Maryland EWA legislation draws protest

Payments Dive

JANUARY 25, 2024

A Maryland bill calling for some earned wage access providers to be registered and licensed has triggered opposition from fintech advocates.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

Maryland Related Topics

Maryland Related Topics

Payments Dive

JANUARY 25, 2024

A Maryland bill calling for some earned wage access providers to be registered and licensed has triggered opposition from fintech advocates.

CFPB Monitor

JANUARY 30, 2024

Maryland has joined the ranks of states considering legislation that would codify elements of “true lender” theory in an effort to impose federally preempted state licensing requirements and rate caps on loans to Maryland residents. Continue Reading

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

AUGUST 17, 2023

At least one earned wage access advocate is pushing back on Maryland’s recent guidance that labels some on-demand wage offerings as loans.

Payments Dive

SEPTEMBER 3, 2024

Two buy now, pay later companies pivoted in offering their services in the state because it insists they must be licensed to provide loans.

CFPB Monitor

AUGUST 21, 2023

Earlier this month, the Maryland Office of Financial Regulation (“OFR”) issued guidance (the “Guidance”) to provide clarity on how the OFR views Earned Wage Access (“EWA”) products and describe the requirements entities offering EWA products must adhere to.

CFPB Monitor

MAY 6, 2021

A Maryland administrative action recently removed to the state’s federal district court illustrates how Maryland law continues to present challenges for the bank partner structure used by many lenders. The new Maryland matter demonstrates that participants in bank model programs continue to face state licensing threats.

CFPB Monitor

AUGUST 8, 2023

Congratulations to Professor Jeff Sovern who was recently named the inaugural Michael Millemann Professor of Consumer Protection Law at the University of Maryland Francis King Carey School of Law. Professor Sovern joins Maryland Carey Law after 40 years on the faculty of St. Continue Reading

PYMNTS

NOVEMBER 16, 2020

Group Seeks to Block Maryland Online Advertising Tax. Marylanders for Tax Fairness is preparing for a battle in January over the state’s attempt to make a digital advertising tax, the Baltimore Sun reported. Maryland legislators ratified the tax earlier in 2020, but Gov. Larry Hogan vetoed the levy. Larry Hogan vetoed the levy.

American Banker

NOVEMBER 8, 2023

An organization in Maryland is shooting for a 2024 opening. The National Credit Union Administration approved the Young Community Federal Credit Union to begin operations in Kentucky soon.

CFPB Monitor

SEPTEMBER 29, 2021

Maryland has enacted legislation that revises the rules of determining creditworthiness. On May 30, 2021, Maryland Governor Lawrence J. Hogan (R) signed HB1213 into law, which adds to Maryland Code Ann. Financial Institutions (FI) § 1-212.

PYMNTS

JANUARY 4, 2018

As more financial institutions (FIs) warm up to the idea, one bank in Maryland is taking significant steps to address cannabis companies’ FinServ challenges. Providing financial services to legal marijuana businesses in the U.S. has proven a challenging, complicated venture for the nation’s banks.

CFPB Monitor

DECEMBER 9, 2019

The CFPB has filed an amicus brief in the Maryland Court of Appeals urging the court to affirm the decision of the Court of Special Appeals reversing the trial court’s approval of a settlement agreement in a class action lawsuit. The circuit court approved the settlement over the Maryland AG’s objections in February 2018.

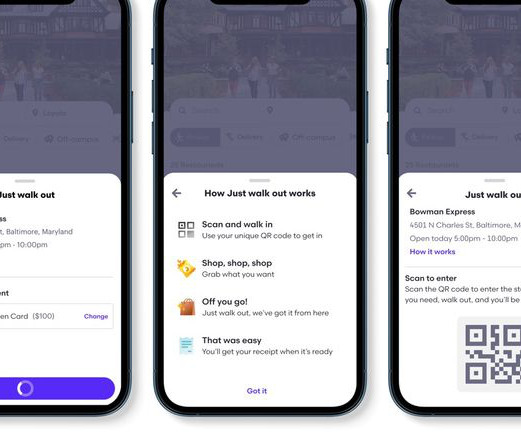

Payments Dive

AUGUST 31, 2023

Students at the Loyola University Maryland store will scan a QR code in the food delivery app to enter the frictionless shop and pay for items.

