Office Lending – Here is Why It is Not as Bad as The Market Thinks

South State Correspondent

MAY 22, 2024

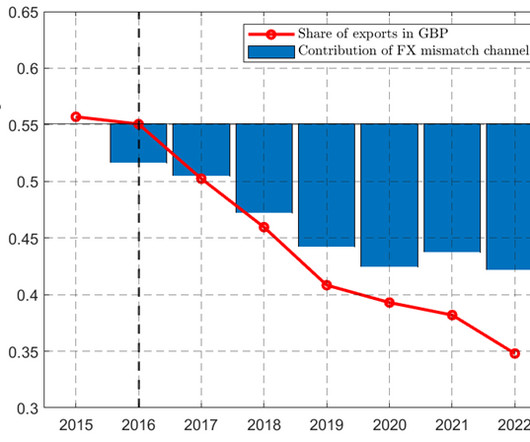

Between now and the end of 2027, it is estimated that $2.2T of office loans is coming due. Much of this product lies on banks’ balance sheets. A high percentage of those office loans on banks’ balance sheet are balloon structures where the bulk of the loan’s principal is due. Equally worrisome is the large number of loans on banks’ balance sheets that are due for a rate reset where the interest rate will be almost double, thereby putting stress on borrowers.

Let's personalize your content