CFPB Director Rohit Chopra Addresses FDIC Deposit Insurance and the Banking Industry

CFPB Monitor

APRIL 11, 2023

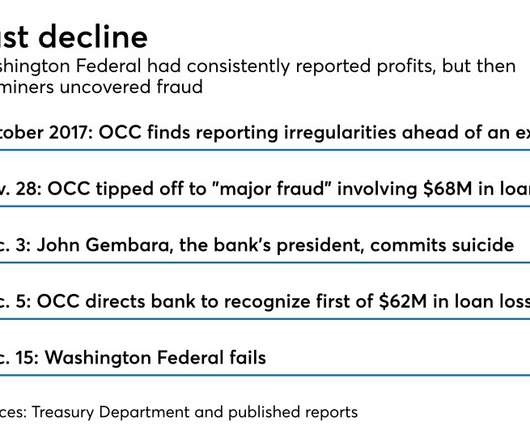

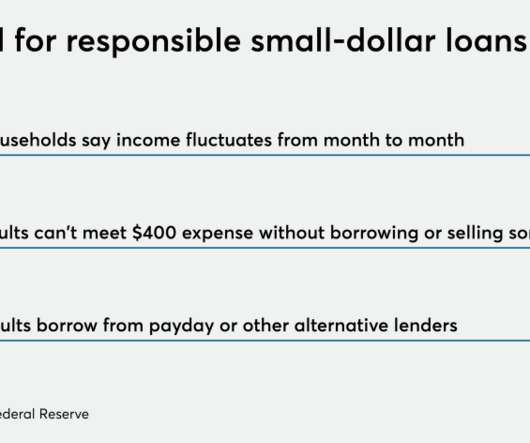

On April 11, 2023, the Consumer Financial Protection Bureau Director Rohit Chopra spoke with the Washington Post regarding the banking industry after the failure of Silicon Valley Bank. Continue Reading

Let's personalize your content