The top trends in retail banking innovation

Chris Skinner

OCTOBER 4, 2017

I get lots of input from many sources, and one of the ones I like is the innovation survey of banking produced annually by EFMA with Accenture.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Chris Skinner

OCTOBER 4, 2017

I get lots of input from many sources, and one of the ones I like is the innovation survey of banking produced annually by EFMA with Accenture.

Bank Innovation

JANUARY 4, 2018

However, more professionals in finance are looking to fintech providers for technological innovation, a survey by TD Bank released yesterday found. While fintech has made headway in consumer banking, commercial applications have remained a little behind the curve.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

PYMNTS

MAY 9, 2019

In today’s digital economy, with shopping as easy as the tap of a finger on a smartphone screen, brick-and-mortar retail businesses have no choice but to innovate to keep and grow their clientele. At the same time, many consumer services firms recognize the value that specific technological applications can bring to their operations.

PYMNTS

MARCH 18, 2019

Is there a right way and wrong way to innovate? Gill asserts that most financial institutions, left to their own devices, may end up following a less than optimal path to innovation, and not because they have selected the “wrong” technology solution, since in Gill’s experience, what’s “wrong” for one FI might be right for another.

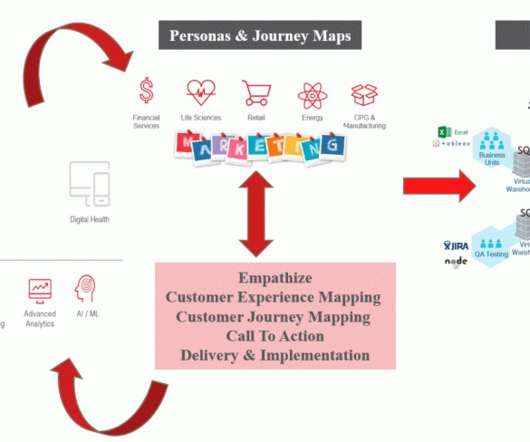

Perficient

AUGUST 2, 2024

Imagine a world where your business can effortlessly keep pace with technological advancements and continuously changing customer expectations. The ability to swiftly develop new technology products and applications is crucial to staying competitive.

Perficient

OCTOBER 15, 2024

Data governance tools are not just for keeping regulators happy, but they also give financial institutions the confidence to innovate, knowing that they’ve got their data house in order. In a world where data is king, and compliance is the watchful queen, banks are stuck playing by the rules whether they like it or not.

Bank Innovation

JULY 20, 2017

This is according to a survey by AxiomSL, which found that 66% of regulatory executives believe their institution needs to make investments in data management. Financial service executives are still concerned about regulatory changes, but the best response is to improve data aggregation and management services.

Abrigo

OCTOBER 22, 2024

In addition, even though many people can’t remember the last time they wrote a check, Abrigo’s recent fraud survey found that 61% of Americans still do—and millions fall victim to fraud. Growing challenges and complexity Financial crime isn’t what it used to be; cybercriminals are more innovative, faster, and harder to catch.

PYMNTS

MAY 13, 2019

Innovation has been the name of the game for financial institutions (FIs) large and small in recent years. While the overall pace of innovation has cooled somewhat over the past two years, as FIs have been slower to market with new products, they are increasingly channeling their energies into tried-and-true product lines.

Bank Innovation

NOVEMBER 8, 2018

A recent survey by Accenture found chief financial officers are taking on expanded roles in helping banks become data-centric and better equipped, in terms of technology, for what will likely be a volatile future.

PYMNTS

MARCH 12, 2020

PingPong did an exclusive survey of 500 merchants about their inventory level and sales expectation. More than half of respondents indicated that their total inventory in possession (FBA, in transit or received) will last less than two months, while close to 25 percent of those surveyed had inventory for less than a month.

PYMNTS

SEPTEMBER 29, 2020

Our survey examined the degree to which these firms have automated their AR processes, the impact of the pandemic on their ability to manage AR, and their interest in adopting technological innovations in the future. These are only some of the findings from PYMNTS' research.

PYMNTS

JANUARY 27, 2021

PYMNTS researchers have identified the restaurants leading the remote ordering game in our Mobile Order-Ahead Tracker , where you can learn which restaurants are the top 10 mobile order-ahead providers and what services and technologies they use to lead the pack.

South State Correspondent

APRIL 1, 2025

Personalization : A Boston Consulting Group survey detailed that 80% of consumers are comfortable, and now expect, some level of personalization. Conclusion As marketing technology continues to evolve, banks are constantly seeking innovative ways to enhance customer communication.

