What Goes Up …

Independent Banker

FEBRUARY 25, 2015

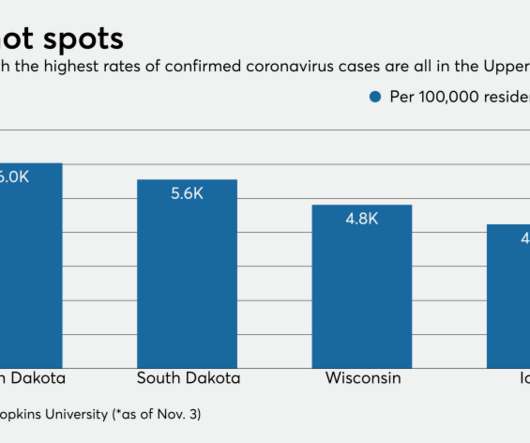

Coping just fine, community banks in energy-producing regions manage the oil-price plunge. New energy regions adapt. But North Dakota is a newcomer to the oil-producing world. Hydraulic fracturing by drillers has sent the region on an oil-producing frenzy since 2007. By Howard Schneider. By midyear we’ll know.”.

Let's personalize your content