3 keys to understanding blockchain

Payments Dive

SEPTEMBER 11, 2020

Blockchain technology can be very difficult to understand, but it doesn't have to be. You just have to grasp three basic key facts.

Payments Dive

SEPTEMBER 11, 2020

Blockchain technology can be very difficult to understand, but it doesn't have to be. You just have to grasp three basic key facts.

Accenture: Banking

SEPTEMBER 11, 2020

What drives change in an industry? Businesses? Consumers? Government regulations? In the case of touchless payments in the United States, change has mostly moved at a glacial pace—until COVID-19. Touchless payments have expanded rapidly in countries throughout the world—and the benefits are significant—so why did it take a global pandemic to move the needle in….

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Source

SEPTEMBER 7, 2020

Biometric cards have garnered more attention in recent times through various trials, but the coronavirus pandemic looks set to accelerate their adoption with a series of major card issuers beginning to roll out the technology.

Perficient

SEPTEMBER 9, 2020

As an avid at-home cook and lover of food, the office potluck always brings me great joy. I love when I can try other colleagues’ favorite things to cook and share mine as well. However, this year office potlucks have gone on hold and so has that connection. Provisioning Virtually. With everyone working from home, our colleagues in Chicago wanted to provide a way that they could stay connected with each other.

Advertiser: Trellis

Finance teams find Trellis to be particularly effective in conducting comprehensive due diligence on both individuals and businesses. With our court data solution, financial experts can access critical litigation insights, making it an invaluable resource for informed decision-making in the financial sector.

PYMNTS

SEPTEMBER 9, 2020

Mastercard has announced a new virtual testing platform for Central Bank Digital Currencies (CBDCs). In a Wednesday (Sept. 9) news release, Mastercard said a recent survey revealed 80 percent of central banks are engaged in some form of CBDCs, while 40 percent have moved from research to experimenting with concept and design, according to by the Bank for International Settlements.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

Bobsguide

SEPTEMBER 7, 2020

As the new generation of customers increasingly relies on tech, expectations from the services that banks offer are also expected to change – particularly as Gen-Z and millennials focus in on financial wellbeing. “Gen Z and new consumers in the marketplace want to put so much trust.

Perficient

SEPTEMBER 9, 2020

Calling all manufacturers! Come join us for a candid conversation with experienced manufacturing leaders on Thursday, September 10. Hosted by industry veterans Tony Kratovil from Salesforce and Eric Dukart from Perficient, this virtual roundtable event will dive into what’s top of mind in the world of manufacturing and how companies with indirect sales channels can set their dealers and distributors up for success.

PYMNTS

SEPTEMBER 7, 2020

Despite the pandemic, venture capital dollars are flowing freely to nascent firms in Asia that are tackling the need for contactless interactions and platforms that match supply and demand — setting the stage for innovation on the other side of the public health crisis. In an interview With Karen Webster, Craig Dixon , general partner and CEO of Accelerating Asia , an independent startup accelerator based in Singapore, said helping startups scale and navigate the VC realm requires a focus on tel

Payments Source

SEPTEMBER 11, 2020

American Express is expanding into the fast-growing European market for open banking-based payment initiation services with its Pay with Bank transfer platform.

Advertiser: ZoomInfo

AI adoption is reshaping sales and marketing. But is it delivering real results? We surveyed 1,000+ GTM professionals to find out. The data is clear: AI users report 47% higher productivity and an average of 12 hours saved per week. But leaders say mainstream AI tools still fall short on accuracy and business impact. Download the full report today to see how AI is being used — and where go-to-market professionals think there are gaps and opportunities.

Bobsguide

SEPTEMBER 10, 2020

Federal data protection standards must be created to allow open banking to take off in the US, said Abishek Gupta, head of BBVA Open Platform, BBVA during a Fintech Talents North America panel yesterday. “I agree there has to be some minimum standards across all of those principles to.

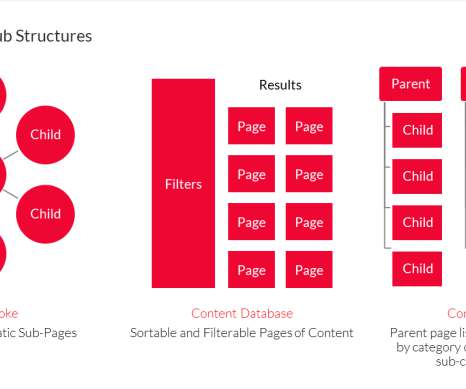

Perficient

SEPTEMBER 9, 2020

People have been talking about content marketing for years. Creating web pages that generate leads and help move clients through the buyer’s journey can produce bottom-line results and be more cost-effective than advertising or other paid methods. The effects of good content marketing can be long-lasting, offering ongoing engagement while other tactics capitalize on shorter-term opportunities.

PYMNTS

SEPTEMBER 8, 2020

Amazon put a new date on the calendar last week. No it’s not Prime Day. But it has told its sellers that “Black Friday” deals will start on Monday, Oct. 26, leaving the rest of the retail world to read the tea leaves on Amazon’s Q4 plans. According to Tamebay , an Amazon seller news site, Amazon Early Black Friday Deals will start and run through Nov. 19.

Payments Source

SEPTEMBER 11, 2020

American Express Co. began reopening offices in New York and London this week even as it told employees that they can continue working from home through June 2021 if they wish.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

BankBazaar

SEPTEMBER 9, 2020

When it comes to financial mistakes, the devil lies in the habits. Luckily, you can get rid of them for good. Read on to find out how. Identifying bad financial habits is a tough task, because they’re never ‘in-your-face’ Unlike the one-off errors that we all make at some point and time, habitual errors aren’t easy to spot in your bank statement or credit report; they’re systemic in nature, and like any other bad rule, they require a revolution to overcome.

