FTP – Another Bank Failure and Another Learning Opportunity

South State Correspondent

MAY 3, 2023

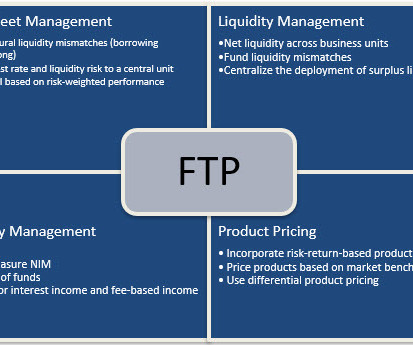

Last week, we published an article [ here ] discussing how fair value accounting for assets and liabilities may have prevented the failure of Silicon Valley Bank, even if sound risk mitigation practices were not resolutely embraced by management. We argued that valuing assets at historical value or measuring net interest margin (NIM) is not only a static view of cash flow but also backward-looking.

Let's personalize your content