How quantum will change everything (including banking, money and security)

Chris Skinner

MARCH 21, 2018

I know that we deal with quite complicated things in financial technologies.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Chris Skinner

MARCH 21, 2018

I know that we deal with quite complicated things in financial technologies.

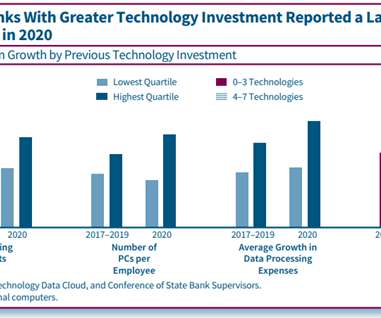

Jack Henry

NOVEMBER 26, 2021

Banking and securities lead all industry sectors in terms of average IT spending as a percentage of revenue, at nearly 8%, according to a 2018 Deloitte study. Global IT spending in the banking sector during 2021 is estimated to be nearly $300B.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Bank Innovation

SEPTEMBER 12, 2017

Finovate kicked off its 2017 Fall conference with demos from about 40 financial technology companies on its first day yesterday in New York.

PYMNTS

SEPTEMBER 20, 2018

20), Ant Financial announced the launch of Ant Financial Technology, a unit designed “to support the growth of financial institutions by improving user experience and lowering cost.” The brand was announced at the 2018 Ant Technology Exploration Conference. In a press release issued Thursday (Sept.

Banking Exchange

DECEMBER 4, 2020

OneSpan, one of the leaders in Financial Technology, released its 2021 Security and Fintech Predictions The Economy Technology Tech Management Outsourcing/Cloud Mobile Online Cards Branch Technology/ATMs Security Feature3 Fintech Financial Research Feature Financial Trends.

PYMNTS

OCTOBER 22, 2020

A major provider of financial technology to banks, Mitek Systems said its digital identity verification software will now incorporate near-field communication (NFC) technology as well. Mitek, a top developer of digital identity verification and mobile check deposit technology, announced on Thursday (Oct.

PYMNTS

JANUARY 15, 2019

based corporate payments and treasury technology company AccessPay , reports in The Telegraph said on Sunday (Jan. million investment with Intel Capital in InContext Solutions, a firm targeting retailers with shopper engagement technologies. investors have placed new funds with U.K.-based ” Beringea, based in both the U.K.

Bank Innovation

OCTOBER 24, 2017

Continuing its development of financial technologies on its platform, social media firm Facebook has joined a Visa program that enables the network to access its Token Service for payments, Visa announced today.

PYMNTS

APRIL 29, 2019

Bessemer System Federal Credit Union, a financial organization in Pennsylvania, is suing financial technology company Fiserv Solutions over what it calls rampant billing errors, significant bugs and “baffling” security lapses, according to reports.

Bank Innovation

APRIL 17, 2019

Having a "frictionless" user experience (UX) is among the top three qualities that bank customers look for when picking a new bank, right after "security" and "trustworthiness," according to a new report by financial technology provider, FIS.

CFPB Monitor

DECEMBER 5, 2019

In this podcast, we are joined by Tom Vartanian, who leads the Financial Regulation & Technology Institute of George Mason University Antonin Scalia Law School, to discuss his proposal for the President and Congress to establish a National Financial Technology Commission. Click here to listen to the podcast.

Bank Innovation

MARCH 27, 2019

Hong Kong’s traditional banks are set to face one of their biggest challenges yet: a new breed of financial technology firms estimated to snare as much as 30% of their revenue. The Hong Kong Monetary Authority has granted three virtual bank licenses and is processing five more, Deputy Chief Executive Arthur Yuen said in a […].

PYMNTS

NOVEMBER 8, 2018

banks and financial technology firms have worked together to create a set of guidelines to improve the relationship between FinTech startups and financial institutions (FIs). USD) a year into financial technology companies. has been a hotbed of FinTech startups.

PYMNTS

MARCH 6, 2020

The aim of creating this system was both to provide more speed and security to the country’s merchants. Financial technology provider Fiserv has devised a technology that allows individuals to accept payments on consumer-grade smartphones and other digital devices, as well as handheld business point-of-sale (POS) systems.

