Bank Regulators Seeking Comments on the Use of AI and ML in the Industry

Perficient

APRIL 2, 2021

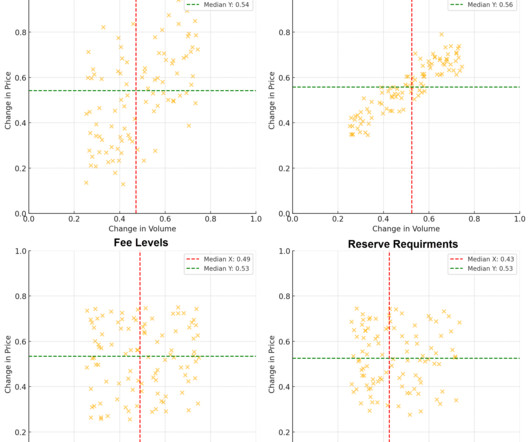

Finally, views are sought for compliance with applicable laws and regulations, including those related to consumer protection. Risk Management. AI may be used to augment risk management and control practices. The challenge is to ensure that the software being developed is not coded with biases. Textual analysis.

Let's personalize your content