4,000 banks and credit unions to name the top performers Community Banking Feature3 Feature Bank Performance The Economy Financial Trends Retail Banking.

Advertisement

With automation, you’ll reduce errors and save valuable time, allowing you to focus on what really matters: strategic analysis and insightful decision-making. Picture accurate financial reports ready at your fingertips, giving you the confidence to tackle business challenges head-on. Embracing automation not only boosts productivity but also elevates your role from number cruncher to closing rockstar.

Payments Source

MARCH 22, 2021

Google will have to bring new leadership to initiatives like financial inclusion and its operations in India now that Caesar Sengupta, vice president and general manager of payments, has announced he will leave the company. ]].

Perficient

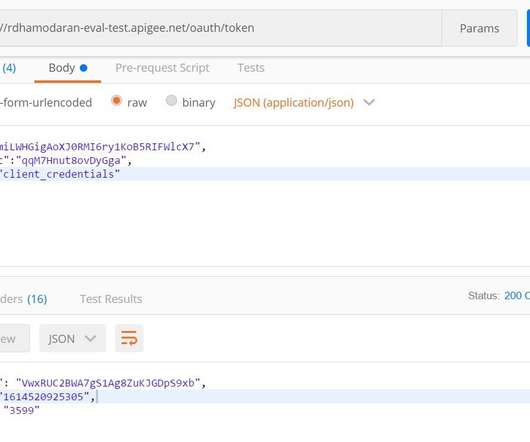

MARCH 23, 2021

Overview. This use case describes how to customize and validates JSON message for GrantType client credential – AccessToken. What is GrantType client credential? Client POST’s an API call to Apigee with client ID and client secret to fetch the access token from the registered developer application. In addition, query parameter grant_type=client_credentials must be passed in the request.

BankUnderground

MARCH 26, 2021

Maren Froemel, Mike Joyce and Iryna Kaminska. Introduction. During 2020 the MPC announced a further £450 billion of QE purchases, slightly more than the total amount of assets purchased over the preceding ten years, taking the target QE stock to £875 billion of gilt holdings and £20 billion of sterling investment-grade corporate bonds. We study the high-frequency reaction of gilt markets to these QE announcements in light of the surprises to market expectations of the future QE path.

Banking Exchange

MARCH 24, 2021

Rapid advances in technology, mobile phone penetration, new players and massive investments in technology are transforming the financial services industry Technology Feature3 Feature Fintech Financial Trends.

Advertiser: ZoomInfo

In today’s ultra-competitive markets, it’s no longer enough to wait for buyers to show obvious signs of interest. Instead, sales teams must be proactive, identifying and acting on nuanced buyer behaviors — often before prospects are fully ready to make a purchase. In this eBook from ZoomInfo & Sell Better, learn 10 actionable ways to use these buyer signals to transform your sales strategy and close deals faster.

Let's personalize your content