Fraud and AML integration: Is the FRAML approach right for your financial institution?

Abrigo

NOVEMBER 22, 2024

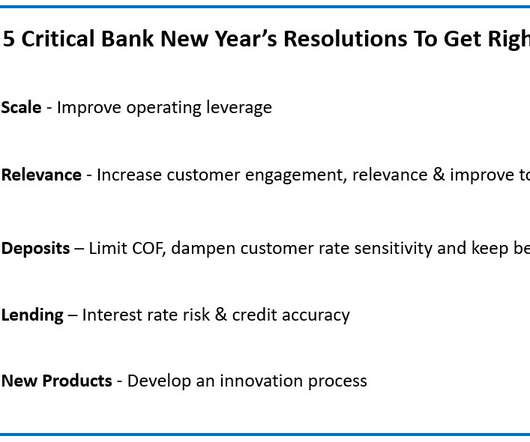

This article covers these key topics: Benefits of FRAML for risk management Potential drawbacks of the FRAML approach Factors to consider in decision-making What is FRAML? At its core, FRAML is about taking a more holistic approach to financial crime risk management. Staying on top of fraud is a full-time job.

Let's personalize your content