Fed, FDIC, OCC update guidance on third-party risk management

Payments Dive

JUNE 8, 2023

The guidance is aimed at helping banks address the operational, compliance and strategic risks of third-party tie-ups, such as those with fintech firms.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Payments Dive

JUNE 8, 2023

The guidance is aimed at helping banks address the operational, compliance and strategic risks of third-party tie-ups, such as those with fintech firms.

Abrigo

MAY 20, 2022

Meet Model Risk Management Expectations Updates to the FDIC Risk Management Manual should steer institutions toward a model that manages risk and drives growth. Takeaway 1 Aside from meeting examiner expectations, proper model risk management can protect your institution from unnecessary risk. .

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Abrigo

FEBRUARY 25, 2025

Back-end processes for small business loan approval in some financial institutions operate in an automation desertand it shows. Without the water of automation, applications trudge along the financial analysis, risk assessment, pricing, and other processing steps like a traveler slogging through dunes. The results?

Gonzobanker

OCTOBER 31, 2024

Vendor management is risky business. The FDIC issued a consent order against Discover Bank last year for lacking oversight into third-party risk management and a compliance vendor management program. Institutions often outgrow their vendors’ ability to provide hardware to keep operations running smoothly.

Perficient

APRIL 2, 2021

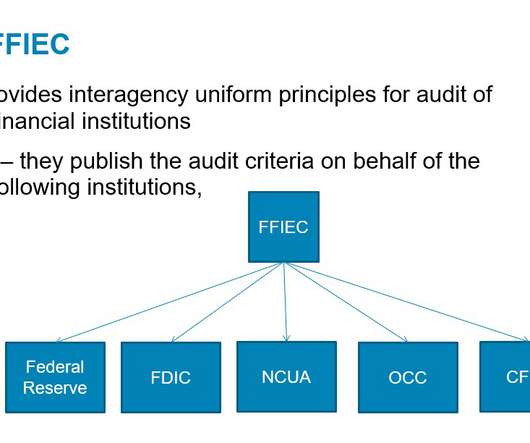

The five federal agencies are: the Consumer Financial Protection Bureau (CFPB), the Federal Deposit Insurance Corporation (FDIC), the Federal Reserve Board (Fed), the National Credit Union Administration (NCUA) and the. Risk Management. AI may be used to augment risk management and control practices.

Abrigo

MARCH 31, 2017

Commercial real estate lending continues to receive regulatory scrutiny and reminders for financial institutions to practice solid risk management. FDIC officials in March outlined several types of weaknesses in loan underwriting, administration and oversight practices that are emerging at some banks with CRE portfolios.

Perficient

AUGUST 16, 2023

A rather small bank, as of the end of its first quarter, the bank reported $139 million in total assets and $130 million in total deposits in its FDIC Call Report. Heartland Tri-State began operations in 1985 under the name First National Bank of Elkhart. bank to fail this year.

Celent Banking

DECEMBER 13, 2016

But the slew of banking regulatory requirements for third party risk management is proving to be complex, all-consuming and expensive for both institutions and the third parties involved. In a nutshell, institutions are liable for risk events of their third and extended parties and ecosystems. " www.fdic.gov.

Abrigo

APRIL 12, 2016

The FDIC is offering a fresh take on how a bank’s board of directors should understand and manage risk. The core principles for directors have not changed materially since 1988, the FDIC said. Risk management culture What exactly is a risk management culture? Evaluating risk management.

Perficient

JULY 12, 2023

Perficient provides risk management to more than 500 financial services organizations, many of whom have multiple bank regulators. Often an organization will have a state-charted non-member bank, which has the FDIC as its primary federal regulator. Introduction It’s not you. It’s the guidance.

Celent Banking

DECEMBER 12, 2016

But the slew of banking regulatory requirements for third party risk management is proving to be complex, all-consuming and expensive for both institutions and the third parties involved. In a nutshell, institutions are liable for risk events of their third and extended parties and ecosystems. ” www.fdic.gov.

Abrigo

MARCH 18, 2025

However, retail and wholesale payment systems are operated by public and private sector entities, which are responsible for communicating information about individual payment transactions and settling transactions. The growing risk of payment fraud With faster payments comes greater fraud risk. consumers lost over $12.5

Abrigo

JANUARY 24, 2024

Account for the details before your FDIC bank acquisition Consider these tips for assessing your institution and a to-be-acquired institution for a smooth integration You might also like this webinar, "Valuation and purchase accounting: Navigating the changing M&A landscape."