PYMNTS

JANUARY 24, 2020

The crypto could be a joint effort between private firms and the government, which would help Japan tap into worldwide shifts in financial technology, as the Parliamentary Vice Minister for Foreign Affairs Norihiro Nakayama told Reuters. The first step would be to look into the idea of issuing a digital yen,” Nakayama said.

PYMNTS

NOVEMBER 17, 2020

Open banking lets third-party financial service companies to have access to a consumer’s banking transactions and other financial data from financial institutions (FIs). Revolut said its new open banking offer was developed with TrueLayer , a London-based financial technology (FinTech) company.

Bank Innovation

SEPTEMBER 14, 2016

Financial technology may be evolving at a rapid pace, but well, so is financial crime — meaning that the security of online and mobile payments is a constantly developing area and nowhere more so than biometrics. This is obviously of interest to financial institutions across the globe, like the company Read More.

PYMNTS

JUNE 23, 2020

In an announcement made last week, the community bank said the integration will support customers that seek “new functionality” from their banking service providers, according to Chief Information Officer DJ Seeterlin, who added that customers “need financial technology tools that align with their personal and business needs.”

PYMNTS

MARCH 16, 2018

Through the collaborative efforts of those with backgrounds in payments and security, the Federal Reserve’s Secure Payments Task Force has published “Payment Lifecycles and Security Profiles.” They also cover security methods — and identity management controls — along with relevant laws and regulations, among other topics.

Perficient

JULY 11, 2022

I used Afterpay for the shoe purchase because it allowed me to not take as big of a hit to my bank account at a time when I had more expenses than usual occur all at once so that I could feel more financially secure as I awaited my next paycheck. Looking Ahead in the BNPL Landscape.

Chris Skinner

MAY 12, 2017

Chris has been voted one of the most influential people in banking by The Financial Brand. He is also one of the Top 5 most influential people on BankInfoSecurity’s list of information security leaders, as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal.

PYMNTS

OCTOBER 23, 2018

The SBI Group plans to license Sepior ApS ’ wallet technology to use in its own wallet, which will become a part of its digital currency exchange platform, the company said in an announcement. When it came to the decision, SBI said that Sepior’s multiparty computation (MPC) approach allows for a high level of protection for crypto wallets.

PYMNTS

JUNE 29, 2020

Valdis Dombrovskis , the EU’s executive vice president of the European Commission for an Economy that Works for People, told attendees of the Digital Finance Outreach 2020 , a series of events for the 27-nation bloc on financial technology companies, that Europe must become the leader in crafting rules for digital finance.

PYMNTS

NOVEMBER 10, 2020

New technologies such as stablecoins — privately-issued digital currencies — could transform the way people store and exchange their money, making payments cheaper and faster,” the release stated. Peirce defended the slow pace for many securities regulations, but not when they limit new technologies from being used.

PYMNTS

MAY 18, 2016

As President of Trulioo, Jon Jones is passionate about protecting consumers and businesses from all facets of fraud and subsequent loss — but he doesn’t believe that doing so effectively has to come at the expense of technological innovation. PYMNTS: You classify yourself as a RegTech company.

The Paypers

JULY 24, 2024

Galileo Financial Technologies has announced the launch of Galileo 3D Secure (3DS) Access Control Server (ACS) to help clients against cars-not-present (CNP).

PYMNTS

JULY 24, 2020

has secured $80 million in new funding at a $5.5 Since then, the financial technology (FinTech) company has expanded its portfolio to also offer business banking. London startup mobile bank Revolut Ltd. billion valuation as part of its Series D round that kicked off five months ago.

PYMNTS

JUNE 9, 2019

Reuters reported Lagarde said that technology companies’ use of big data and AI i ncreases big tech companies’ dominance in the mobile payments market, which could result in policymakers around the world rethinking how they regulate the banking system and how they ensure financial settlements are made safely and securely. “A

PYMNTS

FEBRUARY 28, 2020

FinTechs are helping companies understand and optimize their total cost of payments acceptance through technology. FinTechs, such as Modo, handle the technology and the data security issues. Companies don’t have to build this technology out themselves — they can rent it through a software-as-a-service (SaaS) model instead.

