Maryland EWA legislation draws protest

Payments Dive

JANUARY 25, 2024

A Maryland bill calling for some earned wage access providers to be registered and licensed has triggered opposition from fintech advocates.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Maryland Related Topics

Maryland Related Topics

Payments Dive

JANUARY 25, 2024

A Maryland bill calling for some earned wage access providers to be registered and licensed has triggered opposition from fintech advocates.

Payments Dive

AUGUST 17, 2023

At least one earned wage access advocate is pushing back on Maryland’s recent guidance that labels some on-demand wage offerings as loans.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

SEPTEMBER 3, 2024

Two buy now, pay later companies pivoted in offering their services in the state because it insists they must be licensed to provide loans.

CFPB Monitor

JANUARY 30, 2024

Maryland has joined the ranks of states considering legislation that would codify elements of “true lender” theory in an effort to impose federally preempted state licensing requirements and rate caps on loans to Maryland residents. Continue Reading

PYMNTS

NOVEMBER 16, 2020

Group Seeks to Block Maryland Online Advertising Tax. Marylanders for Tax Fairness is preparing for a battle in January over the state’s attempt to make a digital advertising tax, the Baltimore Sun reported. Maryland legislators ratified the tax earlier in 2020, but Gov. Larry Hogan vetoed the levy. Larry Hogan vetoed the levy.

PYMNTS

JULY 31, 2019

The state of Maryland has launched a new eProcurement system for the Maryland Department of General Services following a collaboration with source-to-pay and eProcurement FinTechs. The platform will be available for use by state agencies, local governments, municipalities, and various players within the education and school system.

PYMNTS

APRIL 6, 2016

In Walmart’s defense, it was specifically selling the promotion of the University of Maryland’s mascot , not the school itself … where one could presumably learn the basics of U.S. We understand the pride Marylanders feel for the Terps and apologize for the mistake.”

PYMNTS

JANUARY 4, 2018

As more financial institutions (FIs) warm up to the idea, one bank in Maryland is taking significant steps to address cannabis companies’ FinServ challenges. Providing financial services to legal marijuana businesses in the U.S. has proven a challenging, complicated venture for the nation’s banks.

PYMNTS

JUNE 12, 2017

Maryland and Virginia, as well as online. Mama Biscuit’s Gourmet Biscuits (MBGB) produces flavored gourmet biscuits that “bridge the gap between” sweet cupcakes and savory tasting treats. They are sold in major retailers such as Wegmans and Whole Foods Market in Washington, D.C.,

PYMNTS

AUGUST 15, 2018

To bring a beer tour and tasting experience to its customers, Guinness has opened a $90 million brewery in Maryland. The location is the company’s first new brewery in 60 years, CNBC reported.

CFPB Monitor

MAY 6, 2021

A Maryland administrative action recently removed to the state’s federal district court illustrates how Maryland law continues to present challenges for the bank partner structure used by many lenders. The new Maryland matter demonstrates that participants in bank model programs continue to face state licensing threats.

CFPB Monitor

FEBRUARY 2, 2022

Court of Appeals for the Fourth Circuit recently ruled that a mortgage servicer violated the Maryland Consumer Debt Collection Act (MCDCA) by charging a $5 convenience fee to borrowers for monthly payments made by phone or online. In Alexander v. 14-202(8) Claim). 14-202(8) because such fees are prohibited by Sec. 14-202(11).

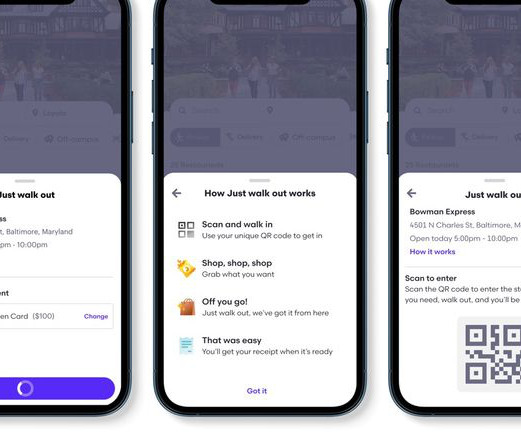

Payments Dive

AUGUST 31, 2023

Students at the Loyola University Maryland store will scan a QR code in the food delivery app to enter the frictionless shop and pay for items.

CFPB Monitor

AUGUST 21, 2023

Earlier this month, the Maryland Office of Financial Regulation (“OFR”) issued guidance (the “Guidance”) to provide clarity on how the OFR views Earned Wage Access (“EWA”) products and describe the requirements entities offering EWA products must adhere to.

