OCC seeks to halt Illinois card interchange fee law

Payments Dive

OCTOBER 3, 2024

The Office of the Comptroller of the Currency blasted an Illinois law that prohibits credit and debit card interchange fees on tips and excise taxes.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

Payments Dive

OCTOBER 3, 2024

The Office of the Comptroller of the Currency blasted an Illinois law that prohibits credit and debit card interchange fees on tips and excise taxes.

Payments Dive

OCTOBER 8, 2024

Dick Durbin threw his weight behind an Illinois law that would nix interchange fees on taxes and tips, supporting the edict in a court document filed Friday.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

NOVEMBER 18, 2024

In the wake of Illinois being sued over its landmark law exempting state taxes from the calculation of card interchange fees, other states are making little progress with the idea.

American Banker

AUGUST 15, 2024

The American Bankers Association and the Illinois Bankers Association, among other groups, are challenging an Illinois law barring swipe fees for taxes and tips should be preempted by federal law.

American Banker

MAY 29, 2024

The Illinois state legislature, as part of an agreement with retailers to raise state tax revenue, passed a budget bill that would bar the collection of interchange fees on sales taxes, excise taxes and tips for transactions that would be subject to Illinois sales taxes.

PYMNTS

FEBRUARY 10, 2020

The jousting over eCommerce taxes — especially for U.S. Last week in India, the government proposed a tax on eCommerce transactions that will likely increase operating costs for sellers large and small. The tax, technically known as “Tax Deducted at Source” (TDS), is sent directly to an account held by the central government.

PYMNTS

DECEMBER 27, 2019

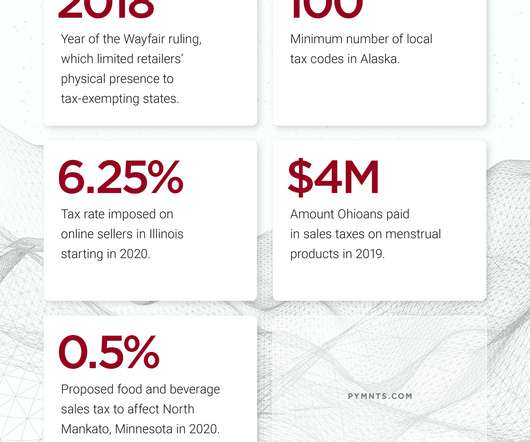

Retailers that want to sell merchandise nationwide must pay attention to how each state’s tax code treats their goods. For example, products considered to be exempt medical necessities in some states might be taxed at high rates in others. 100: Minimum number of local tax codes in Alaska.

PYMNTS

DECEMBER 30, 2019

Wayfair Supreme Court decision continue to rattle online merchants, as three states (California, Louisiana and South Carolina) are now trying to collect eCommerce sales tax retroactively, as far back as five years. have moved to collect sales tax from remote sellers, and it’s just the beginning. To date 43 states and Washington, D.C.

PYMNTS

NOVEMBER 26, 2018

Ohio is leading the charge in terms of accepting bitcoin as a payment method, as it is the first state to accept bitcoin to cover tax bills. The state will eventually open it up to individual tax filers as well.

PYMNTS

DECEMBER 27, 2019

Sales taxes empower governments to maintain critical public services, but they can also make medical essentials too expensive for those who need them. Campaigns against taxing obligatory items are spreading across the United States, forcing states to rethink their revenue generation decisions. Sales taxes’ price tags.

PYMNTS

DECEMBER 26, 2019

Merchants aiming to sell nationwide must pay attention to how their goods are treated by each state’s tax code. Items considered as exempt medical necessities in some states may be taxed at high rates in others, and businesses cannot afford to be caught by surprise. Around The Next-Gen Sales Tax Wor ld.

American Banker

OCTOBER 2, 2024

The state's ill-conceived law banning interchange fees on sales tax and gratuities will be burdensome and expensive to implement and could portend a patchwork of state-level copycat legislation that would balkanize the payments system.

PYMNTS

SEPTEMBER 24, 2019

As commerce has, increasingly, moved into the digital realm, and even the smallest merchants have gone omnichannel, tax policy has evolved as well — although perhaps it may be more apt to say tax policy has scrambled to keep up. Thus far, a bit more than a year after the ruling, tax policy remains fragmented.

American Banker

JUNE 11, 2024

Illinois' recent move to prohibit the inclusion of taxes and tips in credit card interchange fees suggests that electronic transactions are too expensive and also that there are too many entities working unilaterally to reduce those costs.

