What Wayfair’s Lawyer Says About The Wayfair v. South Dakota Decision

PYMNTS

NOVEMBER 22, 2019

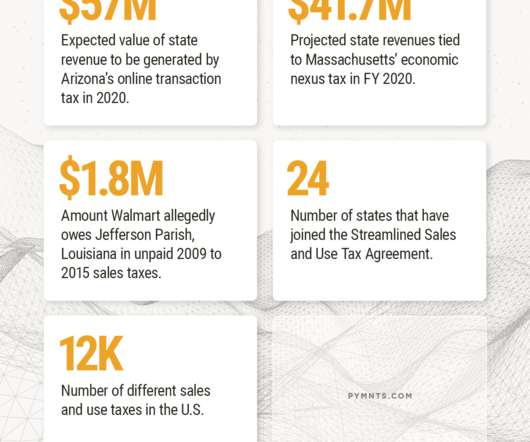

The 2018 South Dakota v. Wayfair ruling allowed counties, states and municipalities to pass laws to tax out-of-state sellers and the eCommerce marketplaces that serve them, but the ruling did not disclose specifications on what such laws must look like. still-developing tax landscape, and explores other critical updates.

Let's personalize your content