CFPB Monitor

SEPTEMBER 29, 2021

Maryland has enacted legislation that revises the rules of determining creditworthiness. On May 30, 2021, Maryland Governor Lawrence J. Hogan (R) signed HB1213 into law, which adds to Maryland Code Ann. Financial Institutions (FI) § 1-212.

CFPB Monitor

JULY 27, 2021

A Maryland federal district court has dismissed a putative class action lawsuit filed against nine companies that manage apartment buildings in the Washington, D.C.

PYMNTS

AUGUST 16, 2020

including Geico, the Maryland-based auto insurer; BNSF, the largest railroad in the U.S.; Berkshire Hathaway remains invested in Bank of America, including a recent investment of more than $2 billion, giving it a nearly 12 percent stake worth over $27 billion. In addition, Berkshire also has nearly 100 operating units in the U.S.,

CFPB Monitor

DECEMBER 9, 2019

The CFPB has filed an amicus brief in the Maryland Court of Appeals urging the court to affirm the decision of the Court of Special Appeals reversing the trial court’s approval of a settlement agreement in a class action lawsuit. The circuit court approved the settlement over the Maryland AG’s objections in February 2018.

American Banker

NOVEMBER 8, 2023

An organization in Maryland is shooting for a 2024 opening. The National Credit Union Administration approved the Young Community Federal Credit Union to begin operations in Kentucky soon.

CFPB Monitor

AUGUST 8, 2023

Congratulations to Professor Jeff Sovern who was recently named the inaugural Michael Millemann Professor of Consumer Protection Law at the University of Maryland Francis King Carey School of Law. Professor Sovern joins Maryland Carey Law after 40 years on the faculty of St. Continue Reading

PYMNTS

APRIL 20, 2020

The Maryland-based hotel giant has approximately 1.4 Like other hotel chains, the world’s largest hospitality company reported hotel revenues declined 60 percent in March and it’s expected to get worse. Marriott has closed about one quarter of its 7,300 hotels worldwide. Of that number, 1,000 are in the U.S.

PYMNTS

JANUARY 9, 2019

The Maryland Attorney General Brian Frosh announced Tuesday (Jan. In a press release , the Maryland AG said Neiman Marcus agreed to pay $1.5 The states’ investigations determined that around 370,000 payment cards were breached, including 8,323 associated with consumers in the state of Maryland.

CFPB Monitor

SEPTEMBER 25, 2018

Noting, among other things, “retrenchment” on the federal level, the Maryland Financial Consumer Protection Act of 2018 ( HB 1634 ) was signed into law on May 15, 2018. Requires the Maryland Financial Consumer Protection Commission to conduct various studies and include recommendations in its 2018 report to the Governor.

PYMNTS

OCTOBER 8, 2020

26 were in Maryland (3,619), Illinois (3,414) where layoffs in retail and healthcare fueled the number of applications, New Jersey (2,504), Michigan (2,358) and Massachusetts (1,886), while the largest decreases were in Texas (7,075), Florida (6,655), Georgia (5,895), New York (5,112) and Oregon (2,317). That contrasts with 1.4

CFPB Monitor

MAY 23, 2019

Colorado and Maryland have each enacted legislation regulating student loan servicers. On May 13, Colorado Governor Jared Polis (D) signed into law SB 19-002 , and that same day, Maryland Governor Larry Hogan (R) signed HB 594.

CFPB Monitor

MARCH 17, 2020

A Maryland federal district court, in Jennings v. Dynamic Recovery Solutions LLC , ruled that the effect of a partial payment on revival of the statute of limitations was governed by the law of Delaware, the state designated in the choice of law provision in the plaintiff’s credit agreement, rather than the law of Maryland, the forum state.

CFPB Monitor

JULY 13, 2020

The Department of Justice recently announced that it had settled a lawsuit filed in 2019 that alleged a Maryland used car dealership discriminated against African Americans in violation of the Equal Credit Opportunity Act by offering different credit terms based on race.

PYMNTS

SEPTEMBER 20, 2018

According to Reuters , the men — Kevin Merrill of Maryland, 53, Jay Ledford of Texas and Nevada, 54, and Cameron Jezierski of Texas, 28 — falsely claimed to be investment professionals and used a fake portfolio to defraud hundreds of investors. Attorney for the District of Maryland, Robert Hur, said.