PYMNTS

NOVEMBER 10, 2020

Vestager, now in her second term, has a reputation of being aggressive in going after companies or sectors suspected of unfair or manipulative practices that stifle competition, avoid taxes or mistreat customers. . Apple faced €13 billion in back taxes to Ireland. Illinois residents also have a $650 million lawsuit against Facebook.

PYMNTS

AUGUST 24, 2020

The news comes as a new Indian equalization measure came into existence in 2020 that puts a 2 percent tax on every digital transaction that foreign online shopping firms conduct. Facebook first let American and Canadian users move their videos and pictures to Google Photos in April.

PYMNTS

OCTOBER 29, 2018

In Illinois, and a handful of other states, changes in how employees are reimbursed for business-related expenses herald changes on a broader scale, and in how firms use technology to make sure that expenses are being recorded accurately. Miles To Go For Mileage Reimbursement.

PYMNTS

SEPTEMBER 25, 2018

This month, for example, Maryland passed a bill that requires car-sharing companies to comply with regulations similar to rules for car rental companies, including paying sales tax.

PYMNTS

JANUARY 22, 2020

Fifty-one percent of United States consumers stated in the most recent PYMNTS Disbursements Satisfaction Report that they would prefer to receive tax refunds, child support payments and other government payments through instant payout methods. The state of Illinois is still considering digital disbursements, though innovation remains slow.

PYMNTS

OCTOBER 24, 2019

Now, small business owners are struggling to make up thousands of dollars in tax payments that vanished or are in limbo , Chicago’s Daily Herald reported Tuesday (Oct. Pro/Data Workforce Solutions, based in Gurnee, Illinois, notified its clients in September that it would stop handling payroll services as of Oct. 28 and Sept.

Independent Banker

APRIL 30, 2022

3-yr average pre-tax ROA. pre-tax ROA: 3.08%. pre-tax ROA: 2.83%. pre-tax ROA: 2.68%. 3-yr average pre-tax ROA. pre-tax ROA: 2.68%. In true community bank fashion, each has its own story to tell and its own path to success. Molly Bennett, executive editor, Independent Banker. Less than $300 million.

PYMNTS

JANUARY 27, 2020

Illinois printed and mailed $1.3 Illinois could have saved an estimated $1 million by digitizing its payments. Illinois could have saved an estimated $1 million by digitizing its payments. More states are starting to use recurring digital payments as the means by which tax refunds and other government monies are paid out.

CFPB Monitor

OCTOBER 22, 2020

Falsely threatening debtors with arrest, criminal prosecution, service of legal process at their residences or workplaces, civil lawsuits, civil liabilities or penalties, wage or tax-refund garnishments, liens on vehicles and homes and the freezing of assets. Using profane or abusive language when communicating with debtors.

PYMNTS

JUNE 20, 2018

This month, for example, Maryland passed a bill that requires car-sharing companies to comply with regulations similar to rules for car rental companies, including paying sales tax.

Independent Banker

AUGUST 31, 2019

“While community banks could certainly benefit from the tax advantages credit unions have, we flourish despite them.”. I will be attending the Community Bankers Association of Illinois and Independent Bankers of Colorado annual conventions. There’s something about September that inspires a focus on priorities.

CFPB Monitor

OCTOBER 12, 2021

The law exempts insured financial institutions (banks, savings banks, savings and loan associations, financial services loan companies, and credit unions), nondepository financial services loan companies, open-end credit as defined in TILA, and tax refund anticipation loans. The definition of “installment lender” in H.B.

PYMNTS

DECEMBER 15, 2020

Apply the local sales tax and the new total is $48.07. will go to taxes, $8.29 Even as the new California benefits and the fees to cover them roll out, gig economy companies are facing scrutiny in other states that are mulling adopting similar workers’ rights rules, including Illinois, Massachusetts and New York. Of that $65.36

PYMNTS

JUNE 22, 2020

On the optimistic side Elliot Nassim , president of Mason Asset Management, which co-owns the University Mall in Carbondale, Illinois, says: “We have always felt that the retail industry is evolving, despite what doomsday headlines would have you believe. The tale of woe (or whoa!) can go on forever.”.

Bank Activities

JUNE 22, 2022

The company’s Board of Directors has already approved the separation through tax-free spinoffs to unlock the full potential of each separate business unit. will be located in Chicago, while the company plans to continue operating with dual campuses in Battle Creek and Chicago, Illinois. The headquarters of Global Snacking Co.

