Tax Compliance Complicates Software Subscription Business

PYMNTS

FEBRUARY 2, 2021

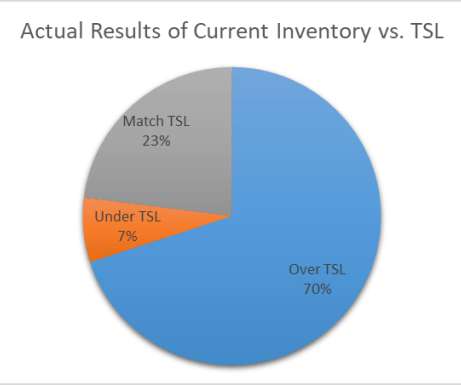

Tax compliance has never been a simple issue for businesses. Enter Software as a Service (SaaS), and even tax codes have been playing catch-up with the subscription business. As the marketplace shifts toward a more SaaS-based strategy, you can be sure that we're going to see a shift in tax guidance as well.”. Here in the U.S.,

Let's personalize your content