Banks rethink branch operations on back side of COVID-19 threat

Payments Dive

MAY 1, 2020

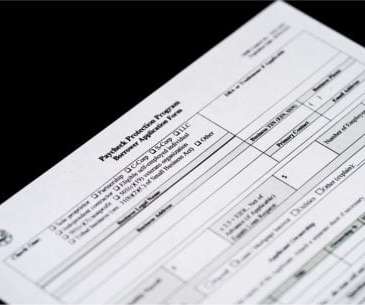

Major banks are reviewing plans to relaunch branch operations after the peak of the COVID-19 pandemic in the U.S., but executives and experts say some key changes in bank operations will likely continue going forward.

Let's personalize your content