Perficient

SEPTEMBER 10, 2020

How will you spend your COVID-19 bonus? No, not a fatter paycheck (sorry). I’m talking about the additional resources your CFO may be freeing up for new digital initiatives. A survey of U.S. executives by Duke’s Fuqua School of Business shows that due to pressures brought on by the COVID economy “nearly 2/3 of companies are shifting resources to create better digital interfaces and more engaging digital experiences.”.

PYMNTS

SEPTEMBER 8, 2020

The rise of the coronavirus has spotlighted the need for corporate treasurers to make real-time decisions about cash management. JPMorgan ’s Head of Global Liquidity Product Solutions Specialists, Lori Schwartz , told PYMNTS in a recent Masterclass that the very nature of liquidity management is changing — and leading treasury management professionals to pivot to digitization and move from physical to virtual accounts.

Payments Source

SEPTEMBER 11, 2020

The Philippines’ anti-money laundering authority has identified 57 “people of interest,” including foreigners and local bank officers and government officials, whose links to Wirecard AG are being scrutinized.

Advertisement

Automation is changing the game for commercial lenders, offering a clear path to competitive advantage in 2025. Rising costs, outdated workflows, and manual data entry slow growth and impact borrower satisfaction. Automation addresses these challenges, reducing costs, speeding up loan cycles, improving accuracy, and elevating borrower experiences. With market uncertainty easing, now is the time to act—waiting until loan volumes rebound leaves lenders unprepared and struggling to compete.

Bobsguide

SEPTEMBER 8, 2020

The payments industry has undergone drastic changes in the last decade, making reconciliation critical to cope with huge volume, abundant data sources and a growing number of players involved in each individual transaction. Yet what remains unchanged is the essence – payments are.

Perficient

SEPTEMBER 8, 2020

The Basics of Headless. “Headless” has been a buzzword for more than a few years in the CMS space, but what exactly is a headless content management system? In short, content management systems (CMS) have traditionally handled content management and rendering (creating markup and serving to web browsers or other clients). A headless CMS only handles content management and provides an API for other systems to consume that content.

PYMNTS

SEPTEMBER 11, 2020

The great digital shift in the quick-service restaurant (QSR) space shows no signs of stopping. To that end, Bloomberg reported that Chipotle Mexican Grill CEO Brian Niccol estimated the firm’s digital sales could be as much as $2.4 billion in 2020, leagues higher than the $1 billion seen in the previous year. And in a nod to the fact that mobile and online orders are here to stay, Niccol said sales digital sales could be as much as 40 percent to 50 percent of revenues, which Bloomberg noted wo

Payments Source

SEPTEMBER 11, 2020

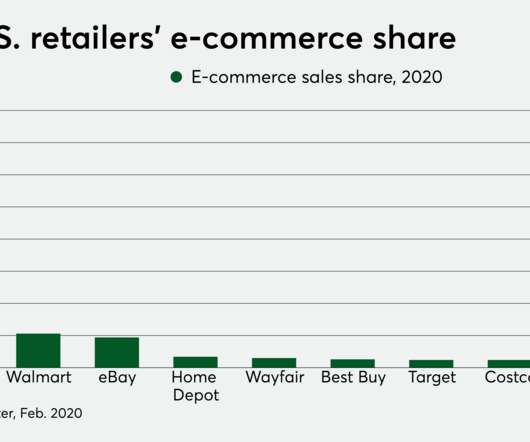

Citi has teamed with home furnishings giant Wayfair on a pair of credit cards—one cobranded with Mastercard and a private label version—capitalizing on the pandemic-accelerated e-commerce boom.

Advertisement

Remote Deposit Capture (RDC) clients are more likely to use additional treasury services and maintain larger deposits. However, poor customer experiences—particularly if they delay deposits—can compel RDC clients to take their business elsewhere. This eBook makes the case for outsourcing RDC operations to a proven managed services partner. This approach helps Treasury Departments with limited resources provide excellent client experiences that result in higher retention and productivity rates.

ATM Marketplace

SEPTEMBER 11, 2020

ATM Marketplace talks with Sanjay Gupta, ACI Worldwide executive vice president, regarding an ACI study that sheds light consumer preference in regards to digital payments and billing.

Perficient

SEPTEMBER 9, 2020

In the past, ecommerce was believed to be the simple act of building a commerce website for your business and seeing how your customers used it. However, many B2B sites weren’t performing well or able to adapt to this approach because they lacked the specific resources and knowledge needed to be successful, and even felt hesitant to adopt new digital methods because previous of ecommerce site failures.

PYMNTS

SEPTEMBER 7, 2020

The nation’s banks are anxious about getting loans repaid that are secured against empty office buildings, hotels and malls. Disclosure of these so-called criticized loans, which are warning signs about a borrower’s ability to pay, revealed of the 10 banks that have seen the largest increases, criticized loans have risen by 62 percent in the second quarter (Q2).

Payments Source

SEPTEMBER 8, 2020

Many of the changes on the horizon were inevitable, but the pandemic has accelerated the shift to digital payments and finance, forcing banks to reevaluate their models and pivot toward faster technology adoption.

Advertiser: ZoomInfo

ZoomInfo customers aren’t just selling — they’re winning. Revenue teams using our Go-To-Market Intelligence platform grew pipeline by 32%, increased deal sizes by 40%, and booked 55% more meetings. Download this report to see what 11,000+ customers say about our Go-To-Market Intelligence platform and how it impacts their bottom line. The data speaks for itself!

Let's personalize your content