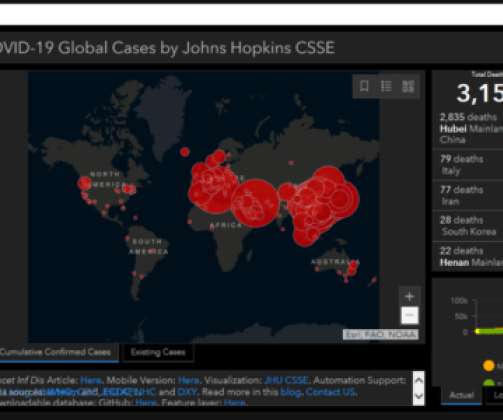

Amazon To Deliver Coronavirus Test Kits In Seattle

PYMNTS

MARCH 11, 2020

To assist in bringing at-home testing kits for COVID-19, the disease caused by the coronavirus , to homes of Seattle-area residents, Amazon Care is reportedly in discussions with local health groups, according to a CNBC report. The talks have been occurring for over a week, according to unnamed sources. Amazon Care rolled out last fall as an experimental effort to provide employees and dependents in the area of Seattle with high-quality health care.

Let's personalize your content