Today’s Cyber Risk Management

Cisco

JUNE 7, 2022

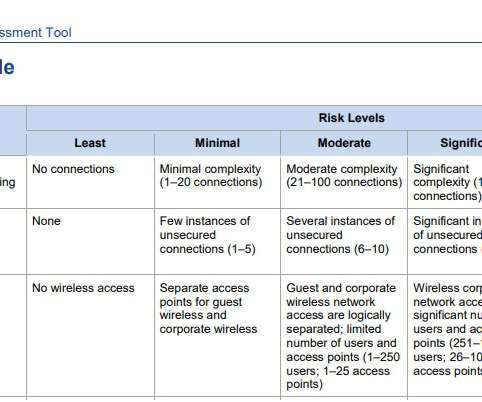

It also put an even greater emphasis on cyber risk management within institutions and financial regulatory agencies. The FFIEC issued an update for US banks to the Architecture, Infrastructure, and Operations Examinations Handbook , as well as guidance for Authentication and Access to Financial Institution Services and Systems.

Let's personalize your content