PYMNTS

MAY 5, 2016

Amazon Business — which first launched on April 28, 2015 — offers those organizations some of the same shopping benefits that it does individual consumers, such as two-day free shipping on orders of $49 or more, as well as additional features, notes Reuters, like exclusive pricing, discounts for buying in bulk and tax exemptions.

Abrigo

MARCH 31, 2020

15 and verify the borrower had employees for whom they paid salaries and payroll taxes. Farmers State Bank in Harrisburg, Illinois, for example, has been emailing customers and putting information about SBA relief loans on its website to help small business customers get a jump on applying.

PYMNTS

DECEMBER 18, 2018

The tax man cometh, logging miles — in a manner of speaking. Lackey related to PYMNTS that a number of inputs go into calculating the standard rate, including fixed costs such as insurance, registration fees and taxes. On Friday (Dec. 03 hike in the offing) can have an impact on the bottom line. Compliance Concerns.

PYMNTS

SEPTEMBER 28, 2020

Canadian Lawmakers Want Big Tech to Pay for Content, Taxes . EU Renews Demand for Back Taxes on Apple’s Ireland Ops. billion back-tax bill in Ireland. Margrethe Vestager, executive vice president of the European Commission for a Europe Fit for the Digital Age , last week appealed that ruling and wants the tax bill paid.

MyBankTracker

MARCH 16, 2021

These accounts are tax-advantaged which could help you save money on taxes. Contributions to HSAs are made pre-tax or give you a tax deduction. Money in the account grows without paying taxes on it at the time. Money used for qualifying medical expenses can be withdrawn tax-free.

PYMNTS

OCTOBER 11, 2017

Chicago, Illinois. Facebook will receive around $19 million in state tax exemptions through 2035, CNN Tech reported. Facebook is getting big, and we don’t just mean popular: the social media giant has gotten bigger than its britches in more places than one, with new offices cropping up across the U.S.

PYMNTS

FEBRUARY 22, 2019

For example, the Illinois Supreme Court ruled earlier this year that companies can be sued for biometric data collected without users’ consent. PSD2 is here, of course, changing the way consumers and companies access data. And recently, legal challenges centered on data collection have begun popping up.

Independent Banker

AUGUST 31, 2022

According to Cyndi Mergele, senior director of capital consulting at tax, audit and consulting firm RSM US, there are a number of reasons good employees will leave organizations, including lack of training, compensation/benefits, culture, burnout, lack of career growth opportunities and poor management/bosses.

MyBankTracker

APRIL 21, 2021

lifetime protection) with a consistent premium that accumulates a cash value, which grows tax-deferred. As long as premiums are paid, benefits are disbursed upon the insured’s death and are generally income tax-free. Like whole life, this coverage is a permanent policy that also accumulates cash value that grows tax-deferred.

MyBankTracker

JANUARY 11, 2021

These plans do not qualify for premium tax credits as the Affordable Care Act plans might. These non-marketplace health insurance plans do not qualify for premium tax credits. This means they check your medical history before approving or denying you. Here are a few other details on some key differences. What is covered. Massachusetts.

MyBankTracker

MAY 22, 2020

To apply, you must live in one of the following states : Arizona California Florida Illinois New Jersey New Mexico Nevada Texas Utah Idaho (online only) Missouri (online only) Wisconsin (online only) Currently, you can only apply if you receive an offer code in the mail, but the company plans to open applications to the public in the near future.

Banking 2020

JULY 15, 2015

CPFCU exclusively served the Chicago Police Department until 2011, when it began expanding to other police departments in the Chicagoland area and the State of Illinois, with the most recent addition being the National Fraternal Order of Police in 2014.

Jeff For Banks

DECEMBER 12, 2017

Nasdaq: OSBC) Old Second is a single-bank holding company headquartered in Aurora, Illinois. Actually, the Bank had a one-time after tax litigation settlement (from a 2002-04 event) of $6.2 (Nasdaq: MBTF) #5. BNCCORP, Inc. OTCQX: BNCC) Here is this year's list: #1. Old Second Bancorp, Inc. In 2012, the company had net income of $7.0

FICO

JANUARY 6, 2019

Another way to look at it is that if Illinois abandoned all state funding (police, K-12 education, prisons, etc.) for the next six years, and took 100% of their current tax revenue and allocated it 100% to its pension fund, the state would still be underfunded for their promised payouts.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content