How Do You Select the Best Digital Banking Platform?

BankInovation

APRIL 4, 2023

Why you need one, what to look for and how to select the best digital banking platform to support your digital banking strategy heading into the new year.

BankInovation

APRIL 4, 2023

Why you need one, what to look for and how to select the best digital banking platform to support your digital banking strategy heading into the new year.

South State Correspondent

APRIL 3, 2023

In recent articles ( here and here ), we discussed why banks that take the interest rate movement risk demonstrate lower performance as measured by return on assets (ROA). Empirical evidence, historical bank failures, and common sense teach us that many risks do not translate to higher yields. The second article compared and contrasted community banks’ pay-for-risk and relationship business models.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

APRIL 5, 2023

The leader of one of the biggest asset managers in the world doesn’t think the U.S. payments system is keeping pace.

Accenture

APRIL 5, 2023

There’s a lot of buzz about next-gen payments rails globally, but where does North America stand when it comes to adopting these new options? Accenture’s recent consumer payments research—which you’ll find in our report, Payments gets personal: strategies to stay relevant—revealed that North Americans have a clear preference for payment methods they trust, from providers… The post Americans value trust above all in payment options appeared first on Accenture Banking Blog.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Abrigo

APRIL 7, 2023

Making a case for greater efficiency Loan review automation eliminates manual processes, saving time and reducing human error. Here's what to say when presenting a case for software at your institution. You might also like this whitepaper: "2022 Loan Review Benchmark Survey Results." DOWNLOAD Takeaway 1 Loan review automation can help reduce or eliminate common efficiency problems that financial institutions face.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

Payments Dive

APRIL 5, 2023

No arrests have been made in the Tuesday morning death of Bob Lee, the chief product officer at crypto firm MobileCoin, police said.

CFPB Monitor

APRIL 7, 2023

In the CFPB’s second attempt to define “abusive” acts or practices, the first being guidance rescinded a year after it was given in 2020, the CFPB has issued a new policy statement in which it turns to statutory analysis and past enforcement actions to provide a framework for determining what constitutes abusive conduct. .

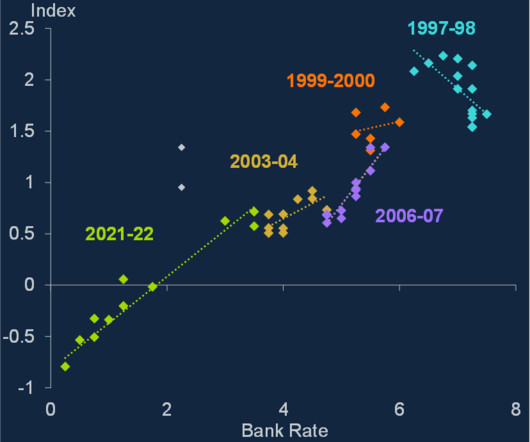

BankUnderground

APRIL 6, 2023

Natalie Burr The challenge of measuring financial conditions Imagine you were tasked with thinking about how financial conditions have changed over a policy tightening cycle. Different economists would come to very different conclusions, and none would necessarily be wrong. Why? Because measuring financial conditions is challenging – for a variety of reasons.

ATM Marketplace

APRIL 7, 2023

Video banking is a now a multi-billion dollar industry. Where's it headed? ATM Marketplace takes a closer look.

Advertiser: ZoomInfo

Incorporating generative AI (gen AI) into your sales process can speed up your wins through improved efficiency, personalized customer interactions, and better informed decision- making. Gen AI is a game changer for busy salespeople and can reduce time-consuming tasks, such as customer research, note-taking, and writing emails, and provide insightful data analysis and recommendations.

Payments Dive

APRIL 3, 2023

The instant payment floodgates are about to open when FedNow launches in July, giving banks a chance to win back customers lost to fintechs, says one GFT Group executive.

CFPB Monitor

APRIL 5, 2023

The CFPB has filed a Notice of Appeal with the U.S. Court of Appeals for the Seventh Circuit from the district court’s decision in the CFPB’s enforcement action against Townstone Mortgage (Townstone). In the case, the district court ruled that a redlining claim may not be brought under the Equal Credit Opportunity Act (ECOA) because the statute only applies to applicants.

BankBazaar

APRIL 5, 2023

One of the most highly acclaimed films of the year, RRR is much more than its entertainment value. The film also offers valuable lessons about finances and money management. In this listicle, we’ll take a closer look at what RRR teaches us about finances and how we can apply these lessons to our own lives. Set Clear Goals In RRR, the characters – freedom fighters Komaram Bheem and Alluri Sitarama Raju – have clear goals and motivations that drive their actions throughout the film

ATM Marketplace

APRIL 4, 2023

What's driving the bitcoin ATM market? There are several factors to consider including security and accessibility. However, there are also issues holding it back. Let's take a look at both.