PYMNTS

APRIL 6, 2016

In Walmart’s defense, it was specifically selling the promotion of the University of Maryland’s mascot , not the school itself … where one could presumably learn the basics of U.S. We understand the pride Marylanders feel for the Terps and apologize for the mistake.”

MyBankTracker

JANUARY 18, 2021

Homeowners insurance in Maryland protects your property from damage. Are you shopping for homeowners insurance in Maryland? If so, here are the average rates to expect based on the proper coverage needed for your Maryland home. Average Maryland Homeowners Insurance Rates. How Does Home Insurance in Maryland Work?

PYMNTS

AUGUST 15, 2018

To bring a beer tour and tasting experience to its customers, Guinness has opened a $90 million brewery in Maryland. The location is the company’s first new brewery in 60 years, CNBC reported.

American Banker

SEPTEMBER 9, 2024

The bank faced credit setbacks in the nation's capital and margin pressure this year. But it made a series of new hires to reduce risk and diversify its loan portfolio, preparing for a new era of demand as the industry awaits interest rate cuts.

CFPB Monitor

FEBRUARY 2, 2022

Court of Appeals for the Fourth Circuit recently ruled that a mortgage servicer violated the Maryland Consumer Debt Collection Act (MCDCA) by charging a $5 convenience fee to borrowers for monthly payments made by phone or online. In Alexander v. 14-202(8) Claim). 14-202(8) because such fees are prohibited by Sec. 14-202(11).

PYMNTS

JUNE 12, 2017

Maryland and Virginia, as well as online. Mama Biscuit’s Gourmet Biscuits (MBGB) produces flavored gourmet biscuits that “bridge the gap between” sweet cupcakes and savory tasting treats. They are sold in major retailers such as Wegmans and Whole Foods Market in Washington, D.C.,

CFPB Monitor

SEPTEMBER 25, 2018

Noting, among other things, “retrenchment” on the federal level, the Maryland Financial Consumer Protection Act of 2018 ( HB 1634 ) was signed into law on May 15, 2018. Requires the Maryland Financial Consumer Protection Commission to conduct various studies and include recommendations in its 2018 report to the Governor.

CFPB Monitor

MAY 23, 2019

Colorado and Maryland have each enacted legislation regulating student loan servicers. On May 13, Colorado Governor Jared Polis (D) signed into law SB 19-002 , and that same day, Maryland Governor Larry Hogan (R) signed HB 594.

CFPB Monitor

JULY 13, 2020

The Department of Justice recently announced that it had settled a lawsuit filed in 2019 that alleged a Maryland used car dealership discriminated against African Americans in violation of the Equal Credit Opportunity Act by offering different credit terms based on race.

American Banker

OCTOBER 24, 2024

The bank cut its dividend, raised capital, hired multiple top executives and vowed to reduce its commercial real estate concentration after a bruising first half of 2024.

CFPB Monitor

MARCH 17, 2020

A Maryland federal district court, in Jennings v. Dynamic Recovery Solutions LLC , ruled that the effect of a partial payment on revival of the statute of limitations was governed by the law of Delaware, the state designated in the choice of law provision in the plaintiff’s credit agreement, rather than the law of Maryland, the forum state.

ABA Community Banking

APRIL 26, 2020

With the SBA’s Paycheck Protection Program set to re-opening for applications tomorrow, a Maryland bank CEO this weekend recounted his bank’s experience getting up and running during the early days of the program. The post Maryland Bank CEO Reflects on First Round of PPP Applications appeared first on ABA Banking Journal.

