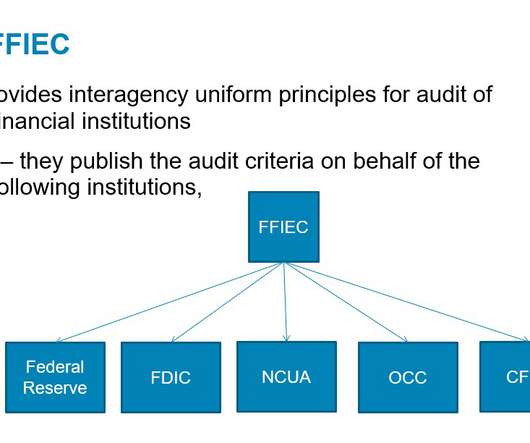

AI Regulations for Financial Services: CFTC and FDIC

Perficient

NOVEMBER 4, 2024

Artificial intelligence (AI) is poised to affect every aspect of the world economy and play a significant role in the global financial system, leading financial regulators around the world to take various steps to address the impact of AI on their areas of responsibility.

Let's personalize your content