Bank Innovation

MAY 10, 2019

House Financial Services Committee has unanimously adopted two resolutions establishing task forces for fintech and artificial intelligence. The Task Force on Financial Technology will examine issues including “the current legal framework for fintech, how fintech is used in lending and how consumers engage with fintech,” the committee stated.

Let's Talk Payments

MAY 16, 2016

Plug and Play Tech Center, the world’s largest global technology accelerator and venture fund, is opening applications for for Plug and Play FinTech’s Fourth Batch. Press Release} SUNNYVALE, CA, May 16,

PYMNTS

APRIL 1, 2020

Credit unions (CUs), as much as other financial entities, are seeing a boom in competition as banking moves to online and mobile channels. Customers today expect to be able to access financial services instantly, which can put pressure on CUs that need to stretch restricted technology budgets into innovative new features.

PYMNTS

JULY 10, 2020

Speaking with PYMNTS, Muller highlighted the opportunity that the cannabis space has to adopt payments and other financial technologies that have leapfrogged over legacy solutions. Muller explained that the technology augments existing rails like eCheck and ACH to enhance data capture and transmission to complete a transaction.

PYMNTS

JUNE 23, 2020

The 50-year-old executive faces charges of accounting fraud and market manipulation designed to artificially inflate the financial technology company’s balance sheet to make it look more appealing to investors and customers, the Financial Times reported. billion euros ($2.1 billion), prosecutors confirmed on Tuesday.

PYMNTS

JUNE 20, 2016

The week is getting off on just the right foot for the folks over at Plaid Technologies, who are announcing $44 million in new funding. Plaid Technologies announced Monday (June 20) that it had secured $44 million in funding courtesy of a round led by Goldman Sachs Investment Partners.

The Paypers

JULY 10, 2024

Galileo Financial Technologies has announced the launch of wire transfer capabilities in order to help fintechs meet the demand for fast and secure money movement.

Bank Innovation

MARCH 1, 2019

This is up from 35% in 2017, and way up from 18% in 2013, according to Financial Technology Partners’ 2018 Annual Fintech Almanac. Strategic participation in fintech climbed in 2018, with 41% of all fintech financings containing either a corporate VC or strategic investor.

PYMNTS

OCTOBER 30, 2019

The People’s Bank of China announced that it will certify 11 types of financial technology hardware and software used for digital payment and blockchain services. In other news, the Korea Internet & Security Agency (KISA) announced that it plans to support blockchain-related projects in 2020 with 10.5

PYMNTS

AUGUST 3, 2020

One financial technology firm currently navigating the process of securing a bank charter is Avanti Financial Group , and as it approaches market launch, Founder and CEO Caitlin Long said the firm is focusing on another area of financial services that has struggled to manage complex regulatory challenges: digital assets. .”

PYMNTS

JUNE 3, 2020

Elsewhere, FinTechs are taking the initiative to work with financial institutions and offer their technologies in an effort to augment corporate services. API technology firm TrueLayer has been cleared by the U.K. RevoluPAY Secures PSD2 License. Below, PYMNTS breaks down the latest in bank-FinTech partnerships.

PYMNTS

JUNE 26, 2020

Mastercard and Visa are considering ending their agreements with Wirecard to process payments on their networks as the German financial technology company’s accounting scandal unravels, Bloomberg reported. In 2016, Wirecard announced its partnership with Visa Europe Collab to provide its technology and banking solutions.

ATM Marketplace

DECEMBER 28, 2021

Every year we at ATM Marketplace get qualified blogs from thought leaders in the ATM and financial technology industries. 2021 was no exception as bloggers covered topics ranging from Bitcoin ATMs to skimmers to biometrics.

PYMNTS

SEPTEMBER 5, 2018

4) said Chinese technology firm Baidu is working with Intel to combine their artificial intelligence and cloud technologies. The companies plan to apply their initiatives to a range of industries, including financial services (FinServ) and shipping. A press release on Tuesday (Sept. Those clouds run on Intel processors.

Bank Innovation

FEBRUARY 6, 2017

INV Fintech, the sister accelerator to this site, is pleased to announce its inaugural episode of INV Unfiltered — a new monthly podcast series, which will cover current trends and intriguing topics in financial technology and beyond.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content