ABA Community Banking

OCTOBER 22, 2024

Atlantic Union to buy Sandy Spring in Maryland; deals also announced in Tennessee and Texas. The post Bank acquisitions announced in three states appeared first on ABA Banking Journal.

American Banker

MAY 23, 2024

The bank took a big hit on an office property in Washington, D.C., during the first quarter. This month, it filed a shelf registration statement for an offering of up to $150 million that could be used to bolster capital or refinance debt.

CFPB Monitor

JULY 27, 2021

A Maryland federal district court has dismissed a putative class action lawsuit filed against nine companies that manage apartment buildings in the Washington, D.C.

PYMNTS

JANUARY 9, 2019

The Maryland Attorney General Brian Frosh announced Tuesday (Jan. In a press release , the Maryland AG said Neiman Marcus agreed to pay $1.5 The states’ investigations determined that around 370,000 payment cards were breached, including 8,323 associated with consumers in the state of Maryland.

American Banker

DECEMBER 13, 2023

The acquisition would deepen Orrstown's presence in its home state and Maryland. Codorus Valley Bancorp in recent years had faced pressure from an activist investor to consider selling.

Jeff For Banks

JULY 28, 2023

A career banker with multiple financial institutions, including the long-admired Mercantile from Maryland, Mike elevated up the credit and lending vertical to his current position. Mark Semanie, Maryland Market President, Wesbanco. Kevin Benson, President of Rosedale Federal S&L Association.

CFPB Monitor

AUGUST 21, 2023

Professor Jeff Sovern, who recently joined the University of Maryland Francis King Carey School of Law faculty, has recently blogged about a forthcoming Study by academicians at other institutions that will be published in the Berkeley Technology Law Journal.

American Banker

AUGUST 29, 2023

Maryland is the latest state to decree that employer-sponsored EWA products aren't loans, but the battle over how they will be regulated is just beginning, experts say.

American Banker

AUGUST 9, 2024

City National Bank of Florida is starting a national capital markets division, Orrstown Financial will close branches in Pennsylvania and Maryland, JPMorgan Chase announces in-store biometric payments and more in this week's banking news roundup.

American Banker

AUGUST 4, 2016

said that its insurance unit bought The Advantage Group, which offers personal, business and life insurance to clients in Maryland, northern Virginia and Washington. Sandy Spring Bancorp in Olney, Md.,

CFPB Monitor

JANUARY 24, 2023

Professional Bureau of Collections of Maryland, Inc. , Court of Appeals for the Tenth Circuit recently joined the Eleventh Circuit (and a growing majority of courts) in rejecting the “ Hunstein theory” of liability under the Fair Debt Collection Practices Act (FDCPA). In Shields v.

American Banker

FEBRUARY 9, 2021

Richard Daugherty stepped down after more than three decades at the Maryland-based institution, including overseeing four mergers and asset growth of nearly 500%.

American Banker

JUNE 18, 2020

Delmarva Bancshares, which was on the brink of failure during the financial crisis, will be sold to BV Financial for $54 million.

American Banker

JULY 27, 2023

Like many of its peers, the bank is grappling with higher deposit costs and net interest margin pressure.

ABA Community Banking

FEBRUARY 10, 2021

Now, she's at the same bank, as chairman, president and CEO of Oakland, Maryland-based First United Bank and Trust. As an early-career CPA, Carissa Rodeheaver began her community banking career as a trust administrator nearly three decades ago.

American Banker

FEBRUARY 2, 2021

The Maryland-based credit union has promoted Chief Operating Officer Tonia Niedzialkowski to president of the organization with an eye toward eventually naming her CEO.

PYMNTS

OCTOBER 8, 2020

26 were in Maryland (3,619), Illinois (3,414) where layoffs in retail and healthcare fueled the number of applications, New Jersey (2,504), Michigan (2,358) and Massachusetts (1,886), while the largest decreases were in Texas (7,075), Florida (6,655), Georgia (5,895), New York (5,112) and Oregon (2,317). That contrasts with 1.4

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content