Risk & fraud management with carrier billing

Payments Dive

JULY 29, 2016

This white paper gives an overview of how fraud and risk management should be implemented for carrier billing.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Payments Dive

JULY 29, 2016

This white paper gives an overview of how fraud and risk management should be implemented for carrier billing.

PYMNTS

OCTOBER 24, 2018

When it comes to deploying corporate resources in the battle against online fraud and account takeovers (ATOs), all too often, guiding principles fail to spot what’s really happening to a business in real time. The rule of thumb here is that after committing account takeover fraud, those fraudsters lie in wait before using the stolen account.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

PYMNTS

SEPTEMBER 3, 2019

Experts estimate that total fraud losses in 2018 totaled $3.9 Fraud takes many forms, from account takeover attacks to identity theft. But ad fraud might be one of the most insidious types. Some estimates range as high as $42 billion, because ad fraud is tricky to measure. Types of Ad Fraud. AI Solutions.

PYMNTS

APRIL 1, 2020

We will be tracing everything around food production, and what we do in terms of managing animals because this (coronavirus) came from animals,” said NZX Head of Analytics Julia Jones. A blockchain system can also attack fraud in the food business. And it could be one of the killer apps for blockchain. “We

PYMNTS

DECEMBER 16, 2019

With the speedy delivery of these specs and the open and transparent approach for sharing them, we hope to further contribute to the creation of a forward-looking pan-European payments ecosystem taking full advantage of real-time messaging” said Erwin Kulk, head of service development and management, EBA CLEARING.

PYMNTS

SEPTEMBER 18, 2019

17) and released a white paper about R2P and the benefits PSPs will experience by having a real-time messaging solution. “As In our white paper, we explain why our users are keen to work on request to pay and why now,” said Erwin Kulk, head of service development and management at EBA CLEARING. “We

Chris Skinner

MARCH 3, 2017

Just to put this in context, there are some very good white papers out there on the subject. Launched work to address the industry’s most pressing payment system security issues: identity management, data protection, and fraud and risk information-sharing. Well that research survey is now live.

PYMNTS

MAY 10, 2019

In a new PYMNTS interview, David Barnhardt, executive vice president of product at GIACT , which offers fraud detection and account validation tools, talks about an upcoming change by NACHA, national administrator of the ACH network, to make internet-initiated debit transactions (WEB debits) safer and more seamless. New NACHA Rule.

PYMNTS

OCTOBER 31, 2018

As noted by Nexus, about 33 percent of firms said they will use blockchain to combat fraud, while 11 percent will use blockchain to help cut costs, and 10 percent see blockchain as useful in supply chain management. As reported in July via white paper, the U.K.

Abrigo

JUNE 23, 2020

We understand the trust you put in us when you use our BSA/AML and fraud software and we make the same investment in your program’s success. From day one with Abrigo, you will have a dedicated Client Success Manager (CSM) who will serve as your advocate within the company. Fraud Prevention. Fraud Trends. Fraud Prevention.

PYMNTS

MAY 3, 2016

In its latest white paper, titled “Omni-Channel Payments for Merchants: Myth or Reality?,” Regulation is a thorny issue for the industry – for some, a necessary intervention while, for others, often outdated, hard to implement in a timely manner and causing unnecessary friction in the payments value chain,” the white paper stated.

FICO

NOVEMBER 24, 2020

Traditionally, credit application fraud has been perpetrated in two ways: First-party fraud – where the criminal uses their own identity to commit fraud, even if they obscure some details in order to prevent detection. Where fraud data sharing is in place, their scope may well be limited across multiple organizations.

PYMNTS

AUGUST 18, 2017

Between account takeovers, business logic abuse, loyalty and reward points fraud and other cybersecurity attack methods, companies are not only suffering financial damages but brand image damages too. Here are a few of the top things every eTailer should know about fraud in 2017. Card Not Present Fraud Is A Big Threat.

FICO

SEPTEMBER 12, 2019

A new independent survey by research firm Ovum has found that banks in multiple regions plan to integrate their fraud and financial crime compliance systems and activities in response to new criminal threats and punishing fines — but not all at the same speed. said TJ Horan, vice president of fraud solutions at FICO. South Africa.

FICO

OCTOBER 29, 2018

The recent fascination with artificial intelligence and machine learning has made some of us ( naturally intelligent) humans confused about the role that these technologies play in the broader field of fraud analytics. Fraud analytics is an umbrella term covering a lot of technologies — let’s look at the two big categories.

FICO

OCTOBER 28, 2018

The recent fascination with artificial intelligence and machine learning has made some of us ( naturally intelligent) humans confused about the role that these technologies play in the broader field of fraud analytics. In the fraud management space, BI can be thought of as a descriptive performance reporter. Source: FICO Blog.

FICO

JUNE 26, 2018

But the global adoption of such schemes, alongside the problems suffered by early adopters, has turned the focus to real-time payments fraud. As discussed in my earlier post , real-time payments make multiple types of fraud more attractive and enable the fast movement and laundering of criminal proceeds. Who Is Liable?