CFPB Monitor

AUGUST 4, 2022

The FDIC has issued an “Advisory to FDIC-insured institutions Regarding Deposit Insurance and Dealings with Crypto Companies ” to address the agency’s concerns regarding misrepresentations about FDIC deposit insurance by certain crypto companies. The first portion of the advisory addresses risks and concerns.

Abrigo

DECEMBER 22, 2023

Takeaway 3 Updates on interest rate forecasting and best practices for managing CRE risk were among the most-read blogs. Abrigo's most popular risk management blogs over the last 12 months cover topics that continue to catch the attention of professionals and regulators. Which credit areas need routine "maintenance"?

Abrigo

OCTOBER 28, 2022

Managing loan workouts and modifications Tips for preparing your bank or credit union to handle an increased volume of problem loans while ensuring prudent credit risk management. You might also like this video, "A look at credit risk in a rising-rate environment." CRE loan accommodations.

South State Correspondent

APRIL 30, 2024

Second, the hedge provider must be an FDIC insured institution and structure its hedges as a qualified financial contract (QFC). We see substantial risk to community banks in dealing with non-FDIC hedge providers or those that do not offer QFC protection – think Lehman Brothers.

South State Correspondent

APRIL 30, 2024

Second, the hedge provider must be an FDIC insured institution and structure its hedges as a qualified financial contract (QFC). We see substantial risk to community banks in dealing with non-FDIC hedge providers or those that do not offer QFC protection – think Lehman Brothers.

Abrigo

JANUARY 29, 2020

Key Takeaways The FDIC issued an advisory to FIs encouraging safe and sound lending practices in today's ag lending environment. FDIC) issued an advisory to financial institutions encouraging exceptionally safe and sound lending practices in agricultural lending. On January 28, the Federal Deposit Insurance Corp.

South State Correspondent

AUGUST 21, 2022

Second, community banks should use FDIC-insured institutions as hedge providers, and the hedges must be structured as qualified financial contracts (QFC). We see substantial risk to community banks in dealing with non-FDIC hedge providers or those not offering QFC protection – think Lehman Brothers.

Abrigo

JUNE 23, 2017

The desire to avoid examiner scrutiny may tempt some financial institutions to set the bar high when it comes to credit and liquidity risk management policy limits, but regulators are discouraging this approach. It could compromise institutions’ risk management effectiveness and ultimately hurt the institution.

Abrigo

NOVEMBER 29, 2021

A recent study by the Cleveland Fed noted that traditionally, noninterest income is only 30% to 40% of small banks’ operating revenue, compared with over half of large banks’ revenue. Noninterest income drove 20% of community banks' net operating revenue in 2019, down from 22% in 2012, according to a recent FDIC study.

Abrigo

MAY 19, 2023

The complexity and scope of a loan review system will vary based on an institution’s size, type of operations, and management practices. In addition to providing more efficient credit risk review , a loan review solution can provide other analytics to elevate loan review’s profile or support staffing requests.

Gonzobanker

JUNE 14, 2023

Cross River Bank recently found itself in hot water with the FDIC when the agency declared that the bank engaged in unsafe or unsound banking practices in relation to its compliance with fair lending laws and regulations, specifically the Equal Credit Opportunity Act and the Truth-in-Lending Act. In effect, Cross River is in time out.

Abrigo

JULY 20, 2021

During Abrigo’s recent ThinkBIG Conference, credit underwriting and loan portfolio risk management trainer and consultant Michael Wear , CRC , of 39 Acres Corp. However, lenders might consider SBA options for their customers or members to help shore up the businesses to survive. We know 2020 stunk,” he said. “As

Abrigo

JULY 20, 2021

During Abrigo’s recent ThinkBIG Conference, credit underwriting and loan portfolio risk management trainer and consultant Michael Wear , CRC , of 39 Acres Corp. However, lenders might consider SBA options for their customers or members to help shore up the businesses to survive. We know 2020 stunk,” he said. “As

South State Correspondent

MARCH 15, 2023

While we wrote about the root cause of the failure of Silicon Valley Bank (SVB) HERE , the lessons of the current banking crisis go beyond interest rate risk management. While interest rate risk caused the most significant impact on value, several other factors contributed to the terminality of each bank that was closed.

Abrigo

DECEMBER 19, 2019

In 2008, there were 7,061 FDIC-insured commercial banks in the U.S. Lending & Credit Risk. Portfolio Risk & CECL. Cyber Complications for Vendor Risk Management. Attain growth through M&A, new partners. In 2018, the number of banks declined by almost a third to 4,708 institutions. Learn More.

Independent Banker

SEPTEMBER 25, 2014

Saving money by conducting inside risk management and compliance reviews. As a group, community banks spend substantial funds hiring outside consultants to help with various management functions, and a substantial share of dollars are spent to help oversee their risk management and compliance activities.