Advertisement

Automation is changing the game for commercial lenders, offering a clear path to competitive advantage in 2025. Rising costs, outdated workflows, and manual data entry slow growth and impact borrower satisfaction. Automation addresses these challenges, reducing costs, speeding up loan cycles, improving accuracy, and elevating borrower experiences. With market uncertainty easing, now is the time to act—waiting until loan volumes rebound leaves lenders unprepared and struggling to compete.

Payments Dive

APRIL 3, 2023

Even with the backing of the nation’s largest banks, the platform, set for a June launch, will have adoption and security hurdles to overcome to grab a slice of the digital wallet market, industry experts say.

TheGuardian

APRIL 4, 2023

Company’s own website went down and internet was inaccessible for several hours. Follow all our live coverage of business, economics and financial markets It has not been a great day for companies bearing the Virgin brand. Virgin Orbit, the satellite launch company started by Sir Richard Branson, has filed for US bankruptcy protection. Last-ditch efforts to find funding for the struggling space firm fell through, the Guardian’s Kalyeena Makortoff reports.

FICO

APRIL 3, 2023

Home Blog FICO Advancing the Science of Optimization: FICO & Zuse Institute Berlin FICO partners with Zuse Institute Berlin on critical research into mathematical optimization FICO Admin Tue, 02/18/2020 - 14:57 by Oliver Bastert Vice President, Product Management expand_less Back To Top Mon, 04/03/2023 - 11:45 As a result of the pandemic, interest in mathematical optimization has risen to new heights.

Advertisement

Remote Deposit Capture (RDC) clients are more likely to use additional treasury services and maintain larger deposits. However, poor customer experiences—particularly if they delay deposits—can compel RDC clients to take their business elsewhere. This eBook makes the case for outsourcing RDC operations to a proven managed services partner. This approach helps Treasury Departments with limited resources provide excellent client experiences that result in higher retention and productivity rates.

Payments Dive

APRIL 4, 2023

The payments gateway startup, which handles acquiring and issuing, is positioning itself as a nimbler competitor to the likes of Stripe and Wex.

ATM Marketplace

APRIL 7, 2023

The LTA-100 provides innovative cassette-based cash recycling technology in a sleek, space saving design. This user-friendly solution delivers optimal efficiency, convenience and security.

TheGuardian

APRIL 5, 2023

Still no agreement after 11 months of talks between the postal firm and CWU; Swiss bank UBS faces investors over merger with Credit Suisse The UBS chairman has told investors that the emergency takeover of Credit Suisse last month marked a “historic day” but one that the Swiss bank “hoped would not happen,” as he warned the first-ever merger of two globally systemically important banks came with “execution risk”.

Advertisement

With automation, you’ll reduce errors and save valuable time, allowing you to focus on what really matters: strategic analysis and insightful decision-making. Picture accurate financial reports ready at your fingertips, giving you the confidence to tackle business challenges head-on. Embracing automation not only boosts productivity but also elevates your role from number cruncher to closing rockstar.

Payments Dive

APRIL 6, 2023

In an annual letter, the digital payments darling’s co-founders acknowledged a “significant deceleration” in payment volume for 2022 and a tougher environment for startups.

CFPB Monitor

APRIL 6, 2023

The CFPB and FTC have targeted the use of “dark patterns” on websites to influence consumer behavior. We first discuss what regulators consider to be dark patterns and why they are a focus of regulatory concern and look at examples. We then discuss the empirical issues and behavioral theories a company should expect regulators to raise if it is the target of a dark patterns investigation or enforcement action, what proactive steps a company can take to reduce the risk of a dark patterns chall

TheGuardian

APRIL 2, 2023

The international banking crisis has sparked fears that nervous investor sentiment could impact local banks too. But senior business reporter Jonathan Barrett tells Jane Lee why Australians should be more worried about a rush of mortgage failures than a run on the banks Read more: Continue reading.

Advertiser: ZoomInfo

In today’s ultra-competitive markets, it’s no longer enough to wait for buyers to show obvious signs of interest. Instead, sales teams must be proactive, identifying and acting on nuanced buyer behaviors — often before prospects are fully ready to make a purchase. In this eBook from ZoomInfo & Sell Better, learn 10 actionable ways to use these buyer signals to transform your sales strategy and close deals faster.

Let's personalize your content