Payments laws apply to online games, CFPB says

Payments Dive

JANUARY 13, 2025

Video game companies that operate online gaming platforms must comply with the Electronic Fund Transfer Act, the agency said.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Payments Dive

JANUARY 13, 2025

Video game companies that operate online gaming platforms must comply with the Electronic Fund Transfer Act, the agency said.

Abrigo

MARCH 18, 2025

Payment system types, trends, and fraud risks Understanding how payment systems function, the different types in use, and the associated risks is critical for financial institutions to be able to balance innovation with security. Key topics covered in this post: What is a payment system? Abrigo Advisory Services can help.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

PYMNTS

JANUARY 25, 2021

According to Ossama Soliman , chief product officer at open banking provider TrueLayer , the very fact that there are so many payment options pushes new entrants to differentiate themselves from the pack. “It But actually, it raises the bar for what it takes to add a new payment method into the checkout.”. 26) in the U.K.,

PYMNTS

JANUARY 19, 2021

Corporate buyers are quickly shifting their purchasing habits online, and seeking more efficient experiences from product sourcing through to checkout. With B2B eCommerce proliferating, the market is rapidly evolving to make way for new business and payment models in response to customer demand. Tying Payments With Loyalty.

PYMNTS

JANUARY 20, 2021

And this is happening across many verticals,” Mastercard ’s Senior Vice President of Digital Payments Silvana Hernandez told PYMNTS in a recent conversation. As consumers’ day-to-day lives have digitized across the board in 2020, Hernandez said that Mastercard had already seen a trend toward the adoption of instant payments.

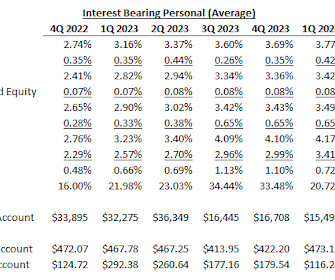

Jeff For Banks

FEBRUARY 12, 2025

Online account opening remains the wild west for most community banks. And naturally I was keenly interested in how to solve this problem, or even diagnose what exactly is the problem, for community banks and online deposit account opening, either retail or business. In so many strategy sessions, I hear from bankers that it is a bust.

PYMNTS

SEPTEMBER 18, 2020

Online marketplaces are the digital storefronts helping small to mid-sized businesses survive — but adding real-time settlement into the mix can help them thrive. And 60 percent of surveyed firms selling across online marketplaces would take their business to one that offers real-time settlement.

PYMNTS

DECEMBER 14, 2020

The 2020 holiday shopping season is picking up, and consumers are heading online or to reopened brick-and-mortar stores to shop and pay for gifts. They are using everything from cash to mobile wallets to complete these transactions, requiring retailers to race to accommodate a wide variety of payment methods.

PYMNTS

SEPTEMBER 29, 2020

New payment rails are once again in the spotlight as real-time payments and cryptocurrency emerge as the top focuses for innovators. In this week’s look at payment rails innovation, the European Union begins paving the way for greater crypto adoption, while Mastercard expands its own crypto accelerator initiative.

PYMNTS

JANUARY 6, 2021

Soon, you might be able to bet on it…literally, online and through mobile means. (OK, According to reports, Cuomo is set to unveil the proposal to legalize online gambling (he also seeks to legalize marijuana) in his state of the state address that is scheduled for next week. Bet on New York emerging a bit more flush from the pandemic.

PYMNTS

NOVEMBER 1, 2020

Sellers have come to find it “crucial” to meeting customers where they live right now, which is through new online transactions during the pandemic. Instead, he said they should focus on setting up online payments first, ensuring that customers have the easiest experience possible.

PYMNTS

OCTOBER 28, 2020

In the November edition of the Payments Orchestration Playbook , PYMNTS examines how payments orchestration is emerging as an effective way to help bring firms up to speed as they find their digital operations wanting. Across The Payments Orchestration Ecosystem. Deep Dive: Using Payments Orchestration To Enhance ROI.

PYMNTS

SEPTEMBER 29, 2020

Filipino online payments platform PayMongo has come off a funding round with $12 million, according to a press release. The growth was driven by the COVID-19 pandemic and the ensuing transition to more digital shopping and payments. We fully support their vision to bring many more Filipino businesses online.

PYMNTS

NOVEMBER 18, 2020

Global payments startup Veem is launching a new business-to-business (B2B) tool to simplify and automate domestic payments, the company announced in a Wednesday (Nov. He said the new tool, Veem Check, “strengthens our domestic payment offering” because users can pay anyone in the U.S. 18) press release.