PYMNTS

DECEMBER 2, 2020

Mark Aquilina , senior vice president of product and strategy at WEX , told PYMNTS that’s partly because digitization of accounts receivable (AR) lags behind that of accounts payable (AP) on the technological front. Companies are learning how to be more efficient, do more with less, do more with technology,” he said. “I

Perficient

JULY 30, 2020

Louis Post-Dispatch survey.” Colleagues now engage in philathropic and social activites through technology like video calls, Microsoft Teams , and social media. Louis’ best midsize companies to work for. “I ” Jason Hudnall , general manager. The Significance of Being Named a Top Workplace in 2020.

PYMNTS

MARCH 12, 2020

percent of CUs believe that challenger banks will play very or extremely important significant competitors in the coming years, largely because they worry that challenger banks will prove to be better innovators. The fear is palpable, but just how likely are members to leave their CUs over their ability to innovate? As much as 41.4

PYMNTS

JULY 1, 2020

A PYMNTS survey of 3,000 U.S. The details are offered in Building a Better App: Banks and the Innovation Imperative Report , a collaboration between PYMNTS and Ondot Systems, the Silicon Valley-based FinTech.

PYMNTS

SEPTEMBER 25, 2019

Innovation can be a blanket term in the banking world. Is artificial intelligence (AI) for anti-money laundering (AML) compliance innovation? Much focus has been given to fundamentals like the payment technologies needed to support features from transactions on real-time payment rails to instant cross-border payments.

Chris Skinner

MAY 17, 2017

I was chairing a conference with various speakers, when Gartner Group stood up and talked about their annual bank survey. They found that of the senior bankers surveyed, 76% don’t believe that digitalisation will affect their business model. Only 3% of these banks have CEOs with professional technology backgrounds.

PYMNTS

APRIL 24, 2020

Some have added support for in-branch digital technologies such as video banking screens and upgraded ATMs to minimize in-person contact while making sure customers’ needs are met, for example. Digital Technologies Under COVID-19. British FI Nationwide U.K. Several U.K.

Bank Innovation

OCTOBER 17, 2016

Mobile banking is the most valuable area of innovation when it comes to consumers, say banks and credit unions—which is probably why that’s the area these institutions are spending the most money on trying to innovate. This is according to Bank Innovation’s annual State of Banking Innovation survey for 2016, Read More.

PYMNTS

JANUARY 27, 2021

Banks’ use of such innovations is predicted to expand, too, with 60 percent of FIs saying they aim to gain customers and improve customer experiences using digital channels. Digital fraud’s scope is hard to overstate, yet banks are deploying emerging technologies to minimize its impact. The Fraud Threats Facing Digital-First Banks.

PYMNTS

JANUARY 22, 2020

A technological level up from those efforts is a product by Japanese startup Xenoma, which recently introduced the world to its “e-skin” pajamas designed for the elderly. With sensors embedded in the pajamas, they look and feel normal, but quietly analyze vitals and detect issues while the wearer sleeps. populations.

Bank Innovation

OCTOBER 18, 2018

Banks need not fear large technology companies like Google or Apple taking their business. Digital banking continues to be the most convenient option for simple daily transactions, but branches are still necessary for the more complex ones And yet banks should not ignore the shift in banking habits brought on by non-bank technology companies.

PYMNTS

MARCH 17, 2020

The 2020 Credit Union Innovation Index , conducted in partnership with PSCU , found that over 20 percent of members would drop their current CU over lack of innovation. The share of CU members reporting they were willing to change primary FIs over insufficient innovation increased by 4.6 percent to 21.9 Competitive Threats.

Perficient

APRIL 4, 2022

While mobile has long been a part of the carrier offering – pay a bill, get an ID card, file a claim – this survey reflects the evolution of insurers from transactional into personalized servicing. This survey highlights the progress the insurance industry is making on its digital transformation journey.

Gonzobanker

JULY 21, 2021

In a recent survey of banks and credit unions about their technology vendor contracts, Cornerstone Advisors found that more than half of these financial institutions allow emotional factors to influence their negotiation processes. Technology Vendor Financials Tell the Story. The post But I Really Like My Technology Vendor!

PYMNTS

OCTOBER 19, 2020

Sixty-one percent of treasury professionals in a recent survey said that the time involved in finding out why payments failed had been a drain on company resources. A recent survey found that one-third of businesses were worried about cross-border payments fraud, while 26 percent expressed data security concerns.