PYMNTS

JUNE 21, 2019

Time will tell on the volatility, however, as the crypto will not be actively managed by the consortium made up of Facebook, Mastercard, Visa and others (known collectively as the Association). The road from white paper to execution is long, and the challenges are many. economy helped lift spending on logistics to new highs.

Insights on Business

AUGUST 6, 2019

Recently, IDC published a white paper, sponsored by IBM, outlining the ten hard realities that FIs and payments services providers must overcome to benefit from modernization, and how they can turn these perceived threats into opportunities. With this change comes new business opportunities. Payments modernization has arrived.

FICO

AUGUST 1, 2018

Luckily, Decision Management (DM) technology has been invented and has come a long way since AC/DC released this epic anthem in 1975. With solutions like the FICO Decision Management Platform (DMP), the journey from novice to rockstar can be faster than a speed metal riff. trillion. Merchant Onboarding: The need for speed.

FICO

JULY 30, 2019

Before getting started, CSPs should determine who “own”’ and is accountable for subscription fraud. Is it the fraud team? Also, is there a clear and agreed fraud risk appetite that has exec sponsorship and is agreed by all stakeholders? In part, this is due to the ever-changing nature of fraud. Credit risk?

FICO

JUNE 29, 2017

FICO has just released an interactive infographic on European card fraud trends since 2006, showing that card fraud in the 19 countries studied has hit a new high of €1.8 In the UK, card fraud also a hit a new high in 2016, £618 million, though the rise was less than the rise from 2014 to 2015. CNP Fraud Takes Over.

FICO

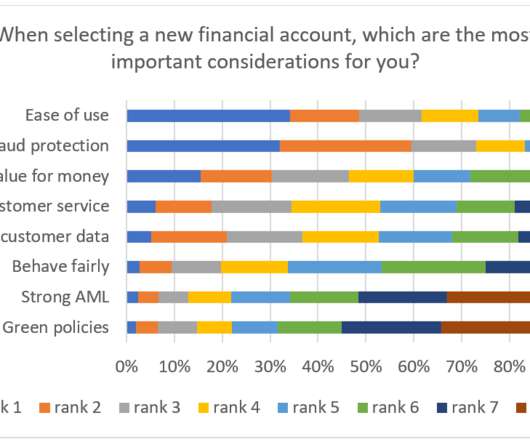

DECEMBER 13, 2022

Biometric Security Crucial for Fraud Protection and CX. Because customers value ease of use and good fraud protection most, FIs must balance scam protection with making things easy for good customers – but not TOO easy. How FICO Can Help You Fight Application Fraud. Download the white paper on this survey.

FICO

JULY 21, 2020

As my colleague TJ Horan says in his post , the worlds of fraud and compliance are moving closer together. The objectives of the fraud department are different from those of the compliance team and traditionally they have come at the thorny issue of accurately identifying and understanding their customers from different angles.

FICO

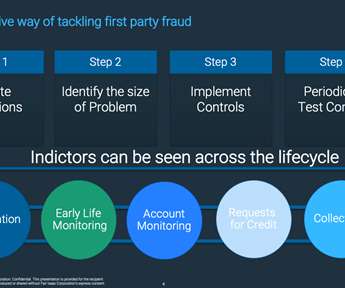

MAY 19, 2021

What Is First-Party Fraud? From banks to telcos to debt collection agencies, what looks like unrecoverable bad debt may in fact be first-party fraud. For many people, the word “fraud” evokes images of shadowy criminals using stolen identities and purloined credit card information to commit financial crimes. by Matt Cox.

PYMNTS

MARCH 10, 2017

In a world where convergence is coming faster than any white paper can articulate, O’Connell said it’s more important than ever for payments players to ensure their payments networks are responsible, safe, secure and fair. When you have that consortium data, fraud becomes much easier to manage and stay ahead of,” O’Connell noted.

FICO

JULY 31, 2019

Fraud management and AML compliance are both about tackling financial crime, but often they are managed by different teams, each with their own processes and technology. On the surface there are clearly reasons why the fraud and AML compliance departments should work together. The likely benefits of convergence.

FICO

NOVEMBER 7, 2018

Health care payers use a variety of tools and solutions to fight fraud, waste and abuse in their fee-for-service healthcare claims. But how can they help reduce your losses to health care fraud, waste and abuse? For more information, see our white paper on Uncovering More Insurance Fraud with Analytics.