PYMNTS

JUNE 25, 2020

Global payments automation platform Tipalti says it has made mass, automated payments seamless for numerous popular online video game customers, according to a press release. Chief Operating Officer Arnold Hur said the partnership would boost the company’s accounts payable process.

PYMNTS

DECEMBER 10, 2020

TSYS , a payment processing company, has suffered a ransomware attack and had some data posted online, according to a report from Krebs on Security. We immediately contained the suspicious activity and the business is operating normally. The company was acquired by Global Payments Inc. Columbus, Ga.-based

PYMNTS

SEPTEMBER 15, 2020

Although they are vastly different beasts, shifts in the consumer payments ecosystem have significantly impacted the flow of B2B payments. This is a great risk because if you don’t have the proper banking tools to get your funds to maintain your business operations, it can be very dangerous for business.”. Diversifying Risk.

PYMNTS

AUGUST 7, 2020

India has seen a steady stream of digital payments since it locked down to prevent the spread of COVID-19 , but the nation of 1.3 billion suffers from either a lack of internet or low-speed service, preventing many residents from taking part in touchless payments. Four years ago, India launched its Unified Payments Interface (UPI).

PYMNTS

SEPTEMBER 15, 2020

In an interview with Karen Webster, Vilash Poovala , founder and CEO of FinTech Oyster , said online financial platforms, powered by open banking, can serve as alternatives for business banking in a country where business banking seems an afterthought. The world needs a FinTech operating system.”.

PYMNTS

MARCH 6, 2020

Real-time payments are imperative for running successful operations in today’s global ecosystem. Digital payments sent internationally are expected to move past $1 trillion in 2025, but getting to that point will require support from payment providers, regulators and other such firms still building out the necessary infrastructure.

PYMNTS

DECEMBER 23, 2020

We’re all consumers of media, of content, of subscriptions — and we do it all online, which means we pay for it all online. Payments 0rchestration, in a nutshell, said Evans, can help the entire payments ecosystem create and benefit from flexible payment stacks.

Abrigo

MARCH 7, 2025

Reg E was created to protect consumers using electronic payment systems. It is part of the Electronic Fund Transfer Act (EFTA), a law passed in 1978 to safeguard consumers using electronic payment systems. This increased scrutiny can divert resources away from core operations and impact overall efficiency.

PYMNTS

SEPTEMBER 30, 2020

Merchants are optimizing their eCommerce operations, but this is posing challenges for some, including luxury merchants. Many consumers are shying away from physical stores, however, leaving these high-end merchants scrambling to develop strong online presences. Around The Buy Now, Pay Later World.

Chris Skinner

MARCH 22, 2017

Under the agreement, Ant Financial will assist Ascend Money to grow its online and offline payments and financial services ecosystem. It is notable that Ascend may be based in Thailand, but also operates in Indonesia, The Philippines, Vietnam, Myanmar and Cambodia.

PYMNTS

OCTOBER 5, 2020

The great digital shift is upending B2B payments , pushing them away from the age-old reliance paper checks toward digital options. The walls are coming down between accounts receivables and payables between buyers and suppliers in a $120 trillion global commercials payments market. Beyond The Safety Factor .

Perficient

FEBRUARY 27, 2023

The payments industry is no different, and we’re quickly approaching a new intersection point due to the Real-time Payments’ movement into the US. These days, as the US prepares to embrace real-time payments in 2023, the intersection of real-time payments and automation has become a key point of discussion.

PYMNTS

NOVEMBER 6, 2020

As eCommerce and B2B payments expand across borders, time zones and currencies, virtual international bank account numbers (IBANS) can pave the way for firms to capture online sales efficiently — and bypass the frictions of traditional banking relationships. . Everything happens in an extremely secure environment,” she said.

PYMNTS

OCTOBER 1, 2020

The pandemic has exposed the pain points of all verticals when it comes to payments, and especially when it comes to transacting in person, in a tactile environment, with cash, and where banking conduits are limited. Those benefits can extend to users in the form of cost savings tied to payments and processing, or speedier processing times.

PYMNTS

DECEMBER 31, 2020

Key Data Points: 60 percent of small restaurant operators have had their revenues decline since the pandemic began. Accelerating The Real-Time Payments Demand Curve: What Banks Need To Know About What Consumers Want And Need. percent of millennials believe it is “very” important to receive payments in real time. percent and 20.3

PYMNTS

DECEMBER 31, 2020

That’s because paper becomes the default method of payment when something goes awry — such as when banking credentials can’t be authenticated or identity cannot be verified. The payments ecosystem, of course, is not and will not be immune to the seismic impact and aftershocks of the coronavirus. According to J.P.

