Will an OCC, FDIC Charter Help Varo Money Become the First National Mobile Bank?

Bank Innovation

JULY 25, 2017

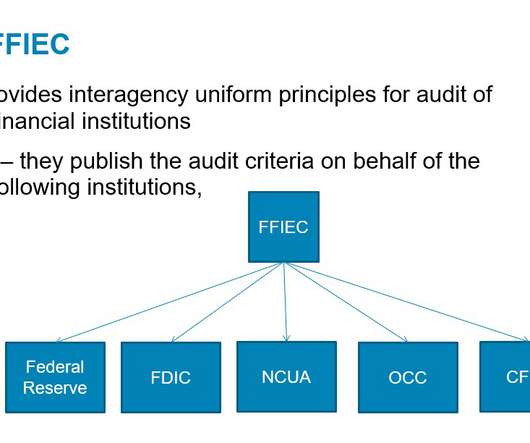

Want a national bank that’s mobile-only? Varo applied for a banking charter from the Federal Deposit Insurance Corporation (FDIC), as well as for a charter from the Office of the Comptroller of the Currenc, in the hopes of forming “Varo Bank,” the mobile banking startup announced today. So does Varo Money.

Let's personalize your content