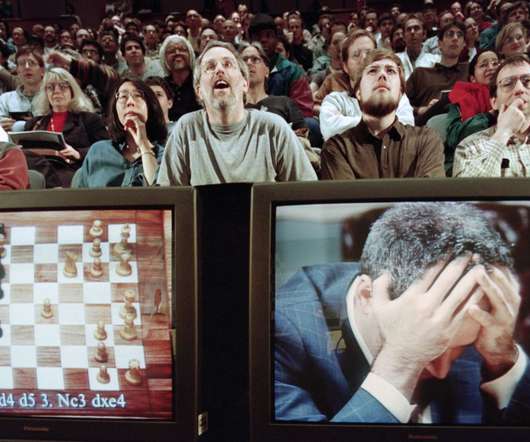

Customer and employee activism will change banking even if the banks don’t want to change

Chris Skinner

FEBRUARY 25, 2020

I know a few of you have spotted that I have a regular theme these days about sustainable finance, purpose-driven banking, the climate emergency and more. It’s a reflection of the world at large and how people like Greta Thunberg and Sir David Attenborough are making our views of the … The post Customer and employee activism will change banking even if the banks don’t want to change appeared first on Chris Skinner's blog.

Let's personalize your content