PYMNTS

NOVEMBER 16, 2020

Real-time payments continue to gain traction around the world. The country’s banking system is giving an upgrade to its instant payments system. Called PIX , the new payment rails have been in the works for some time and launched last week. It will be fully operational starting Monday (Nov. Case in point: Brazil.

PYMNTS

OCTOBER 15, 2020

Stripe is acquiring Paystack , a company that says it processes more than half of online payments in Nigeria. More than 60,000 businesses in Nigeria and Ghana use Paystack to securely collect online and offline payments, launch new business models, and deepen customer relationships.

Bank Innovation

MAY 18, 2017

Consumers can now use their Google credentials to make online and mobile payments via a stored credit card. The tech giant unveiled the tool yesterday, during its annual I/O developer conference in Mountain View, Calif.

PYMNTS

JUNE 29, 2020

The pandemic has drastically affected how consumers are shopping and paying for even routine purchases, and this in turn has altered how businesses are accepting their payments. The health crisis has brought about changes to this rule, however, and these may have long-term implications for payment standards and regulations.

PYMNTS

JULY 20, 2020

The payments program from messenger service WhatsApp will be allowed to go forward in Brazil, the country’s central bank said, so long as all rules are respected, Reuters reported. Concerns over data protection and privacy also cropped up, Reuters reported. ” “Everyone can participate,” he said. “We

PYMNTS

FEBRUARY 2, 2021

To an extent, that same spirit and intention is behind the recent spate of government approvals for online gambling. That leads to the product of said online activity — and that’s money. 1, a milestone that also made Action 24/7 the only locally owned sportsbook gaming operator of four licensed by the state. “I Winning Converts.

PYMNTS

DECEMBER 30, 2020

Whether through the use of online marketplaces or proprietary supplier portals, B2B sellers embraced the opportunity to connect with business customers online, while buyers reciprocated by sourcing, procuring and paying for goods the way they do in their personal lives.

South State Correspondent

APRIL 1, 2025

This means that thanks to recent Apple upgrades in their operating system, most phones are now capable of receiving Rich Communication Services (RCS) messages in addition to traditional SMS. Popular use cases include request for payments using the instant payment rails (above), loan payments and transaction verification to prevent fraud.

PYMNTS

JANUARY 1, 2020

While one might assume that a payments revolution would be a hard thing to miss, as it turns out, it can happen. They’ve seen it since they started working on the ground in Africa in 2006 to develop an online booking system for a small Kenyan airline looking to make themselves more appealing to foreign customers. Feinstein said.

PYMNTS

DECEMBER 16, 2020

Digital sports entertainment and gaming industry platform DraftKings — known for its top-rated daily fantasy sports and mobile sports betting apps — today announced an agreement with InComm Payments , a global leading payments technology company, to launch an industry-first retail gift card. . DraftKings reported on Friday (Nov.

PYMNTS

NOVEMBER 27, 2020

But B2B eCommerce is inherently more complex than consumer-facing sales and payments flows, thanks to the need for corporate buyers to establish payment terms or purchase on credit with suppliers. We've observed over the years in B2C eCommerce that the innovation of payments drives more activity in the shopping cart," noted Tomich. "If

PYMNTS

NOVEMBER 19, 2020

While optimizing B2B payments is often about combating friction at the moment of transaction, the truth is, the B2B payment experience often happens way before any money is ever actually moved. There are many ways that onboarding a new B2B customer can be a headache for suppliers that sell goods and services online.

PYMNTS

NOVEMBER 4, 2020

Many of the numerous ordering and payment methods that today’s QSR customers enjoy have taken time to evolve and catch on. Research confirms that QSR patrons are seeking multiple online and offline ordering methods. How Payments Factor Into The Ordering Equation. The Evolution Of Ordering. Much of the U.S.

PYMNTS

DECEMBER 16, 2020

In today’s top payments news around the world, IBM has bought Canada-based Expertus Technologies, while Gojek is rolling out its new GoBiz Plus point-of-sale (POS) offering. Gojek Debuts POS System for Indonesian Merchants That Accepts Cashless Payments. Plus, Bridgetown Holdings is reportedly thinking about a deal with Tokopedia.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content