PYMNTS

MAY 19, 2020

Voice assistant technology already had an audience even before the coronavirus outbreak gave it a big boost, as it has now radically reshaped consumer habits and preferences on a global scale. According to our survey data, 38.1 Another 30.3 percent of Gen Xers report the same thing, as do 30 percent of bridge millennials.

PYMNTS

JULY 23, 2020

So, how are CUs changing their card innovation plans to match their current members’ demands and attract new potential members? This is just one of many questions PYMNTS, in collaboration with PSCU , set out to answer in the Credit Union Innovation Playbook: Card Trends Edition. Moreover, 89.4 percent between February and May.

PYMNTS

JULY 2, 2020

Although CU members want innovation in member loyalty and rewards, most credit unions are not delivering these programs up to the desired standards. Credit union members’ high expectations when it comes to loyalty innovation do not necessarily make or break their banking relationships. Loyalty Innovation Strategies .

PYMNTS

DECEMBER 31, 2020

Like their cousins in banking, credit unions (CUs) long enjoyed a relaxed pace of technological change. Consumers waited on financial institutions (FIs) to innovate in an odd relationship that put business needs before customers’ needs. It was all on their timetable. Not anymore. We all know what’s transpired since.

Perficient

JULY 15, 2020

Marry in people, process and technology and you have Producers and Consumers with a great value add. The explosion of data and advances in digital technologies has completely disrupted our industry as service / solution providers. Innovation pains – build vs buy decisions. Technology debt. Legacy infrastructure.

Bank Innovation

APRIL 24, 2017

consumers are still not ready for personal, AI-enabled assistants, such as Alexa or Siri, to take control of their financials, according to a survey conducted by digital document technology platform Inlet. According to the ‘Digital Behaviors’ survey released today, nearly half (48%) of the 1,500 participants stated […].

Bank Innovation

APRIL 21, 2017

According to the “Technology for the People” report released this week by Accenture, 75% of professionals surveyed (the report polled more than 500 insurance executives across the globe) believe that AI will have a significant impact on insurance. While the technology […].

Perficient

APRIL 20, 2023

The Landscape According to Forbes Advisor: 2022 Digital Banking Survey , as of 2022, 78% of adults in the U.S. However, it’s not always obvious which of the many potential technology vendors and implementation partners will best drive an organization’s desired business goals. prefer to bank via a mobile app or website.

Bank Innovation

MARCH 6, 2018

Data analytics is the most common digital technology currently being used by banks, a new report by consultancy Infosys, released yesterday, stated. But how are banks really making use of the technology?

PYMNTS

SEPTEMBER 9, 2020

9) news release, Mastercard said a recent survey revealed 80 percent of central banks are engaged in some form of CBDCs, while 40 percent have moved from research to experimenting with concept and design, according to by the Bank for International Settlements. In a Wednesday (Sept. In a Wednesday (Sept.

Bank Innovation

APRIL 12, 2017

According to a survey of 300 banking officials, conducted by Marketforce and Earnix, developing open APIs is becoming more and more crucial to retaining customers. It’s crucial for banks to start participating in the finance revolution, especially as millennials are on the hunt for open banking—at least, according to bankers.

PYMNTS

AUGUST 31, 2020

Banks and other businesses are well aware of the advantages of real-time payments … with a survey of more than 500 company executives indicating that 71.9 It also means that high-impact changes can be made more frequently and predictably with limited effort, so that banks can quickly make adjustments and ultimately drive innovation.

Bank Innovation

JUNE 21, 2017

As noted in recent surveys, a single point of friction is all it takes for consumers to abandon a digital banking product—and thus, the bank itself. Banks should approach points of digital friction in the same way e-commerce giants do, if they want to hold onto their customers. This means banks need to start taking […].

Abrigo

SEPTEMBER 2, 2020

Technology can create efficiencies that allow them to reimagine customer interactions moving forward. Banking technology and digital offerings have long been associated with the preferences of Millennials and Gen Z, but the coronavirus has quickly reshaped banking behaviors. These findings are true among all generations surveyed.

PYMNTS

DECEMBER 15, 2020

The good news, however, is that two-thirds of firms are cognizant of these issues and are actively moving away from manual processes, planning instead to embrace new technological solutions to upgrade their accounts receivable (AR) processes for more efficiency, speed and lower fees. These are only some of the findings from our research.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content