Helping FIs Separate The 'Reality Of Fraud Protection' From Perception

PYMNTS

SEPTEMBER 3, 2020

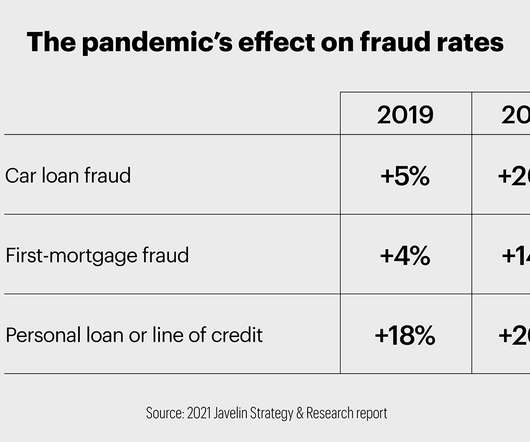

Those new avenues of fraud have leveraged hallmarks of the current pandemic — fears over public health and concerns about stimulus checks issued by the government — to snare unwitting victims. . . According to some estimates, as many as 22 percent of Americans have been impacted by COVID-related fraud. . .

Let's personalize your content