FICO

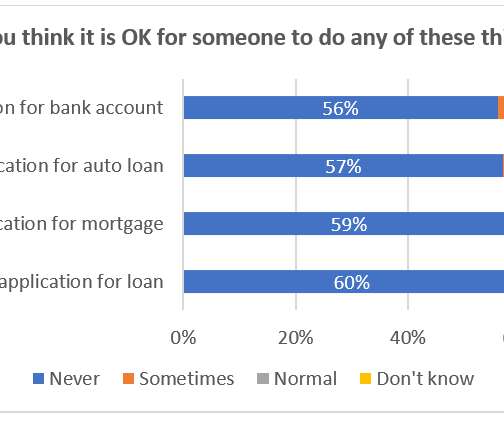

NOVEMBER 21, 2022

First-Party Fraud Must Be Stopped Across the Customer Lifecycle. While those in the financial services industry would term this first-party fraud, it is evident that a significant minority of people don’t think of such behaviour as unacceptable. FICO Admin. Tue, 07/02/2019 - 02:45. by Sarah Rutherford. expand_less Back To Top.

FICO

JULY 2, 2018

Payment fraud is an ideal use case for machine learning and artificial intelligence (AI), and has a long track record of successful use. Recently, however, there has been so much hype around the use of AI and machine learning in fraud detection that it has been difficult for many to distinguish myth from reality.

FICO

JULY 10, 2018

This is the second in my series on five keys to using AI and machine learning in fraud detection. A robust enterprise fraud solution combines a range of analytic models and profiles, which contain the details necessary to understand evolving transaction patterns in real time. Key 2 is behavioral analytics.

FICO

MAY 19, 2021

For many people, the word “fraud” evokes images of shadowy criminals using stolen identities and purloined credit card information to commit financial crimes. Perhaps surprisingly, consumers sometimes use their own personal information to commit fraud. Both of these crimes are first-party fraud.

PYMNTS

SEPTEMBER 19, 2017

Eighty percent of treasurers surveyed identified cash management surveys as the top area under review, followed by liquidity solutions, payables, FX and commercial lending. Regardless of FinTechs and the solutions banks choose to deploy, Finastra and Celent emphasized the importance of integration.

FICO

NOVEMBER 5, 2018

Countries that already have real-time payment schemes have had to manage the related crime. The ‘ Modernization Target State’ lays out Payments Canada’s vision for the future and it does talk about fraud prevention. The post Will Real-Time Rails in Canada Bring More Fraud? appeared first on FICO.

Gonzobanker

OCTOBER 16, 2017

Even though the company had made a significant ($20 million+) investment in its fraud suite, the total package just wasn’t enough to compete. There had been a lack of innovation on the CO-OP platform as well as a significant fraud event on the IVR. A flurry of fraud related products rolled out in 2017.

FICO

OCTOBER 12, 2016

Globally, the European ATM Security Team reported a 19% increase in ATM-related fraud attacks from 2014 to 2015. Earlier this year, FICO reported a six-fold increase in US ATM fraud from 2014 to 2015. To learn more about this technology, see our white paper Putting a Wide-Angle Lens on Fraud. What else can we do?

FICO

DECEMBER 5, 2022

Top 5 Surprises from FICO’s Fraud and Digital Banking Survey. Our survey found that good fraud protection is paramount for customers - even though they themselves may exaggerate income or claims. A report released by the FTC in February 2022 indicates a 71% increase in fraud in 2021, which cost consumers roughly $5.8 FICO Admin.

PYMNTS

NOVEMBER 30, 2017

The German financial institution (FI) recently released a white paper urging banks and account servicing payment service providers (ASPSPs) to implement PSD2-related changes and reforms within their institution. It acknowledges several hurdles FIs continue to face in that effort. 12, 2018, deadline for implementation passes.

Insights on Business

AUGUST 6, 2019

Recently, IDC published a white paper, sponsored by IBM, outlining the ten hard realities that FIs and payments services providers must overcome to benefit from modernization, and how they can turn these perceived threats into opportunities. With this change comes new business opportunities. Payments modernization has arrived.

FICO

JULY 3, 2018

Payment fraud is an ideal use case for machine learning and artificial intelligence (AI), and has a long track record of successful use. Recently, however, there has been so much hype around the use of AI and machine learning in fraud detection that it has been difficult for many to distinguish myth from reality.

FICO

APRIL 8, 2020

Increased use of biometrics to verify identity is likely to continue – so what steps need to be in place in order manage identity using biometrics? If the device profile has also changed, you know there is a potential SIM swap fraud and prevent access or invoke step-up authentication. Identity validation. Authentication.

NCR

JULY 12, 2017

When it comes to fraud detection and prevention, for example, big data analytics tools can offer banks much better, real-time insight into potentially fraudulent transactions. Such investments must also be reinforced with new policies, training, and change management initiatives.

FICO

SEPTEMBER 12, 2018

While AI has been used for more than 25 years in credit fraud detection , few people outside the banking sphere were aware of this. And it’s not just fraud detection people are asking about — they also want to know about other uses of AI and machine learning for financial crime protection, including in cybersecurity and money laundering.

Insights on Business

FEBRUARY 11, 2019

In the beginning of the cloud computing era, “private clouds” promised the scalability, flexibility and manageability of public clouds, combined with the security and control of on-premises data center environments. But some early private clouds, in fact, were neither private nor clouds.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content