Independent Banker

SEPTEMBER 25, 2014

As David Barr, spokesperson for the FDIC, points out, “a vast majority of community banks remain well-rated and exhibit satisfactory corporate governance programs and compliance management systems.”. Be aware of existing or emerging risk concerns. increased operational risks. in Kent, Ohio.

CFPB Monitor

JUNE 1, 2020

It also observed that its interpretation is consistent with the purpose of section 85 by facilitating national banks’ ability to operate lending programs on a nationwide basis and also promotes safe and sound operations by supporting national banks’ ability to use loan transfers as a source of liquidity. (The

CFPB Monitor

NOVEMBER 10, 2020

The Fed, FDIC, and OCC have issued a “ Statement on Reference Rates for Loans ” that addresses replacement rates for the London Inter-Bank Offered Rate (LIBOR). In July 2020, the Federal Financial Institutions Examination Council issued a “ Joint Statement on Managing the LIBOR Transition.”

Jack Henry

JULY 2, 2014

Today, a proper IT risk management infrastructure has a direct impact on the character and value of a financial institution which places an unprecedented value on key IT employees. I would be remiss to discuss outsourcing today without mentioning vendor management.

Abrigo

MARCH 2, 2023

But when a storm hit, limitations on the back end due to its insufficient operations technology hampered Southwest’s ability to handle the most basic customer service in that industry: getting customers safely where they needed to be. Executives took a pay cut. To its credit, Southwest was investing in customer-facing technology.

CFPB Monitor

APRIL 1, 2021

In what could be an important step towards needed regulatory updating to accommodate the growing use of artificial intelligence (AI) by financial institutions, the CFPB, FDIC, OCC, Federal Reserve Board, and NCUA issued a request for information (RFI) regarding financial institutions’ use of AI, including machine learning (ML). Uses of AI.

CFPB Monitor

OCTOBER 21, 2021

The CFPB, Federal Reserve Board, FDIC NCUA, OCC, in conjunction with the state bank and state credit union regulators, jointly issued a statement on managing the transition away from LIBOR (Joint Statement). The Joint Statement indicates that in March 2021, the FCA announced that the one-week and two-month U.S.

Cisco

JULY 12, 2022

Regulatory requirements are a key operational concern that we hear about from our financial customers. a few agencies include the Federal Reserve (FRB), the Federal Deposit Insurance Corporation (FDIC), the National Credit Union Administration (NCUA), the Office of the Comptroller (OCC), and the Consumer Financial Protection Bureau (CFPB).

Jack Henry

APRIL 30, 2014

One such attack by the group Unlimited Operations was able to net over $40 million. The FDIC provides a listing of resources that can be used to better identify and mitigate potential cyber-risks. The FDIC encourages subscribing to these various groups to ensure that you receive regular security alerts, tips, and other updates.

Gonzobanker

MARCH 22, 2023

Irvine Sprague, Former FDIC Director So Gonzo Bankers … how many of us have been hesitant lately to check our iPhone each morning to see what trouble may have hit the fan in the financial world during a few restless hours of slumber? The slow, evolving maturity of a bank’s enterprise risk program needs to speed up fast.

CFPB Monitor

NOVEMBER 24, 2020

The OCC notes that, in the case of energy industries, the terminated services were not limited to lending “where risk factors might justify not serving a particular client,” but also included advisory and other services unconnected to credit or operational risk.

Jeff For Banks

MAY 16, 2015

High level risk management reports (because more granular risk reports are reviewed in Committee) and trends. And most Board members have full time jobs! Financial reports for the current period, and trends. Budget variance reports 3. Financial progress towards strategic plan 4. Financial condition and performance versus peer 5.

Independent Banker

FEBRUARY 24, 2016

Marketplace-driven digital-platform lenders are also structured so that credit risk is held by the investor funding the deal. FDIC-insured deposits largely solve this problem for banks. a community bank operating and software services firm in Wilmington, N.C. Core deposits also come at much lower costs.

Jeff For Banks

OCTOBER 29, 2016

In 2006, when the median asset size within my firm's profitability outsourcing service was $696 million, the operating cost per business checking account was $586 per year. billion, and the operating cost per business checking account is $710. In 2016, the median sized financial institution is $1.1 deposit market share in 2012 to a 80.7%

CFPB Monitor

NOVEMBER 29, 2021

To obtain supervisory non-objection, a bank must demonstrate in writing that it understands any relevant compliance obligations, including under the Bank Secrecy Act, federal securities laws, the Commodity Exchange Act, and consumer protection laws.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content