PYMNTS

AUGUST 16, 2020

including Geico, the Maryland-based auto insurer; BNSF, the largest railroad in the U.S.; Berkshire Hathaway remains invested in Bank of America, including a recent investment of more than $2 billion, giving it a nearly 12 percent stake worth over $27 billion. In addition, Berkshire also has nearly 100 operating units in the U.S.,

PYMNTS

OCTOBER 2, 2020

The website is now being piloted with retailers from Montana, Colorado, Texas, New Mexico, Massachusetts and Maryland. "We went from whiteboard to launch in 30 days because we care fiercely about seeing our small businesses survive COVID and thrive after COVID," said SANDIA Marketing and Advertising Founder Bernard Sandoval.

PYMNTS

AUGUST 28, 2020

The dispute began earlier this month when the Maryland-based game maker released a payment platform that was crafted to bypass the App Store’s payment system and its 30 percent commission. Epic emailed its Fortnite players that the iOS and Mac versions of the game are blocked from receiving updates.

PYMNTS

FEBRUARY 23, 2020

Launched over 20 years ago in Hagerstown, Maryland, Revolution Payments is focused on delivering reliable and secure payment solutions for clients, including Ramada, Holiday Inn Express, Volvo, Kenworth and Mack trucks. By providing Level-3 data, a supplier may reduce their credit card processing fees — often by 30 to 40 percent.”.

MyBankTracker

JANUARY 18, 2021

Homeowners insurance in Maryland protects your property from damage. Are you shopping for homeowners insurance in Maryland? If so, here are the average rates to expect based on the proper coverage needed for your Maryland home. Average Maryland Homeowners Insurance Rates. How Does Home Insurance in Maryland Work?

PYMNTS

APRIL 15, 2020

The decision comes as several Maryland businesses, including a security company, an auto parts maker and a hair salon, sued the bank, alleging that BoA had rejected their applications for loans because they hadn’t dealt with the bank for other loans in the past.

PYMNTS

APRIL 10, 2020

In Maryland, Jason Suggs, an unemployment claims processor, estimated two-thirds of the state’s claims processing staff have retired while others left and were not replaced. But in Maine, at least, the benefits have yet to flow, according to the report.

PYMNTS

OCTOBER 30, 2020

Under Armour was founded in 1996 by former University of Maryland football player Kevin Plank who stepped down as chairman and CEO last year, handing the reins to Frisk, the company’s former chief operating officer. The brand is also making moves to reel-in the number of brick-and-mortar locations that carry the Under Armour line. .

PYMNTS

OCTOBER 29, 2020

During the week ending Oct.

American Banker

SEPTEMBER 9, 2024

The bank faced credit setbacks in the nation's capital and margin pressure this year. But it made a series of new hires to reduce risk and diversify its loan portfolio, preparing for a new era of demand as the industry awaits interest rate cuts.

PYMNTS

NOVEMBER 4, 2020

The states that approved legal sports betting were Maryland, South Dakota and Louisiana, while Virginia approved casino gambling in four locations, Nebraska authorized adding casino games for its horse race tracks, and Colorado added more types and numbers of games allowed at casinos and got rid of some wagering limits.

PYMNTS

JANUARY 17, 2021

Durable Capital Partners is based in Chevy Chase, Maryland. Deliveroo stated in the announcement that it has helped restaurants by funding marketing campaigns to help local eateries, cutting fees for signing up with the service and getting customers’ payments to restaurants faster and at reduced or eliminated fees.

PYMNTS

JUNE 19, 2020

Finance reported. “Many small businesses will continue to struggle in the weeks and months to come,” Senator Ben Cardin (D-Maryland) told Yahoo. To qualify, they must have spent or expect to exhaust their first PPP loan and can demonstrate a 50 percent revenue loss due to the COVID-19 pandemic, Yahoo!

American Banker

OCTOBER 13, 2021

(..)

PYMNTS

DECEMBER 8, 2020

States and territories that currently have COVID-19 travel restrictions include Alaska, Connecticut, District of Columbia, Chicago, Hawaii, Maine, Maryland, Massachusetts, New Hampshire, New York, Pennsylvania, Puerto Rico, Rhode Island and Vermont. The tests will be available to American Airlines customers who are traveling to U.S.

American Banker

MAY 23, 2024

The bank took a big hit on an office property in Washington, D.C., during the first quarter. This month, it filed a shelf registration statement for an offering of up to $150 million that could be used to bolster capital or refinance debt.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content