FTC: Millennials Report Losing $71M To eCommerce Fraud In Two Years

PYMNTS

OCTOBER 1, 2019

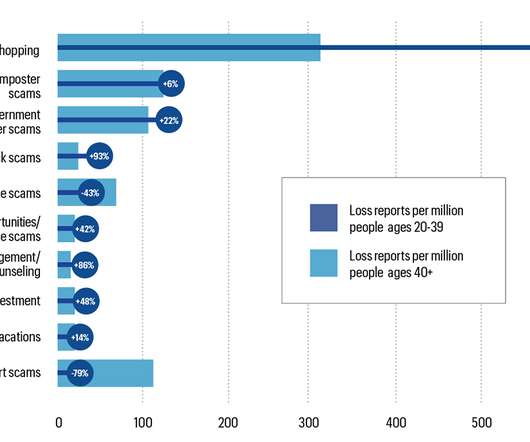

A new report by the Federal Trade Commission (FTC) has revealed that millennials are 25 percent more likely to report losing money to fraud than consumers ages 40 and over. The top five frauds to which millennials report losing money are online shopping frauds, business imposters, government imposters, fake check scams and romance scams.

Let's personalize your content